However, Evergrande is not part of the China A50 index and the spill over was modest compared to moves elsewhere.

This is because the Real Estate, Construction, and Materials sectors in the China A50 most closely linked to Evergrande account for a combined ~3% weighting in the China A50 index.

Furthermore the interest rate-sensitive sectors of Food, Beverage and Alcohol, Banks, Insurance, and Financial Services that account for ~64% of the index likely benefitted from an easing in policy into month-end.

As mainland China traders return from the Golden Week holiday tomorrow challenges remain for the China A50.

These included the Chinese government's regulatory reset in recent months across several sectors, including technology, education and data privacy.

As well as production cuts to comply with energy intensity targets, slower property activity, and near-term funding pressures for property developers that will remain a significant drag on growth.

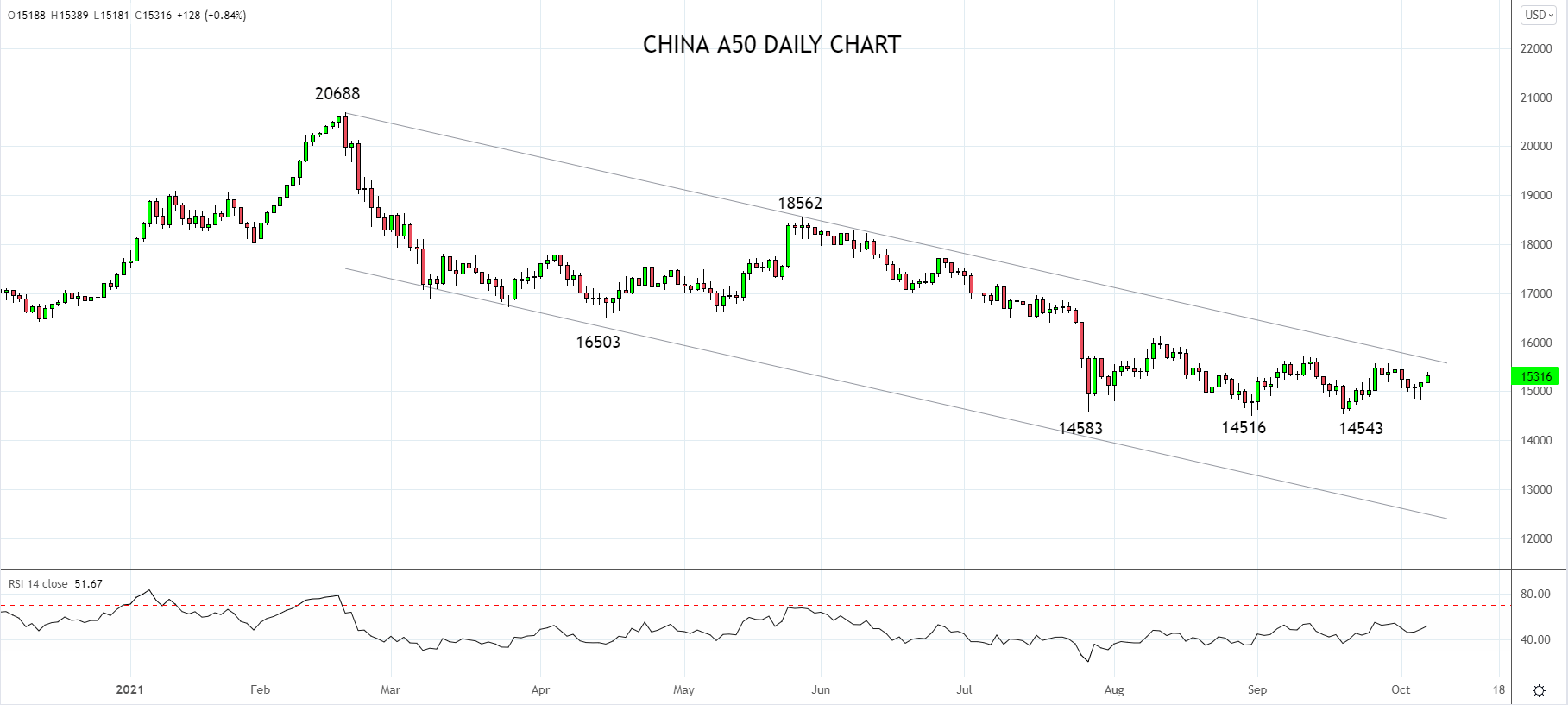

Turning to the charts, the decline from the February 20688 high to the late August 14516 low appears to be a correction after the China A50's strong run higher in the two years beforehand.

Despite the Evergrande turmoil, the China A50 tested and held the August 14516 low, providing preliminary evidence of basing.

Should the index break above trendline resistance at 15650 (coming for the 20688 high) and the September 15715 high, it would be an initial indication the correction is complete, and the index can rally towards resistance, formerly support at 16,500/17,000.

Until this occurs, a retest and break of the 14516 low remain possible.

Source Tradingview. The figures stated areas of October 7th, 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation