China A50 Index and Hang Seng Index are Rebounding from Recent Low

Hong Kong's Hang Seng Index and China A50 Remains trading within the range of July. Investors are weighing on the tension between the U.S. and China. Recently, the U.S. government further tightens the restrictions on Huawei to access the chips.

Last week, China's retail sales unexpectedly dropped 1.1% on year in July, while industrial production was up 4.8% on year, lower than the expectation of the increase of 5.1%. The economic data suggested that the recovery of the economy still has uncertainty.

However, the technical outlook of Hang and China A50 Index remains bullish. Let's take a look at the below charts.

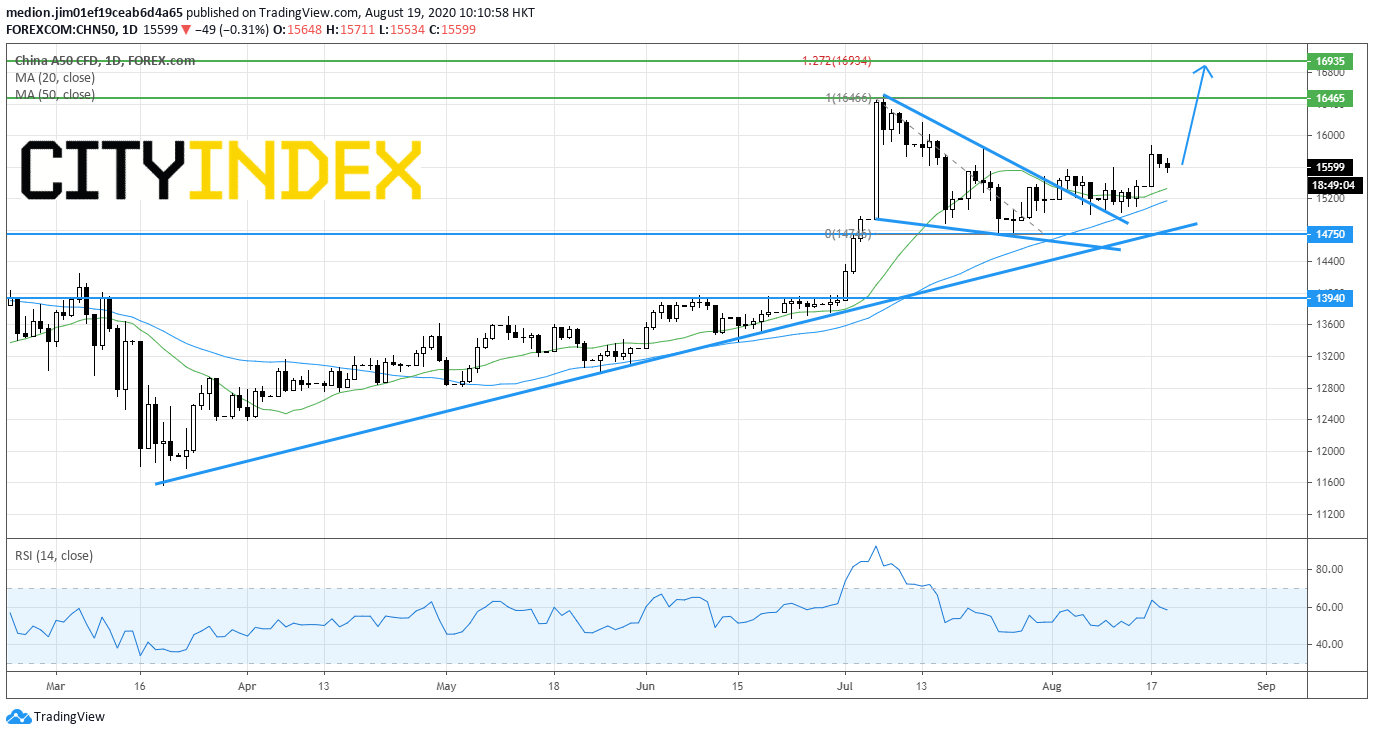

China A50 Index (short term): Bullish bias above 14750

Source: GAIN Capital, TradingView

China A50 rebounded around 5% from July's low at 14750 after breaking above the falling wedge. In fact, the index prices are supported by a rising trend line drawn from March low. Currently, the prices are trading above both rising 20-day and 50-day moving averages.

Bullish readers could set the support level at 14750, while the resistance levels would be located at 16465 (July's high) and 16935 (127.2% Fibonacci expansion).

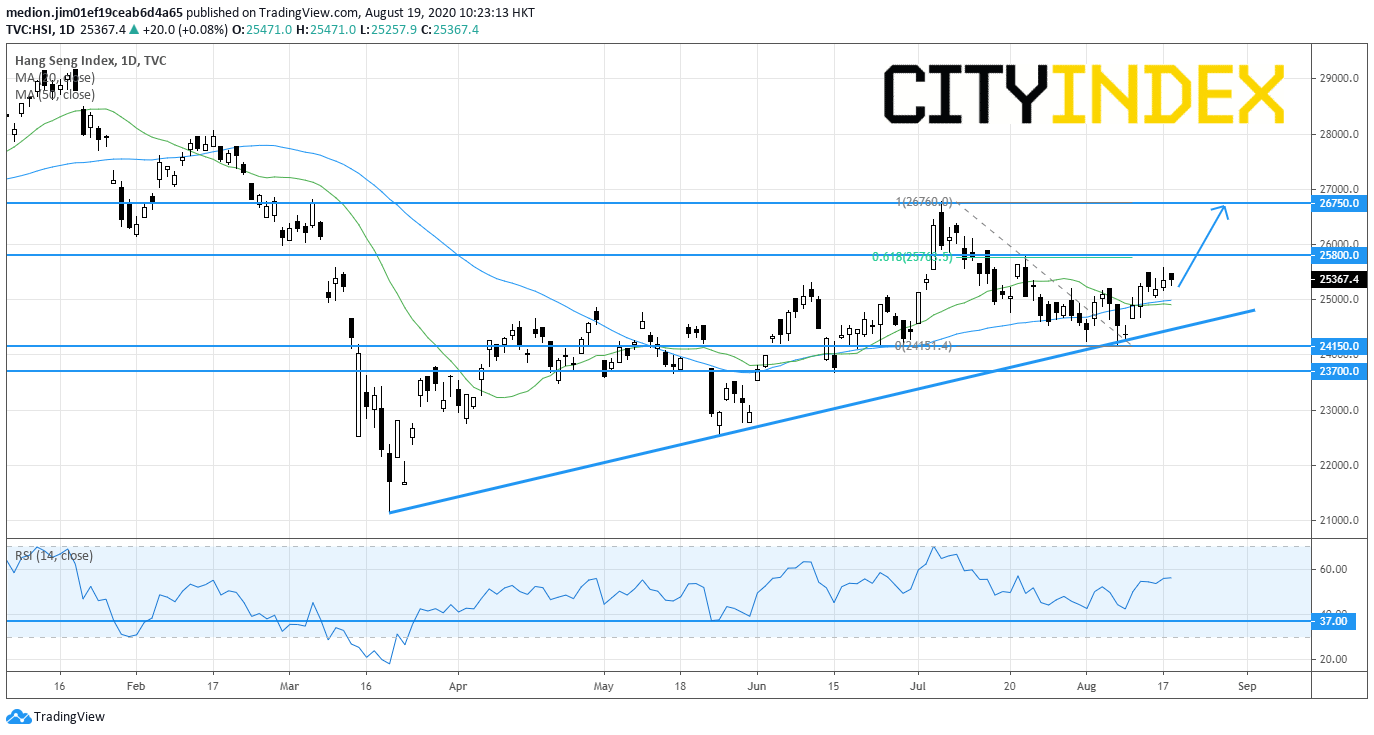

Hang Seng Index (short Term): Rebound expected

Source: GAIN Capital, TradingView

The Hang Seng Index rebounded from 24150 after touching the rising trend line drawn from March low. Currently, the index returns the level above both 20-day and 50-day moving averages. The relative strength index also bounced after failing to penetrate the previous low at 37.

In this case, unless the support level at 24150 (the previous low) is violated, the index could consider a rise to the resistance levels at 25800 (61.8% fibonacci retracement) and 26750 (the previous high).

Last week, China's retail sales unexpectedly dropped 1.1% on year in July, while industrial production was up 4.8% on year, lower than the expectation of the increase of 5.1%. The economic data suggested that the recovery of the economy still has uncertainty.

However, the technical outlook of Hang and China A50 Index remains bullish. Let's take a look at the below charts.

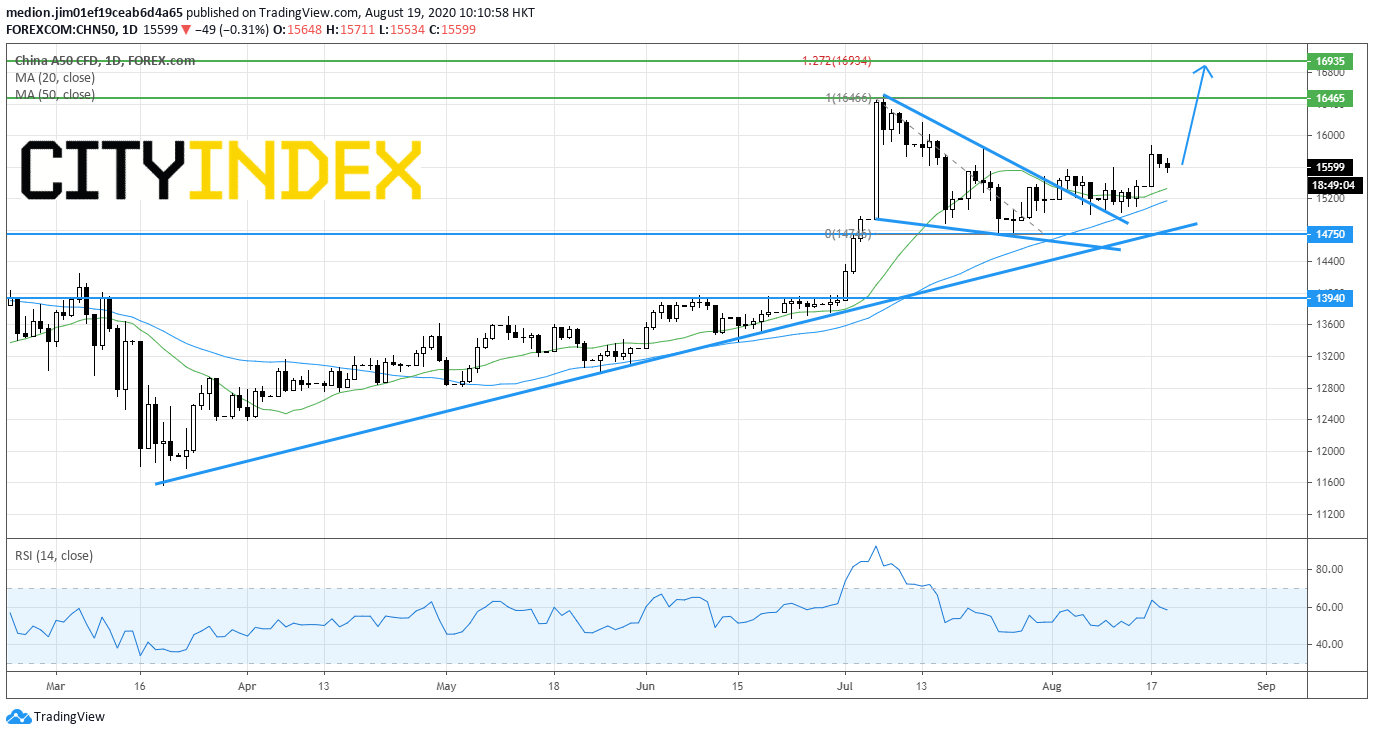

China A50 Index (short term): Bullish bias above 14750

Source: GAIN Capital, TradingView

China A50 rebounded around 5% from July's low at 14750 after breaking above the falling wedge. In fact, the index prices are supported by a rising trend line drawn from March low. Currently, the prices are trading above both rising 20-day and 50-day moving averages.

Bullish readers could set the support level at 14750, while the resistance levels would be located at 16465 (July's high) and 16935 (127.2% Fibonacci expansion).

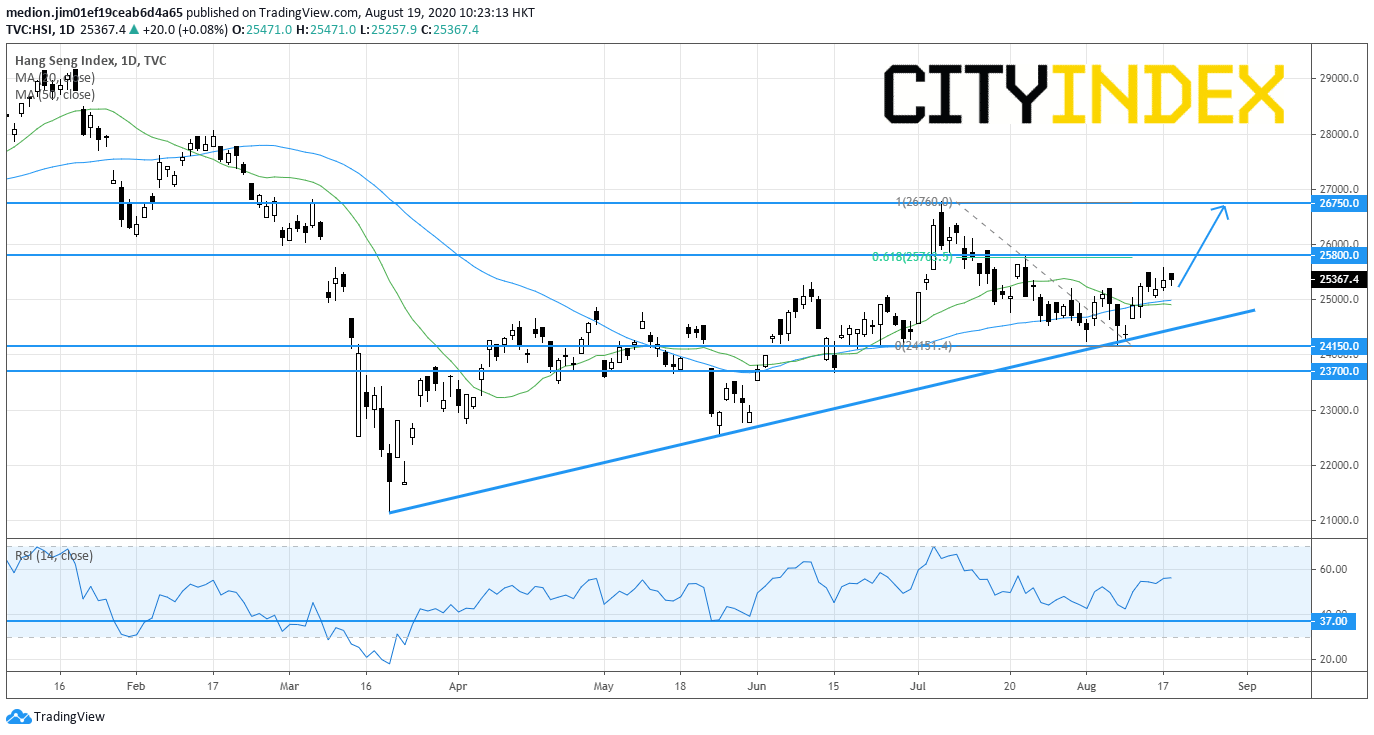

Hang Seng Index (short Term): Rebound expected

Source: GAIN Capital, TradingView

The Hang Seng Index rebounded from 24150 after touching the rising trend line drawn from March low. Currently, the index returns the level above both 20-day and 50-day moving averages. The relative strength index also bounced after failing to penetrate the previous low at 37.

In this case, unless the support level at 24150 (the previous low) is violated, the index could consider a rise to the resistance levels at 25800 (61.8% fibonacci retracement) and 26750 (the previous high).

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM