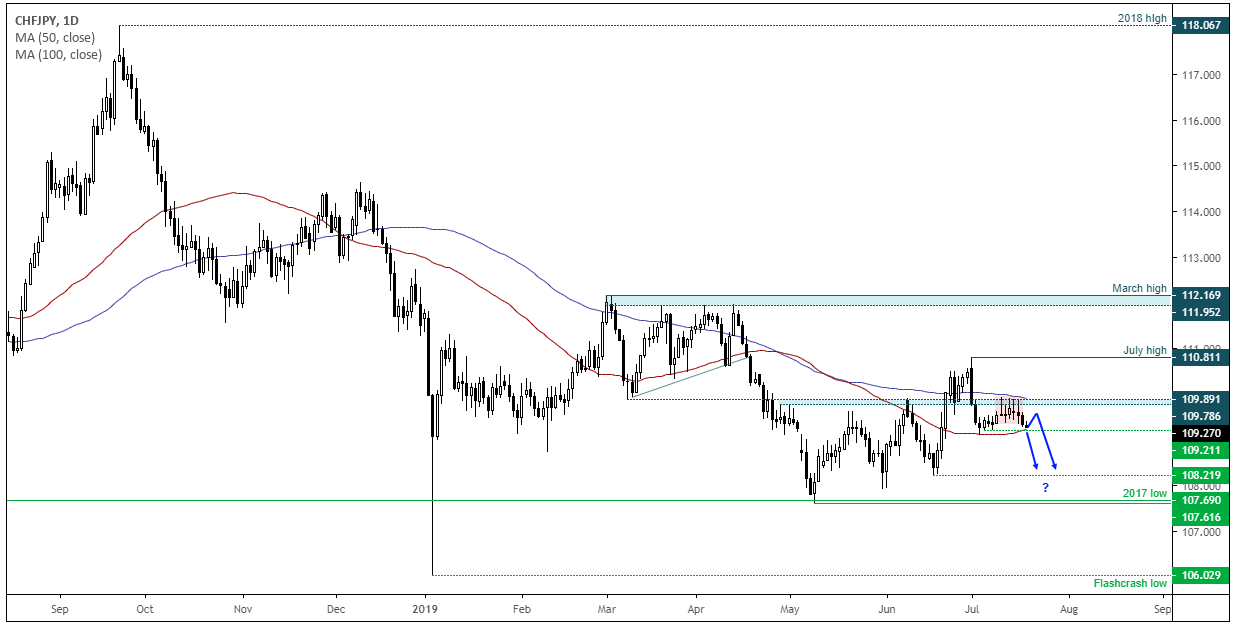

CHF/JPY Could Be Set For Another Break Lower

Since its bull-trap at the start of the month, a lower high appears to have formed and the cross is now testing a potential breakout level.

Two weeks ago, we noted that CHF/JPY’s bull-trap and subsequent crash through key support had slammed it back onto our bearish watchlist. Sometimes it can take a little longer than you’d like to migrate from the watchlist to a trade (and sometimes it simply never happens), but it now appears CHF/JPY is preparing for its next dip lower.

Over the past week, five doji’s have formed below 110 (one being a bearish pinbar) and yesterday was its most bearish day in two weeks. The 100-day average has capped the recent swing high and, whilst the 50-day is acting as support, a clear break of 109.21 support invalidates it and takes it back within its original range.

As a quick re-cap to the prior analysis, CHF/JPY has been trending lower in a choppy fashion since the 118.067 high. We suspect we’re nearing the end of anything choppy, sideways correction.

- Near-term bias is for a break below 109.21, bringing the 108.22 low into focus.

- Should the bearish trend, it should also break beneath the 2017 low.

- A break back above 110 / 100-day MA invalidates the near-term, bearish bias.