China A50 Index: Relatively strong in October within global indexes

The China A50 Index rose 3.8% in October, which outperformed the global indexes, such as Dow Jones (-4.27%) and Euro Stoxx 50 (-7.29%). In fact, China's economy has shown the gradual recovery signal. on the economic front, China's official Manufacturing PMI rose to 51.4 in October (51.3 expected) from 51.5 in September and Non-manufacturing PMI climbed to 56.2 (56.0 expected) from 55.9, according to the government. Besides, Caixin China Manufacturing PMI rose to 53.6 in October (52.8 expected) from 53.0.

Investors should focus on the October Caixin Non-Manufacturing PMI (55.0 expected) and the trade data ahead of this week.

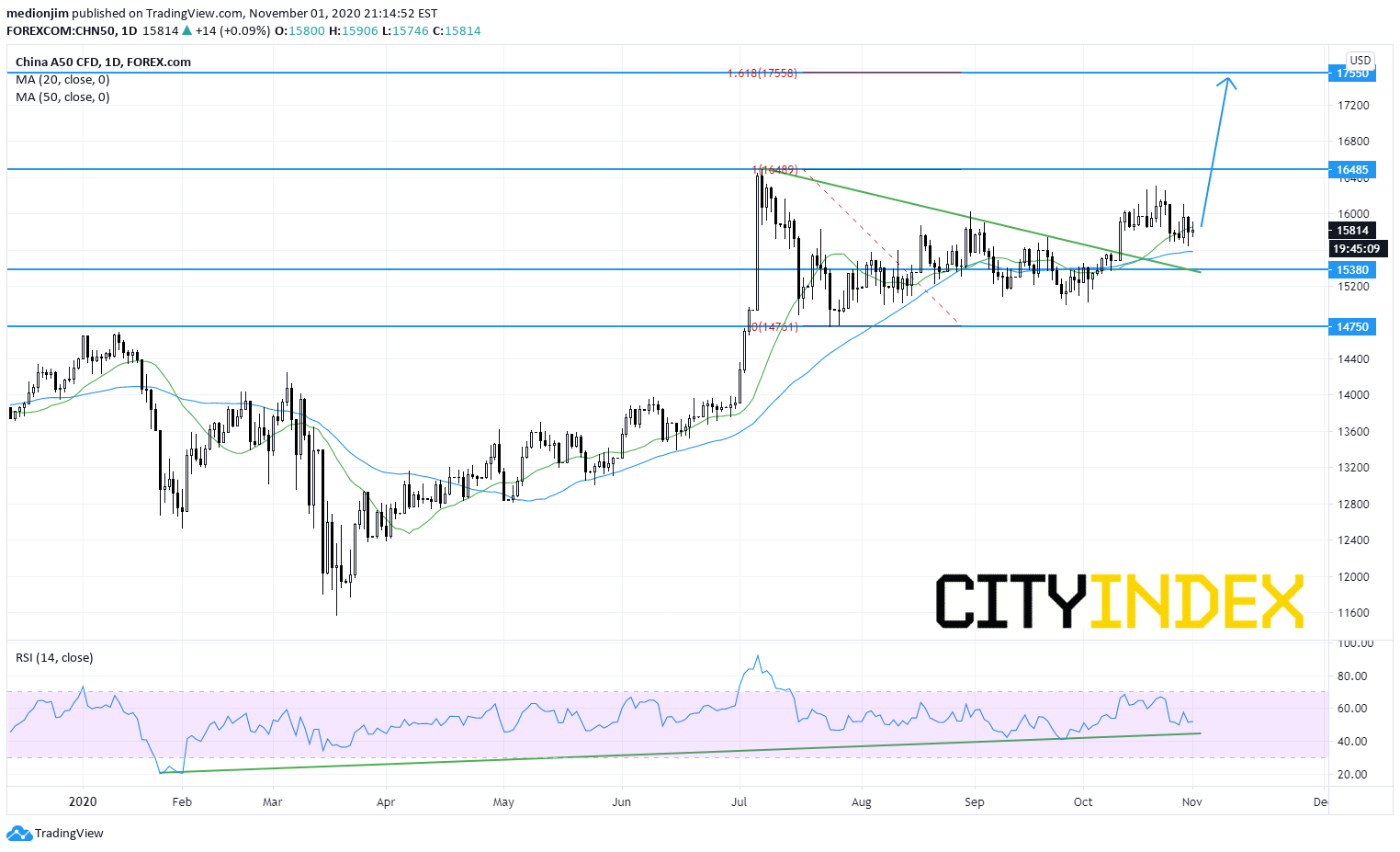

From a technical point of view, the index remains holding above the 50-day moving average after breaking above the declining trend line drawn from July. The relative strength index is also supported by a rising trend line drawn from February.

Bullish readers could set the support levels at 15380, while resistance levels would be located at 16485 and 17550.

Source: GAIN Capital, TradingView

Investors should focus on the October Caixin Non-Manufacturing PMI (55.0 expected) and the trade data ahead of this week.

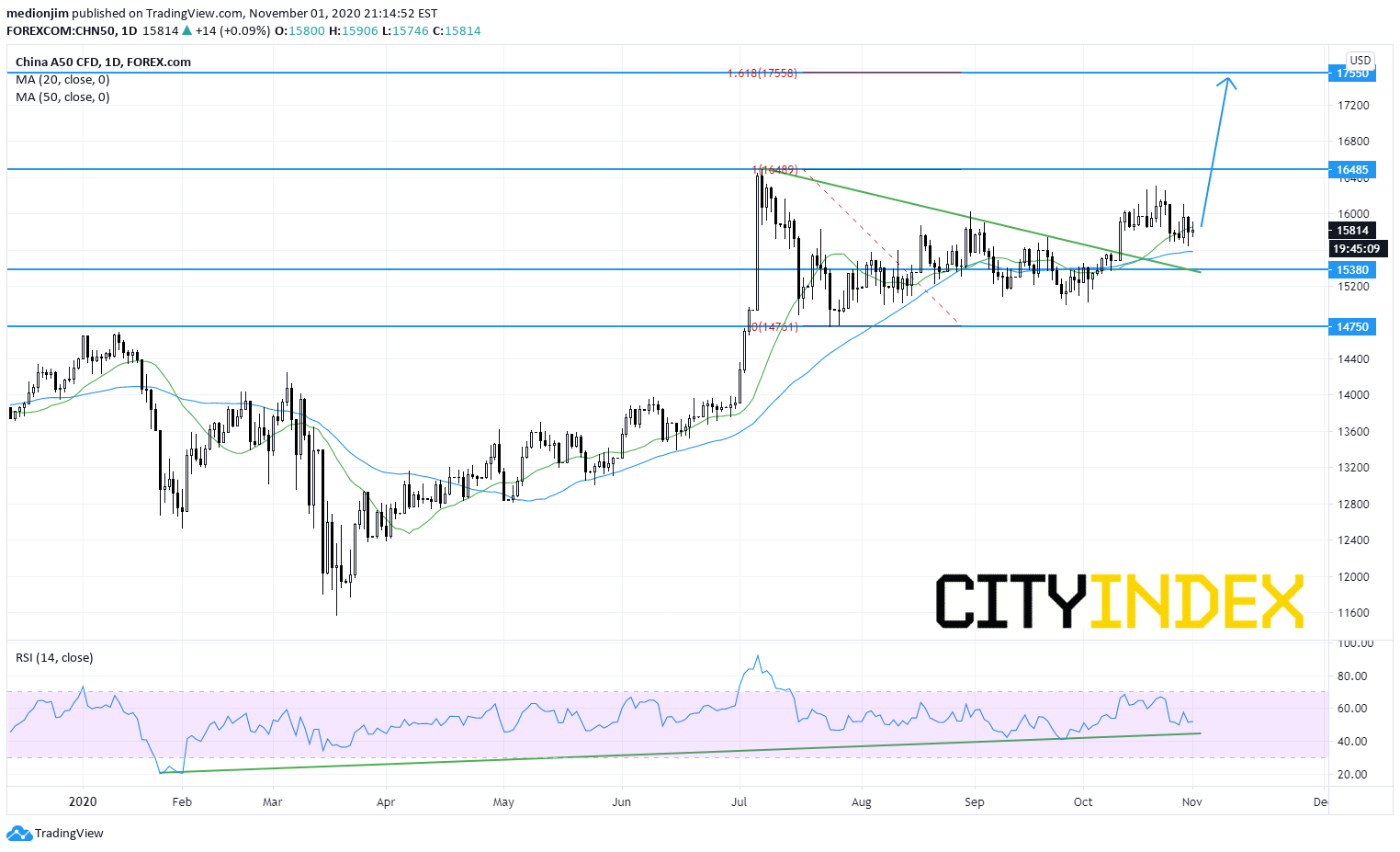

From a technical point of view, the index remains holding above the 50-day moving average after breaking above the declining trend line drawn from July. The relative strength index is also supported by a rising trend line drawn from February.

Bullish readers could set the support levels at 15380, while resistance levels would be located at 16485 and 17550.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM

Yesterday 08:28 AM