Medium-term technical outlook on China A50

click to enlarge charts

Key elements

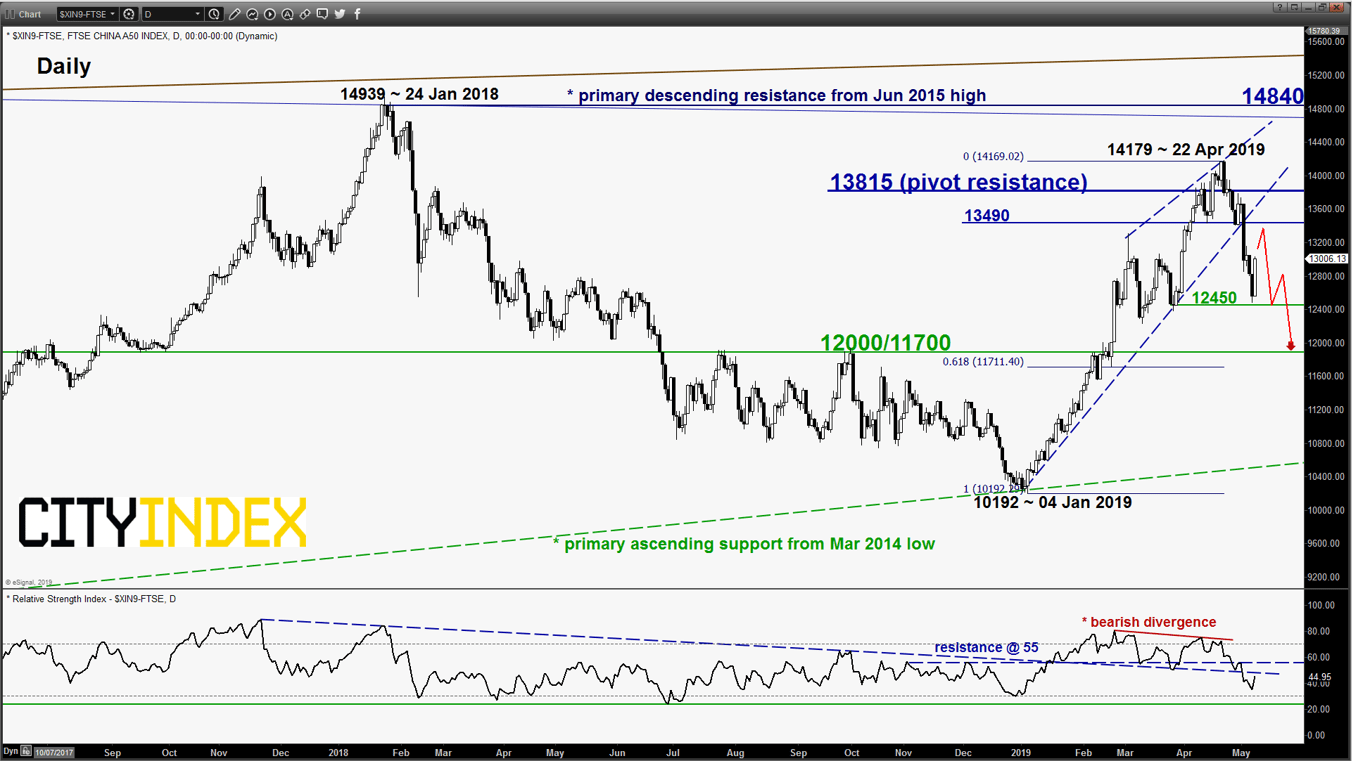

- China A50, the one of best performing stock index in 2019 where it rallied by close to 40% from its 04 Jan 2019 low of 10192 to print a high of 14179 on 22 Apr 2019 has made another remarkable turnaround today, 10 May where it rallied by 3.8% on the back of additional tariffs of 25% on US $200 billion worth of Chinese imports being by the U.S. administration.

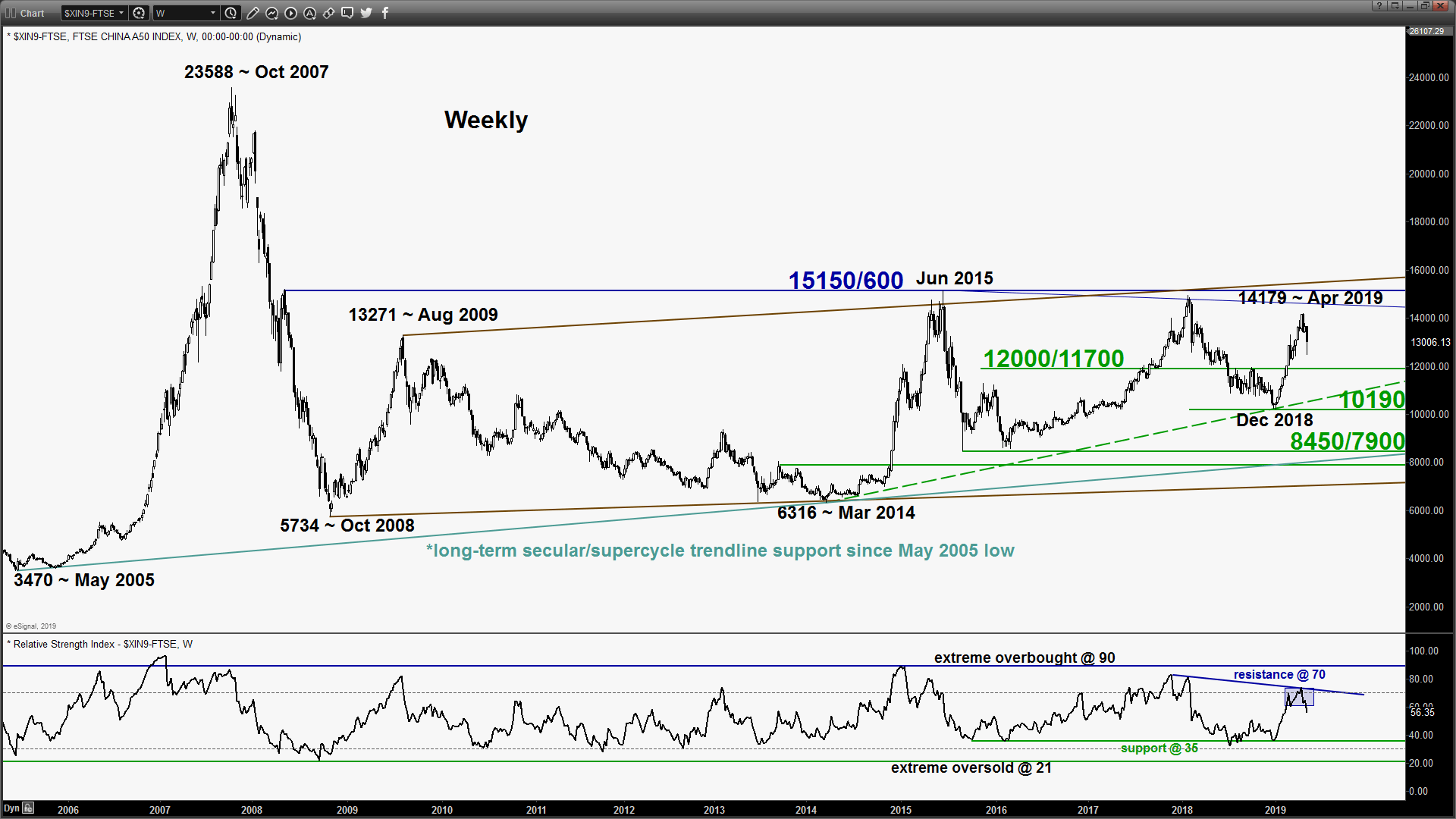

- Momentum indicator has not yet confirmed a revival of upside momentum of price action where the weekly RSI oscillator still has further room to manoeuvre to the downside after its exit from the overbought region/resistance before it reaches its support at the 35 level. In addition, the daily RSI oscillator has traced out a prior bearish divergence signal and remains below a significant corresponding resistance at the 55 level.

- The key medium-term resistance to watch will be at 13815 which is defined by the 29 Apr 2019 swing high and 76.4% Fibonacci retracement of the entire decline from 22 Apr 2019 high to 09 May 2019 low.

- The next significant medium-term support rests at 12000/11700 which is defined by the former range resistance formed on 25 Jul/28 Sep 2018 & the 61.8% Fibonacci retracement of the recent up move from 04 Jan 2019 low to 22 Apr 2019 high.

Key Levels (1 to 3 weeks)

Intermediate resistance: 13490

Pivot (key resistance): 13815

Supports: 12450 & 12000/11700

Next resistance: 14840

Conclusion

If the 13815 key medium-term pivotal resistance is not surpassed, the China A50 may see another medium-term (multi-week) impulsive downleg to retest 12450 before targeting the 12000/11700 before a potential recovery sets in.

However, a daily close above 13815 invalidates the bearish scenario for a continuation of the major (multi-month) up move towards the next resistance at 14840 (also the descending trendline from Jun 2015 high).

Charts are from eSignal