Cathay Pacific (293-hk): A Severely Suffered Airline

Cathay Pacific Airways (293-hk), an airline group that suffered severely from oil-hedging losses and the coronavirus, announced a recapitalisation plan this week, targeting to raise aggregate proceeds of approximately 39 billion Hong Kong dollars. The company said the plan will involve issues of preference shares, warrants, rights shares and an extension of bridge loan.

However, Credit Suisse downgraded the company to "underperform" from "neutral", pointing out that industry recovery is expected to be weak and demand in the third quarter would remain subdued. Meanwhile, Daiwa Securities said Cathay's plan would lead to a 43% share dilution.

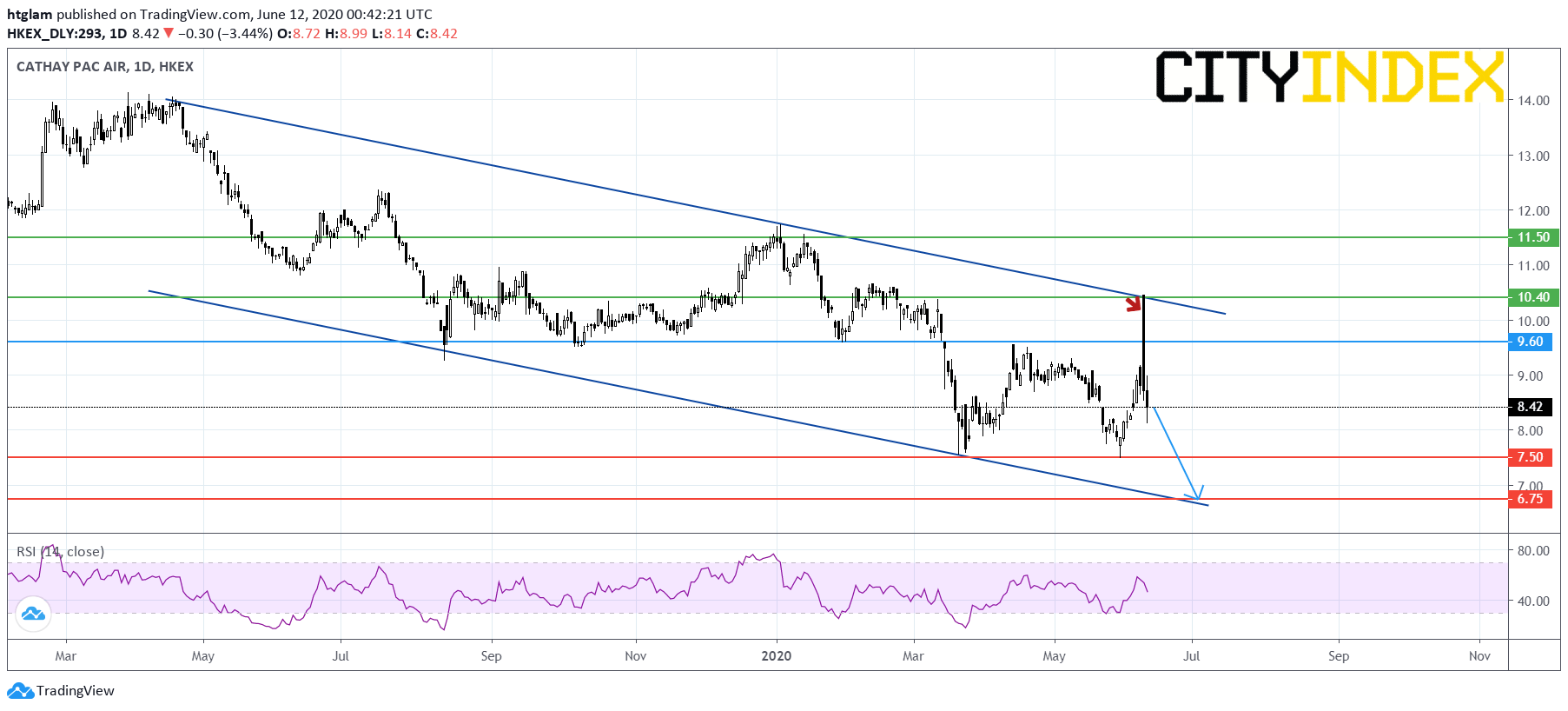

From a technical point of view, Cathay Pacific Airways remains well within a long term bearish channel as shown on the daily chart. It has retreated sharply after reaching the upper boundary of the channel, and formed a one-day reversal candlestick. The level at $9.60 might be considered as the nearest resistance, with prices likely to test the 1st and 2nd support at $7.50 and $6.75 respectively. Alternatively, a break above $9.60 may open a path to the next resistances at $10.40 and $11.50.