China A50 Index: Further upside expected

Last week, the China A50 index jumped around 3%, lifted by banking and insurance sectors. China's CPI rose 1.7% on year in September (vs +1.9% expected), while PPI dropped 2.1% on year (vs -1.8% expected).

Today, the China government reported that GDP rose 4.9% on year in 3Q (vs +5.5% expected). September Industrial production grew 6.9% on year (vs +5.8% expected) and retail sales added 3.3% on year (vs +1.6% expected). Although 3Q GDP is lower than expected, both industrial production and retail sales suggest that China economic activities still show a strong recovery.

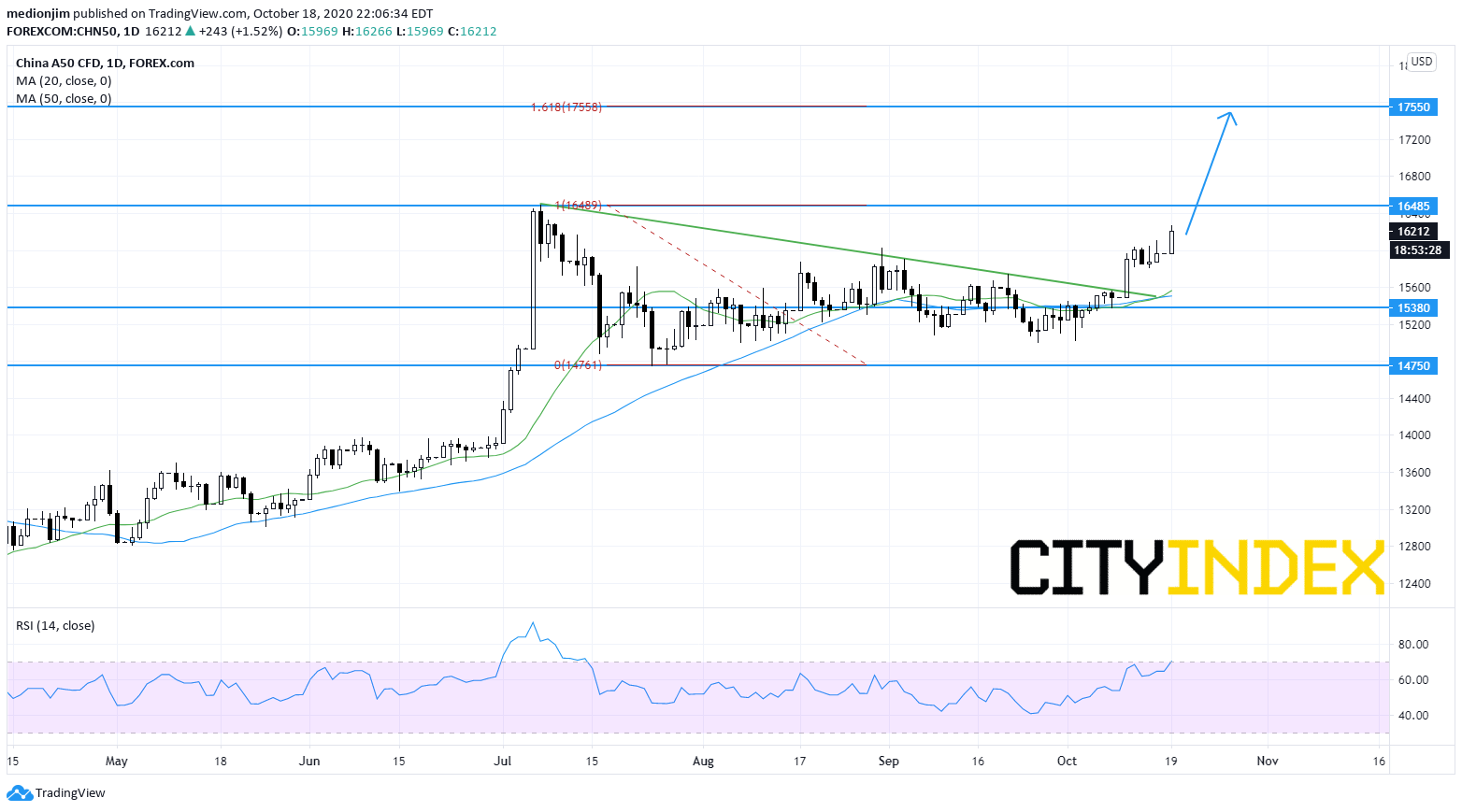

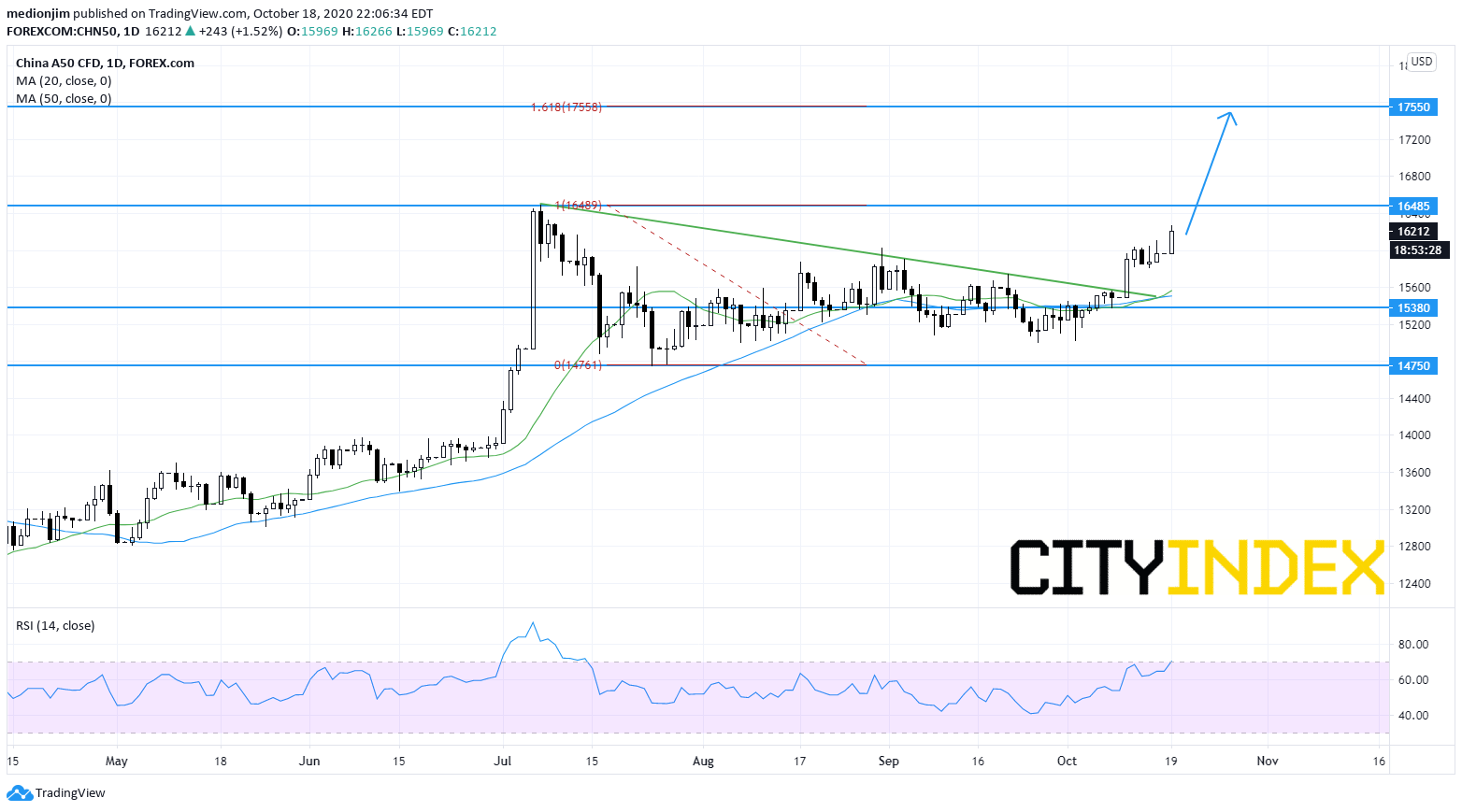

From a technical point of view, the index stayed on the upside after breaking above the declining trend line drawn from June. Both 20-day and 50-day moving averages are turning upward. The relative strength index is locating at 60s, suggesting the upward momentum for the prices.

Bullish readers could set the nearest support level at 15380, while resistance levels would be located at 16485 and 17550.

Source: GAIN Capital, TradingView

Today, the China government reported that GDP rose 4.9% on year in 3Q (vs +5.5% expected). September Industrial production grew 6.9% on year (vs +5.8% expected) and retail sales added 3.3% on year (vs +1.6% expected). Although 3Q GDP is lower than expected, both industrial production and retail sales suggest that China economic activities still show a strong recovery.

From a technical point of view, the index stayed on the upside after breaking above the declining trend line drawn from June. Both 20-day and 50-day moving averages are turning upward. The relative strength index is locating at 60s, suggesting the upward momentum for the prices.

Bullish readers could set the nearest support level at 15380, while resistance levels would be located at 16485 and 17550.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM