China A50 Index: Challenging the High of July

China A50 Index initiates a good start in November as the index prices rise around 4% since November.

Caixin China Service PMI rose to 56.8 in October (55.0 expected) from 54.8 in September, while Caixin China Manufacturing PMI rose to 53.6 (52.8 expected) from 53.0. Both economic data would suggest that China's economy is gradually improving after the outbreak of coronavirus.

Investors should focus on the CPI (+0.8% on year expected) and PPI (-1.9% on year expected), which will be released next week.

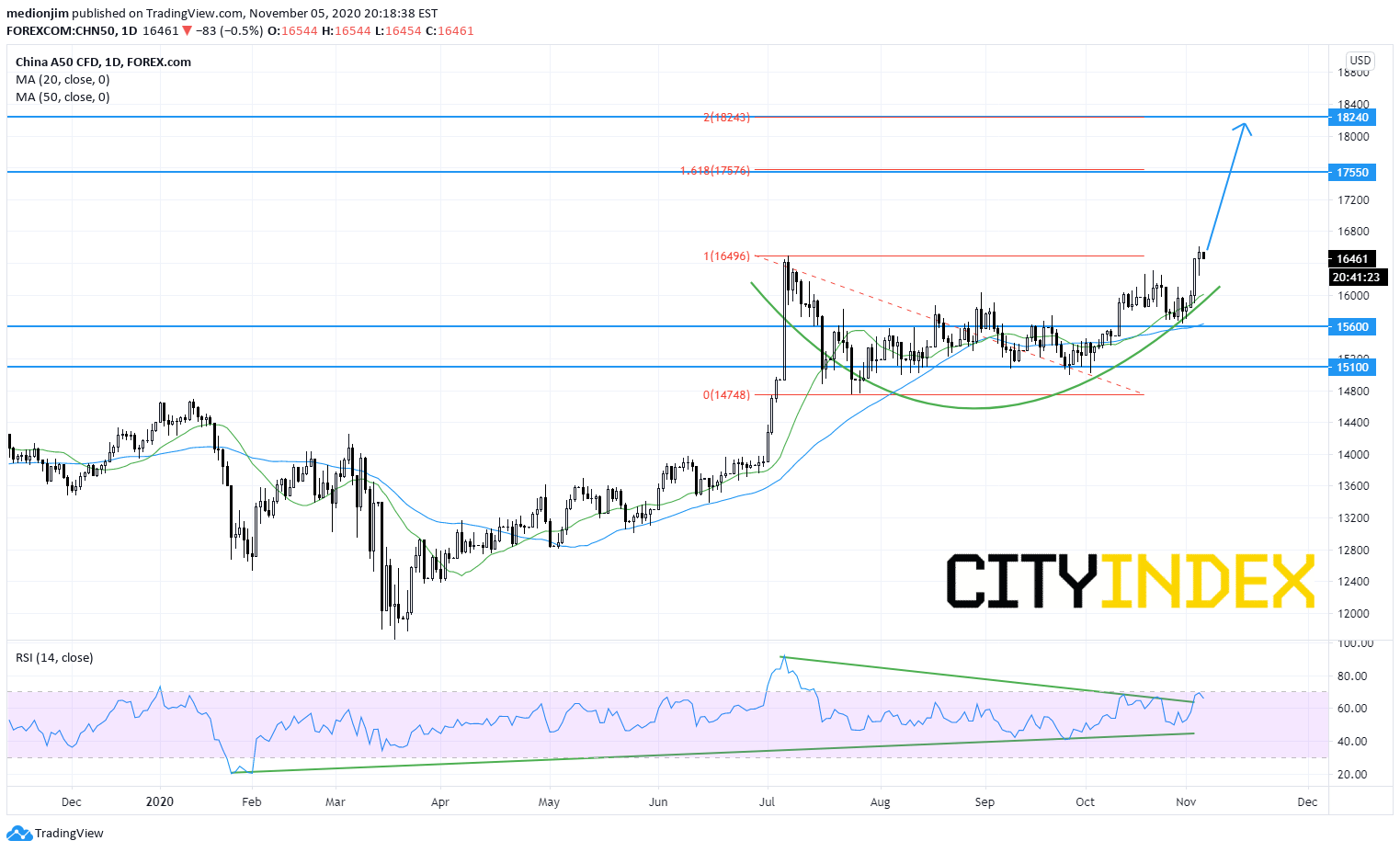

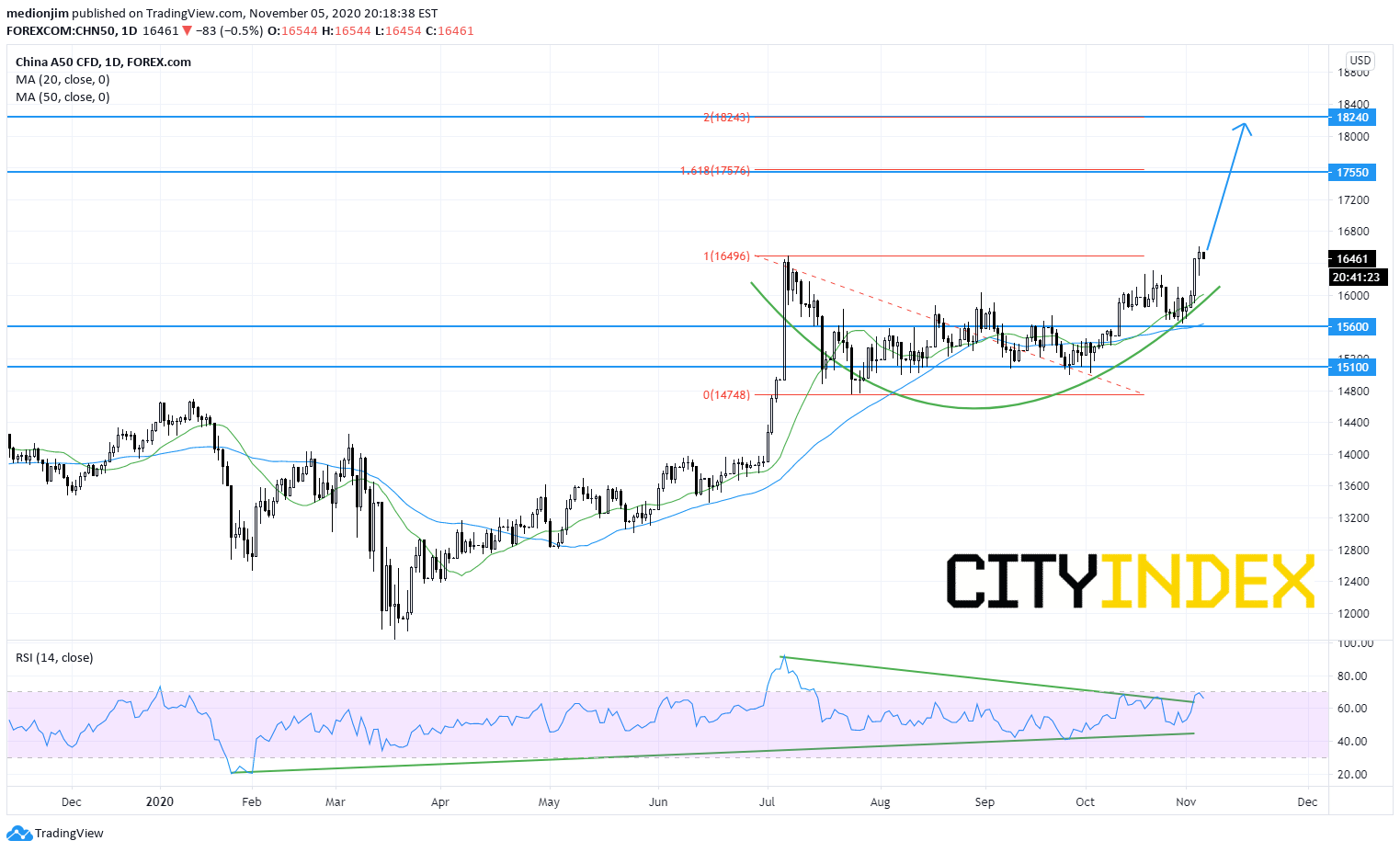

On a daily chart, China A50 Index is challenging the July's high at 16490 now. In fact, the index looks like to validate the continuation of round bottom. Currently, the index prices are trading above both rising 20-day and 50-day moving averages. The relative strength index breaks above the declining trend line drawn from July.

Bullish readers could set the support level at 15600, while the resistance levels would be located at 17550 and 18240.

Source: GAIN Capital, TradingView

Caixin China Service PMI rose to 56.8 in October (55.0 expected) from 54.8 in September, while Caixin China Manufacturing PMI rose to 53.6 (52.8 expected) from 53.0. Both economic data would suggest that China's economy is gradually improving after the outbreak of coronavirus.

Investors should focus on the CPI (+0.8% on year expected) and PPI (-1.9% on year expected), which will be released next week.

On a daily chart, China A50 Index is challenging the July's high at 16490 now. In fact, the index looks like to validate the continuation of round bottom. Currently, the index prices are trading above both rising 20-day and 50-day moving averages. The relative strength index breaks above the declining trend line drawn from July.

Bullish readers could set the support level at 15600, while the resistance levels would be located at 17550 and 18240.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM