Central Bank of Mexico Surprises Market and Cuts Rates by 25bps

The Central Bank of Mexico cut overnight interest rates by 25bps, to 8.00%. Consensus was for unchanged and it was the first time the Central Bank cut rates since 2014. One board member voted to keep rates unchanged at 8.25%. Members cited geopolitical risks and worries over a global slowdown as reasons for the rate cut.

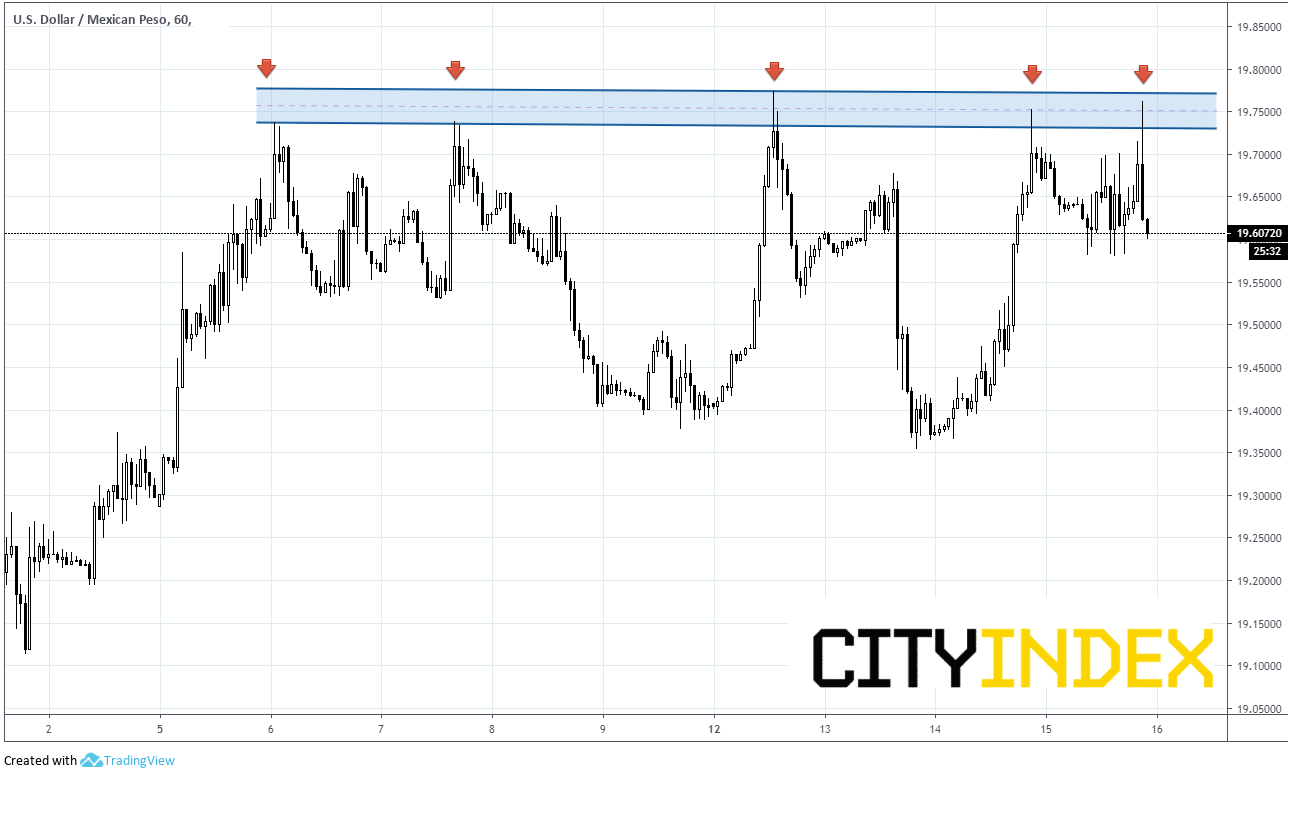

USD/MXN spiked immediately to a high of 19.7624, however has reversed aggressively and has since pulled back toward 19.6000.

There is a short-term resistance zone at 19.7500/19.7700. This area has been rejected 5 times since Monday and may continue act as important resistance in the short term.

Source: Tradingview, City Index

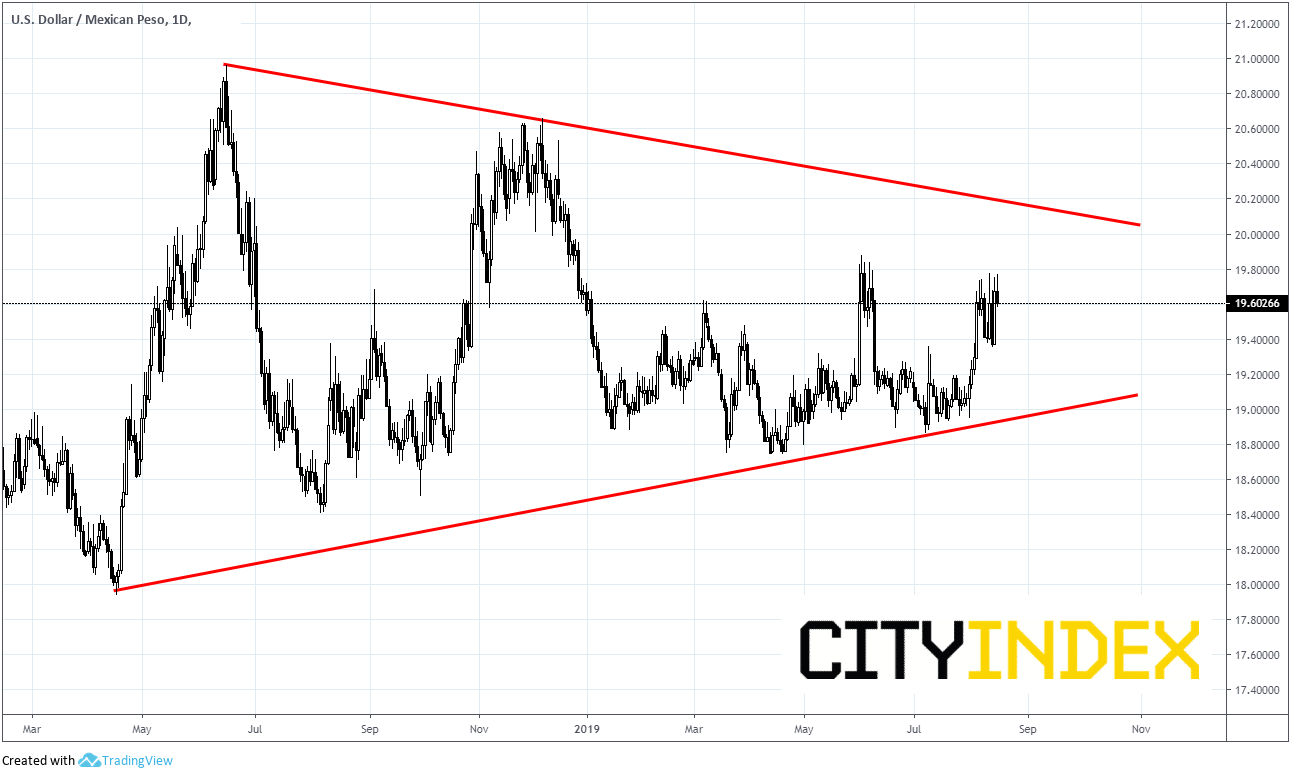

However, a longer-term daily chart shows that price action has been stuck in a symmetrical triangle since April 2018, between the roughly 18.00 and 21.00.

Source: Tradingview, City Index

As we are coiling towards the apex of this triangle, note the approximate breakout levels of the triangle, which are currently 20.00 on the upper trendline, and 19.00 on the lower trendline. A break through either of these trendlines may determine the next long-term direction for USD/MXN.