China A50 index in focus: Assessing the fallout from last week’s selloff

Chinese stocks grabbed all the headlines last week, with the country intermittently, and seemingly arbitrarily, cracking down and relaxing regulations on fast-growing technology and education stocks. Though Chinese authorities sought to limit the damage of the restrictions later in the week, China has undoubtedly suffered some reputational damage among the global investor community that could serve as a headwind for the country’s assets moving forward.

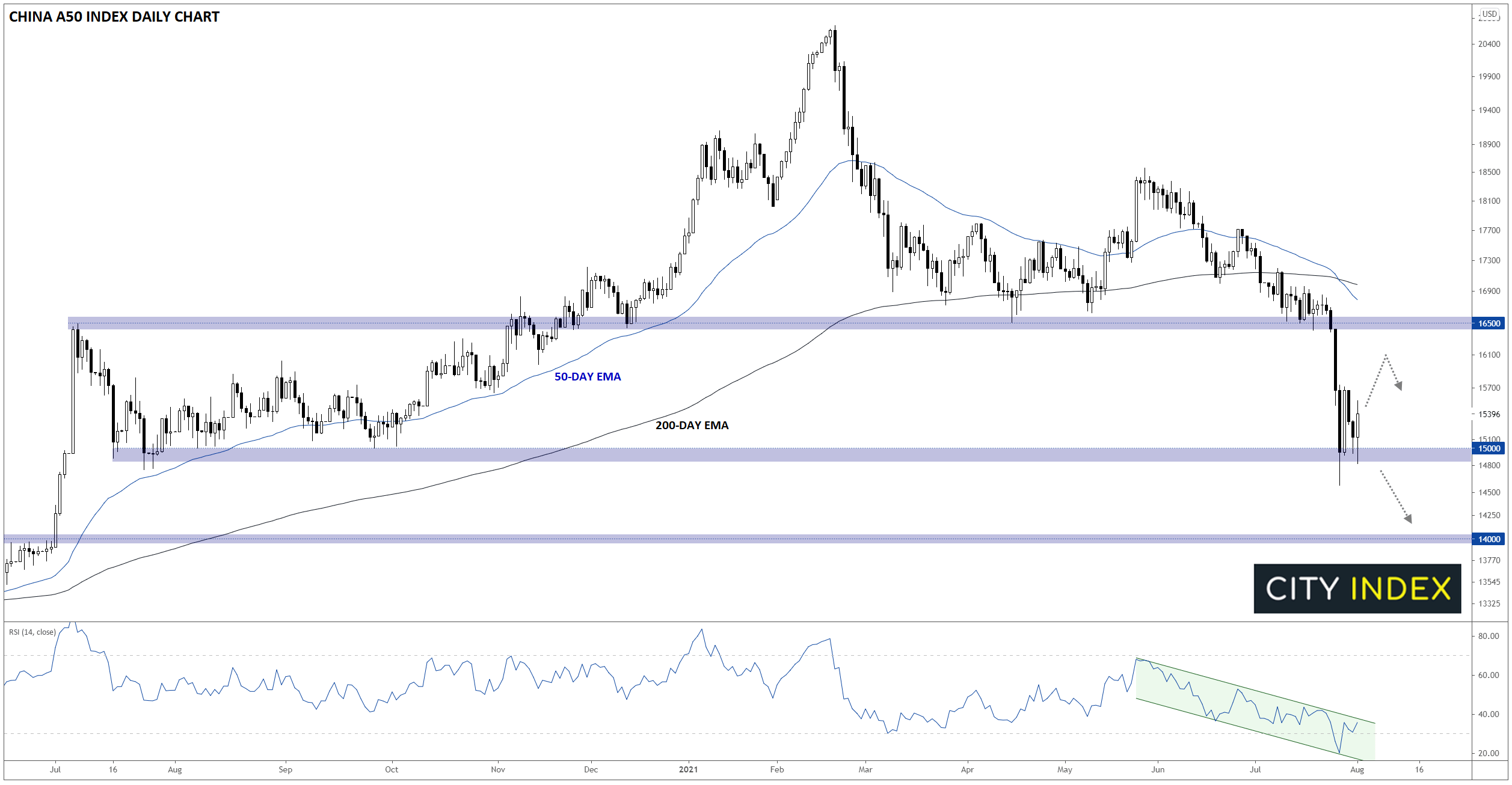

Turning our attention to the chart of China’s A50 index, we can see that the index broke through support at its year-to-date lows around 16,500 at the start of last week, leading to an instantaneous collapse to the next major level of previous support at 15,000. While prices have since stabilized in volatile trade above that area, the technical outlook for the A50 remains fragile.

As we go to press, the index’s 50-day exponential moving average (EMA) is crossing below the 200-day EMA, creating a “death cross” that signals a shift to a medium-term downtrend. Meanwhile, the 14-day RSI indicator remains within a bearish channel, showing growing selling pressure and that bears are in control of the short-term momentum:

Source: Tradingview, StoneX

With today

’s price action forming a “bullish engulfing candle”, there may be a case for a short-term bounce back toward previous-support-turned-resistance in the 16,500 range, but as long as prices remain below that barrier, the path of least resistance will remain to the downside. If we do see a conclusive break below 15,000 from here, bears will likely look to push the embattled index down toward the 14,000 area next.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels.

- Place the trade.