Can’t stop, won’t stop: Gamestop (GME)

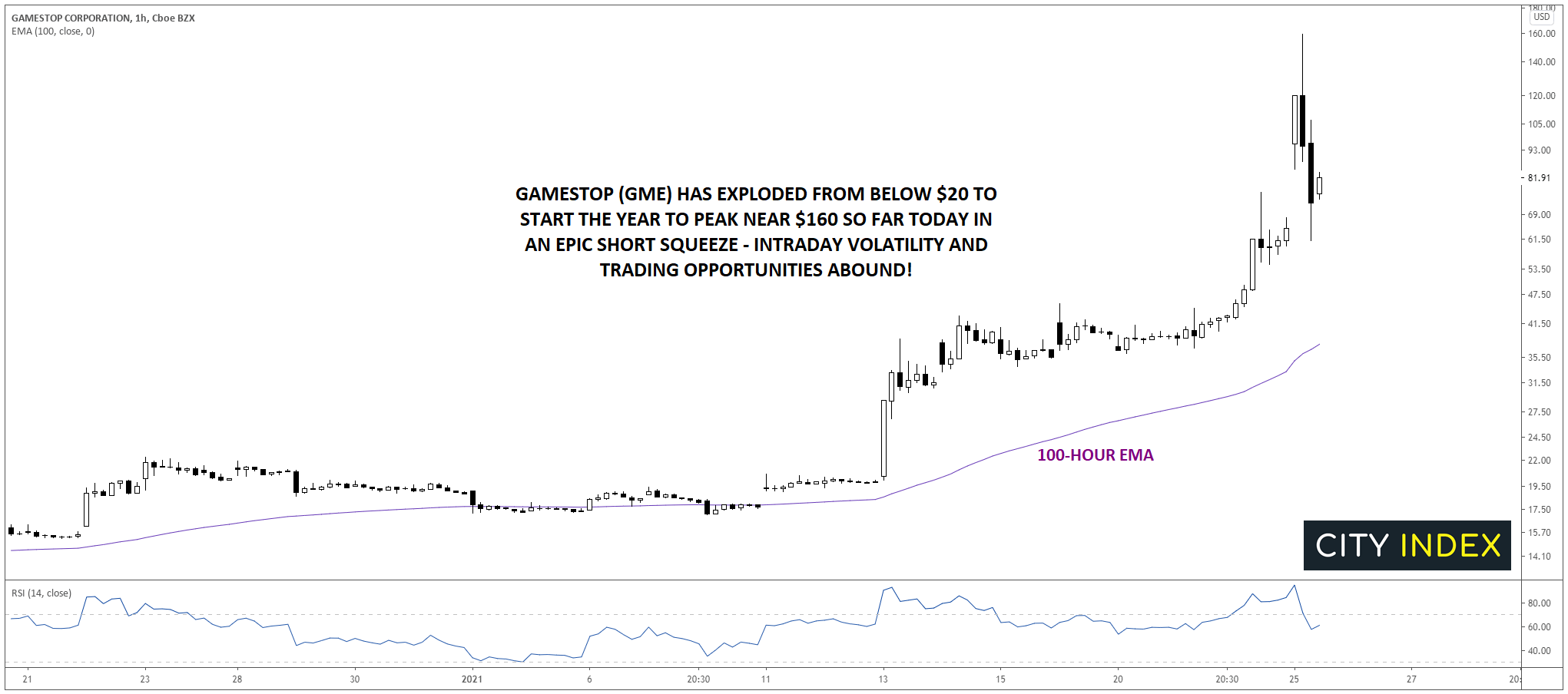

After years of dismal business performance as the omnipresent video game retailer missed the secular shift to digital purchases, the company was priced as if it may soon be forced into bankruptcy during the darkest depths of the COVID-19 pandemic in March. Since then, the company’s turnaround has been nothing short of remarkable, with the stock rising from a low under $3.00 to peak near $160 so far this morning.

Like any dramatic move, the breathtaking surge in GME’s stock is a result of a confluence of different factors.

From a fundamental perspective, the company has recently brought in new management and accelerated its belated transition to an e-commerce business; according to the firm’s holiday sales report, “E-commerce sales…rose 309% and represented approximately 34% of total company sales” at over $1.35B. Meanwhile, the company recently announced a partnership with Microsoft, allowing GameStop to collect recurring revenue from digital sales on Microsoft’s Xbox console. At the same time, the company has been buying back shares hand over fist, reducing its float by over 38M shares in 2020, or about 37% of the company’s total shares outstanding.

Though the fundamental outlook for the company has certainly improved over the last year, the biggest factor driving this year’s explosion in the stock price has been a truly gargantuan “short squeeze.” Throughout most of last year, the market was short in excess of 60M shares of the company, or essentially the company’s entire float. As prices started to rise (purportedly helped along by communities of small investors including the WallStreetBets subreddit and TikTok trading personalities), some of those traders were forced to close their short positions and buy the stock back. This in turn pushed prices up further, forcing more short sellers to buy the stock, pushing prices to rise yet further and so on.

With any parabolic market move, the question isn’t whether it’s reasonable, but where it will stop. After all, in the words of the great John Maynard Keynes, “markets can stay irrational longer than you can stay solvent.” As we go to press, the stock may have just experienced a blow off top (of course, that statement could be proven wrong by the time the market closes later today!). In any event, it would be perfectly normal, and frankly healthy for bulls, for GME to drop back toward its 100-hour EMA near $35.00 at a minimum:

Source: TradingView, GAIN Capital

Regardless of what happens over the next couple days, the stock’s unprecedented volatility will offer plenty of opportunities for traders in both directions!

Learn more about equity trading opportunities.