China A50 Index and Hang Seng Index Regain Upward Momentum

Both the China A50 Index and Hang Seng Index rose around 7% from May's low. In addition, both indexes broke above the declining trend line drawn from the January top. It would suggest that the both indexes have made a significant bottom in March.

China's Caixin Services PMI rose to 55.0 in May (47.3 expected) from 44.4 in April. Key findings included:" Business activity and new work rise at quickest rates since late 2010 (...) Pandemic continues to weigh heavily on export orders (...) Employment falls slightly as firms look to raise efficiency."

In the below chart, the Caixin Services PMI rose the fourth month after reaching the bottom since March. It suggests that the non-manufacturing activities regain the upward momentum after the outbreak of COVID-19.

Sources: Trading Economic

Next week, investors should focus on the imports (-9.7% expected) and exports (-7.0% expected) data.

In addition, different countries in the world have started to launch stimulus packages, when the situation of COVID-19 eased. Moreover, the interest rate in those developed countries are at relatively low levels. When the investors' risk appetite increased, investors would increase the investment of higher risk assets, such as the equities index and stocks.

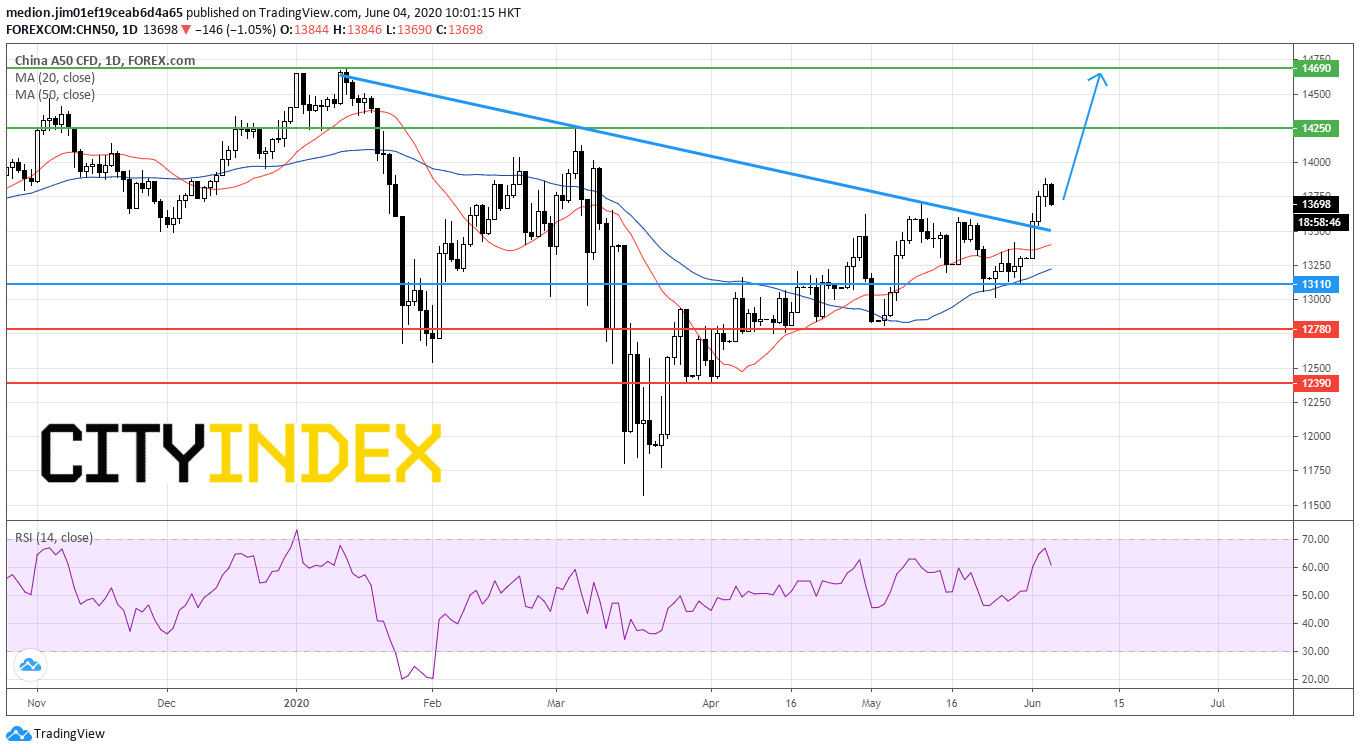

Let's take a look at the daily chart of the China A50 Index.

Source: GAIN Capital, TradingView

From a technical point of view, China A50 Index has recorded a series of higher tops and higher bottoms since March. Currently, the prices are trading above both rising 20-day and 50-day moving averages.

The RSI also reached a new high around the 60s, suggesting the upside momentum for the prices.

The readers could set the support level at 13110 (the low of May 29), while resistance levels would be located at 14250 (the high of February) and 14690 (the high of January).

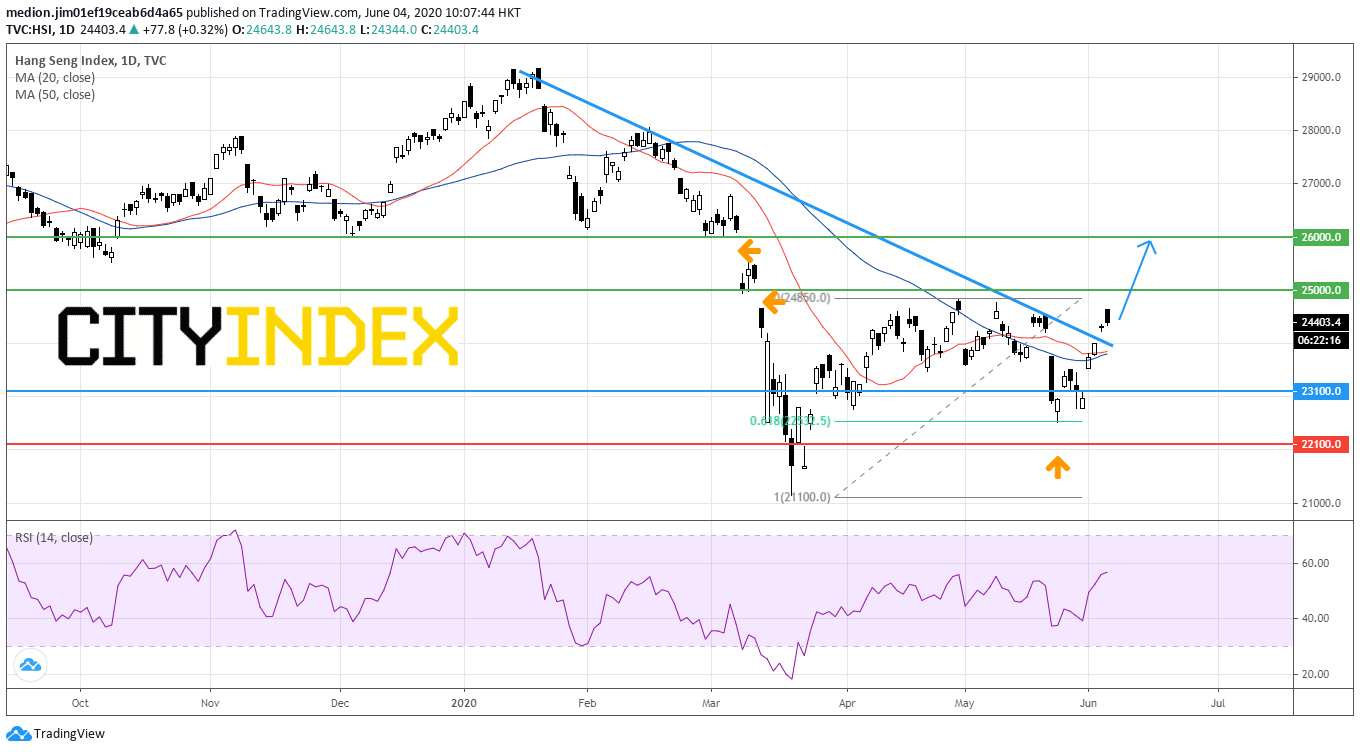

After that, we will check out the daily chart of Hang Seng Index

Source: GAIN Capital, TradingView

The RSI has marked a new high and is still heading upward , suggesting the upward momentum for the prices.

Bullish readers could set the support level at 23100 (the gap created on May 29), while the resistance levels would be 25000 (a gap occurred on March 12) and 26000 (a gap occurred on March 9).

China's Caixin Services PMI rose to 55.0 in May (47.3 expected) from 44.4 in April. Key findings included:" Business activity and new work rise at quickest rates since late 2010 (...) Pandemic continues to weigh heavily on export orders (...) Employment falls slightly as firms look to raise efficiency."

In the below chart, the Caixin Services PMI rose the fourth month after reaching the bottom since March. It suggests that the non-manufacturing activities regain the upward momentum after the outbreak of COVID-19.

Sources: Trading Economic

Next week, investors should focus on the imports (-9.7% expected) and exports (-7.0% expected) data.

In addition, different countries in the world have started to launch stimulus packages, when the situation of COVID-19 eased. Moreover, the interest rate in those developed countries are at relatively low levels. When the investors' risk appetite increased, investors would increase the investment of higher risk assets, such as the equities index and stocks.

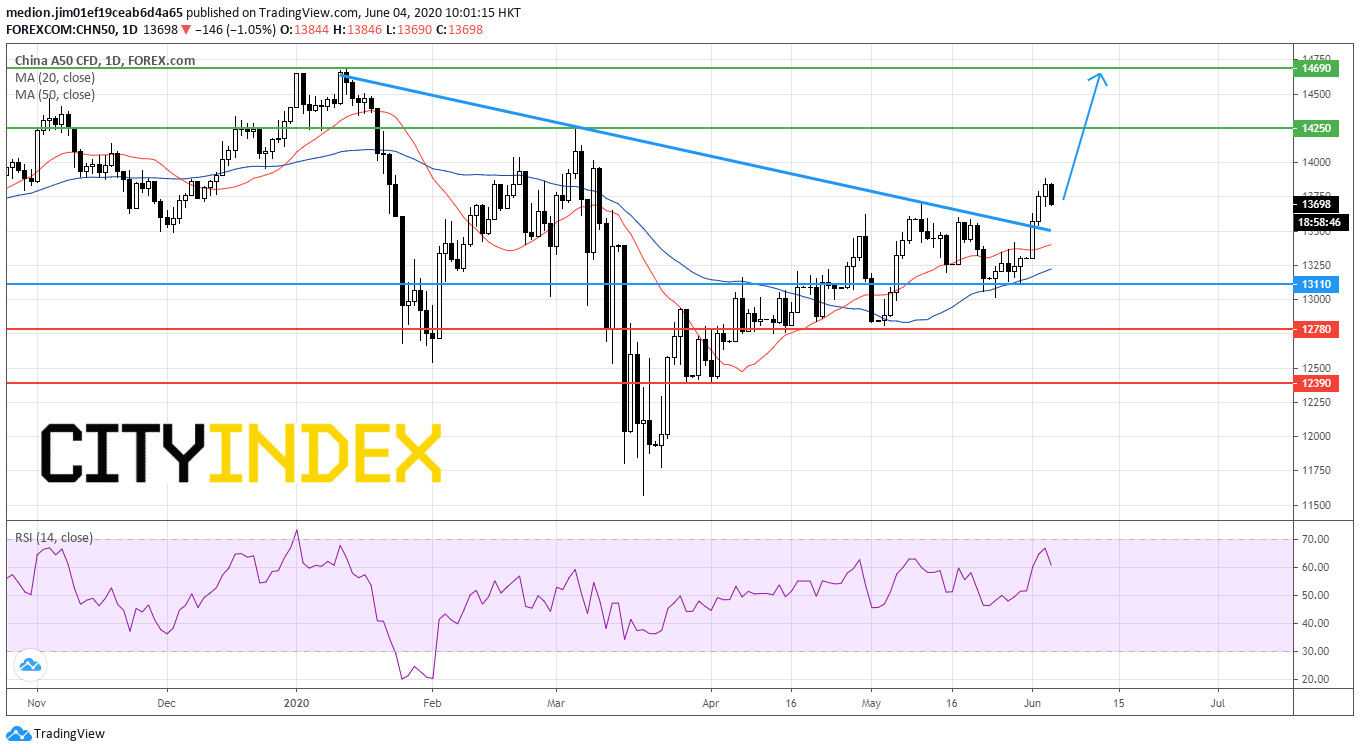

Let's take a look at the daily chart of the China A50 Index.

Source: GAIN Capital, TradingView

From a technical point of view, China A50 Index has recorded a series of higher tops and higher bottoms since March. Currently, the prices are trading above both rising 20-day and 50-day moving averages.

The RSI also reached a new high around the 60s, suggesting the upside momentum for the prices.

The readers could set the support level at 13110 (the low of May 29), while resistance levels would be located at 14250 (the high of February) and 14690 (the high of January).

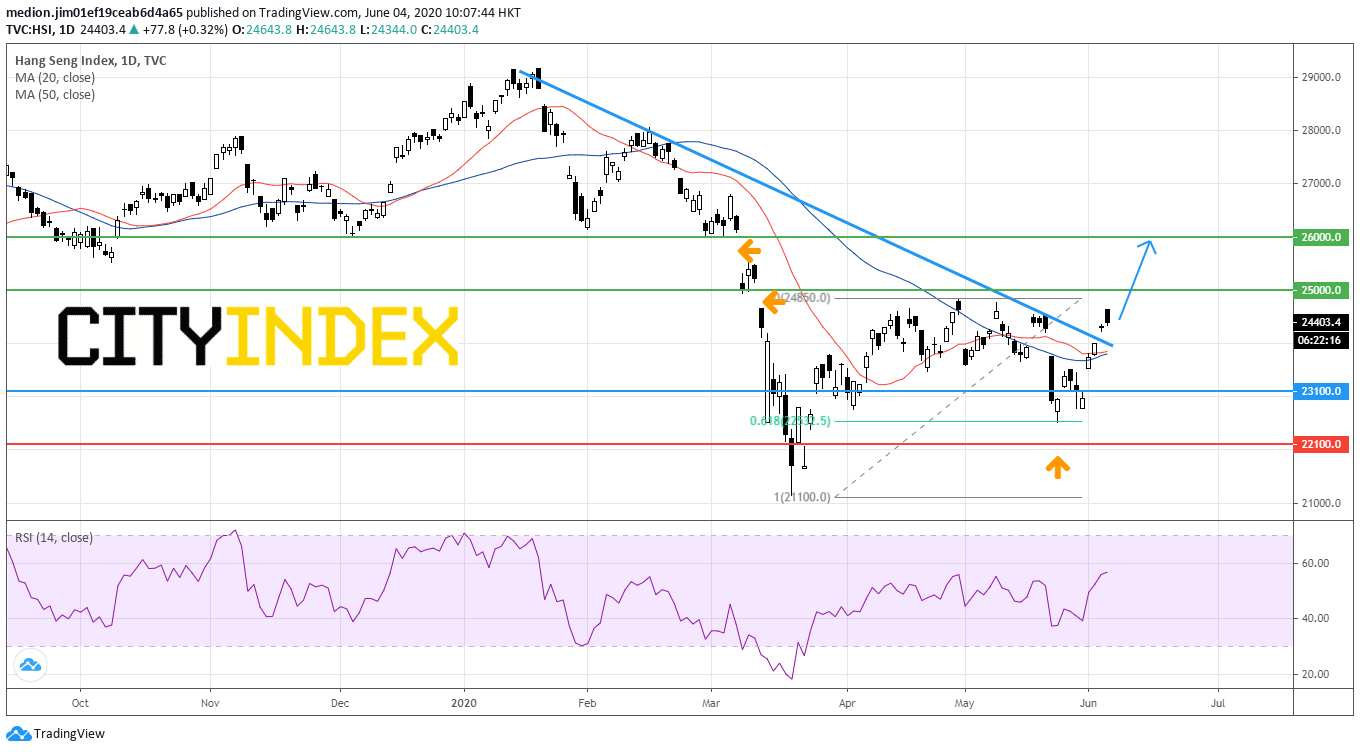

After that, we will check out the daily chart of Hang Seng Index

Source: GAIN Capital, TradingView

The Hang Seng Index posted a rebound after forming a reversal bar at 22600 (Fibonacci 61.8% retracement level between the bottom of March and the high of April). Currently, the index prices returned the level above the level of 20-day and 50-day moving averages. Besides, the 50-day moving average is reversing up, indicating that the trend in a longer period is turning to positive.

The RSI has marked a new high and is still heading upward , suggesting the upward momentum for the prices.

Bullish readers could set the support level at 23100 (the gap created on May 29), while the resistance levels would be 25000 (a gap occurred on March 12) and 26000 (a gap occurred on March 9).

Latest market news

Yesterday 10:40 PM

Yesterday 04:00 PM