US GDP 3.1% lifts sentiment

US GDP Q1 was revised marginally lower as expected to 3.1%. This was still a strong enough level of growth to keep investors placated and helped lift demand for riskier assets. Whether this move higher is sustainable could depend on the Chinese pmi releases on Friday.

Manufacturing activity in China is expected to fall into contraction in May, dipping below the key 50 level. This will be the first glimpse of how the Chinese economy is holding up since Trump’s latest round of tariff hikes in early May. A notably weak reading will almost certainty send jitters through the markets as investors are particularly sensitive to data pointing to slower growth in the world’s second largest economy.

Pound drops sub $1.26

The stronger dollar and increasing Brexit uncertainty sent the pound sub $1.26, which also supported the FTSE. Whilst Labour are pointing towards a second referendum, there is a good chance that the next PM will be a Eurosceptic. The possible outcomes for Brexit are once again wide open creating a level of uncertainty disliked by the markets. Pound traders see few reasons to buy into the pound right now and we don’t expect that to change over the coming weeks. Continued pressure on the pound could ensure that the FTSE fairs better than its European peers.

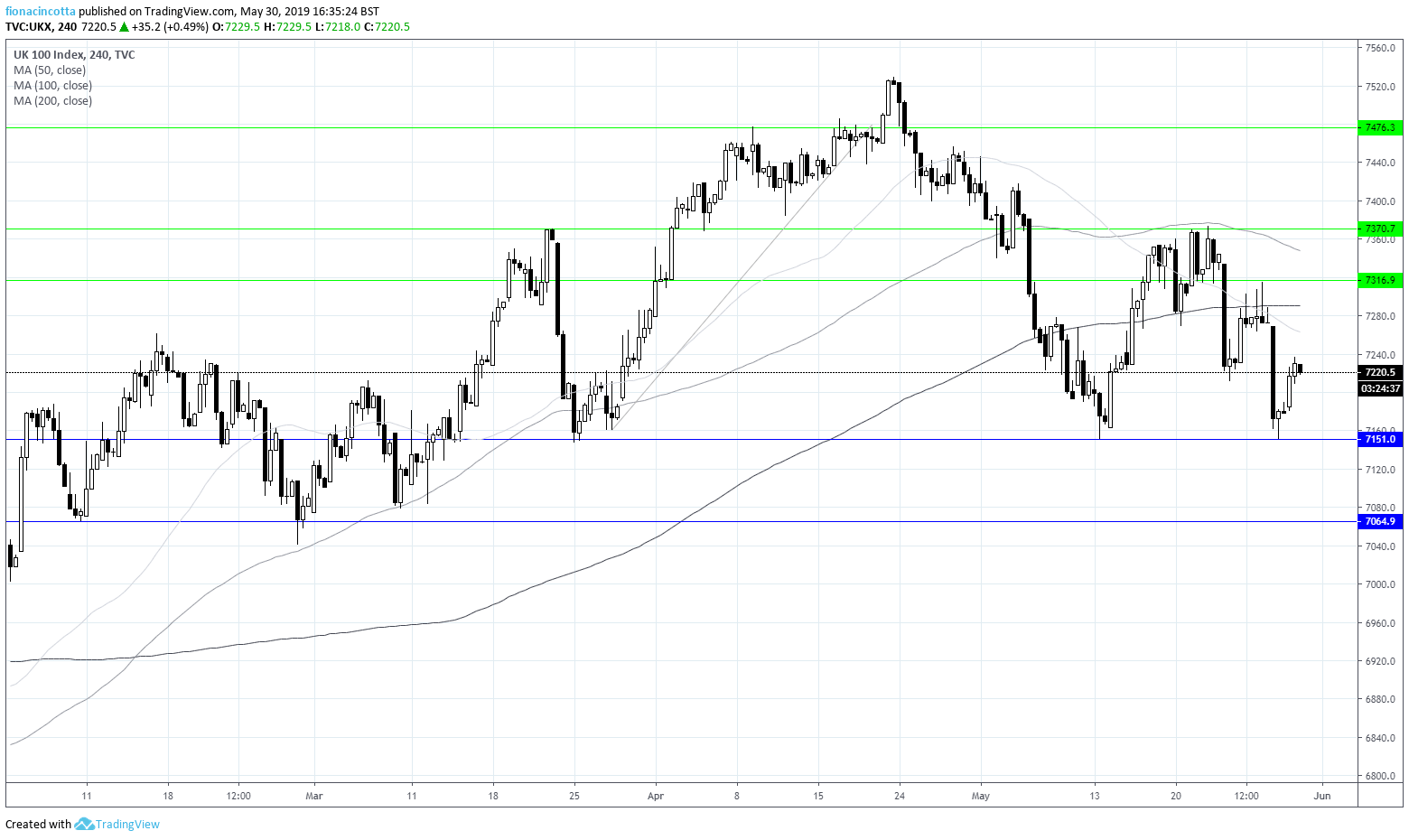

Critical support still holds at 7150. We could be back testing this level sooner rather than later as the trend remains bearish on the 4 hour chart. For now, the FTSE is pushing higher as a more bullish phase takes hold. A break above 7316 could open the doors to 7370.