Currency markets have roared back to life as demonstrated by the U.S. dollar index, the DXY, falling almost 4% month to date. In theory, a falling U.S. dollar is viewed as being reflationary because it pushes up commodity prices, partly because they are priced in U.S. dollars.

Commodities have therefore responded as they should. Copper is up over 7% month to date. Gold made new all-time highs earlier this week and is 10% higher month to date. Both have been left behind by spectacular gains in Silver, up ~34% month to date.

How long the current reflationary thematic will continue to drive currencies and commodities is uncertain. The best guess is it could take many months to evolve. However, as yesterday’s sharp pullback in gold and silver illustrated, its unlikely to be all one-way traffic. Additionally, equities never like to be too long away from the spotlight.

The next few days are shaping as an opportunity for equities to flex their muscles. In the lead up to earnings reports from the FAANG stocks, FOMC, and then end of month, it did not go unnoticed the S&P500 fell -0.65% overnight, while the high beta NASDAQ fell -1.33%.

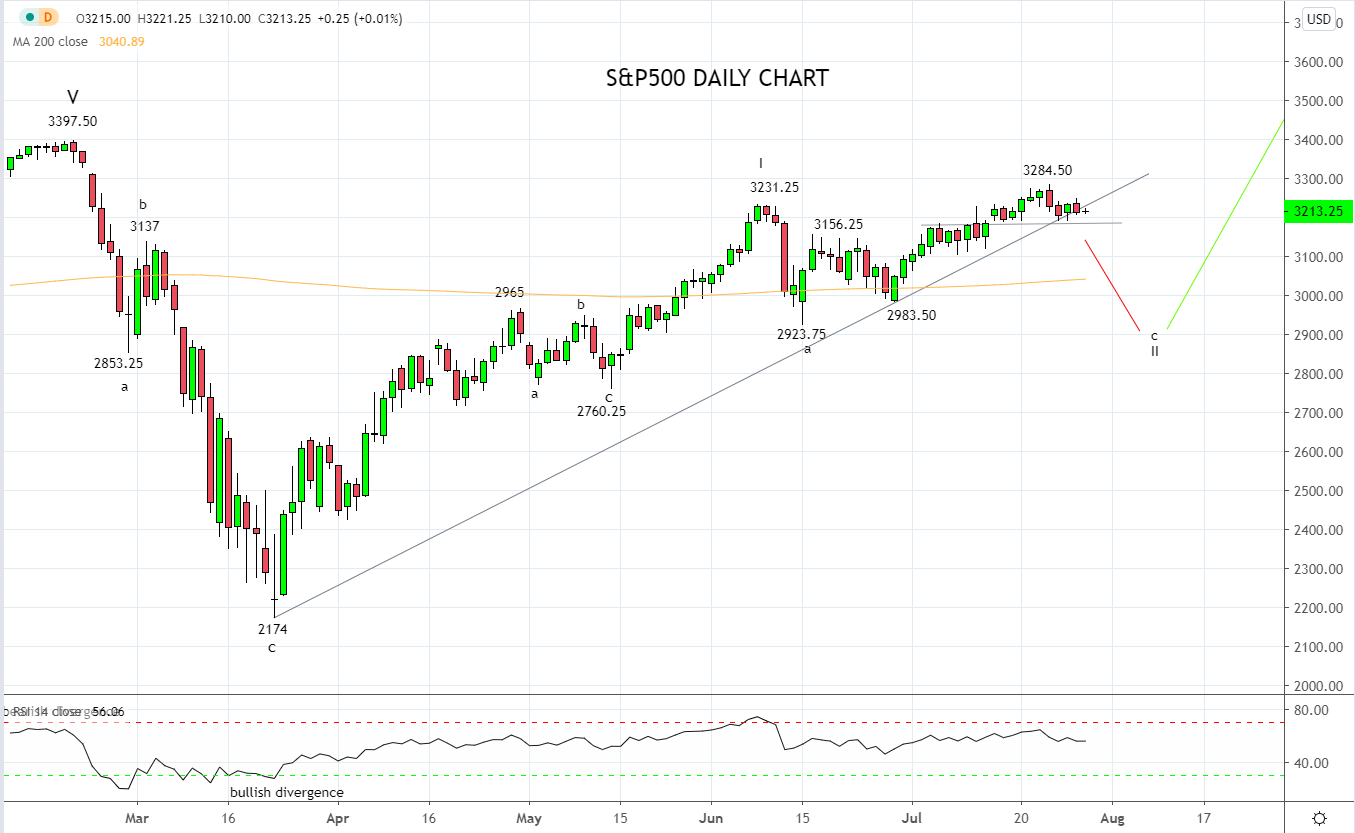

When looking at the S&P500 on the chart below, it is unclear yet whether the lack of bullish follow-through after the break above the June 3231.25 high is just the market trading in a holding pattern ahead of key events or the beginning of a corrective pullback.

Should the S&P500 confirm the break of uptrend support from the March 2174 low, by breaking and then closing below the support coming from recent lows 3190/80 area, it would be an initial warning that a pullback towards 2930 is underway. A break/close below medium-term support 3150/30 would indicate the move lower is gaining traction.

Conversely, should the S&P500 hold above the short term support 3190/80 and trades now lower than medium-term support 3150/30ish, allow for a test and break the all-time high at 3397.50 before extending towards 3500/3600 into year-end.

Source Tradingview. The figures stated areas of the 29th of July 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation