This morning’s volatility was another reminder that the fortunes of risk currencies remain closely tied to the rise and fall of equities. However tomorrow at midday Sydney time, the NZD, a risk currency has a chance to do “its own thing” as the RBNZ meets to discuss interest rates.

While the RBNZ is widely expected to keep interest rates on hold at 0.25% there will be keen interest to see how the RBNZ attempts to juggle the positive surprise coming from the suppression of COVID-19 that allowed New Zealand to move from Level 2 restrictions to Level 1 (the loosest in G10) after just 1 month.

Verse the negative impact of an exchange rate that has risen by 4.5% over the past 6 weeks, defying the RBNZs expectations for a fall. As well as the loss of jobs that come as New Zealand’s borders remain closed to international tourists, a sector that represents 5% of the economy.

In terms of forward guidance, the RBNZ is expected to remind that negative interest rates remain an option as does lifting the cap of the Large Scale Asset Program (QE) if needed. All in all, the RBNZ is expected to attempt to sound a cautiously optimistic tone (without spooking the NZD higher) and that it remains ready to act again if needed.

Whether the RBNZ will be able to strike the right tone to limit future gains in the NZDUSD, from a technical perspective, I am doubtful.

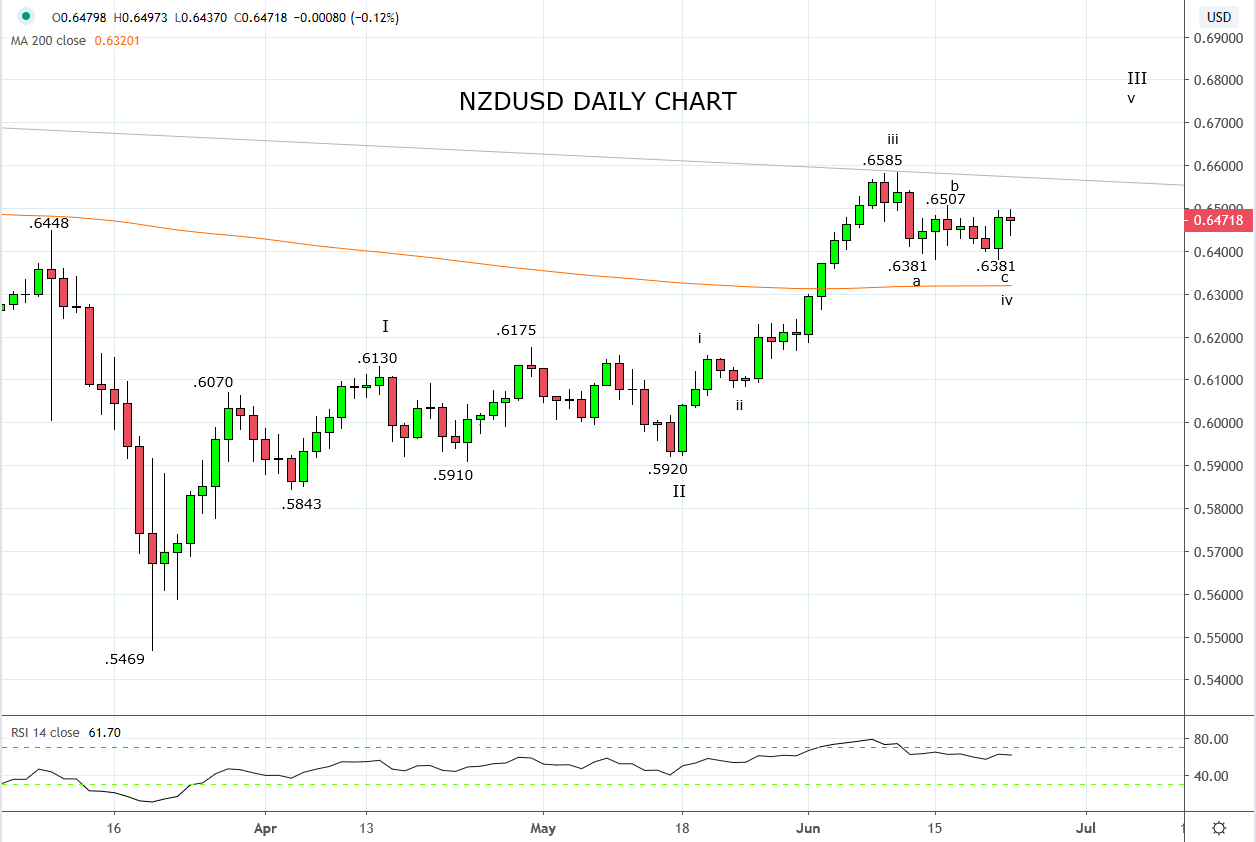

The NZDUSD’s rally yesterday from .6381 (double low) suggests the correction from the June .6585 high is now complete. Should a break and close above last week’s .6507 high occur after tomorrow RBNZ meeting, it would warn the uptrend has resumed and that a test and break of .6585 is likely, before .6720.

Keeping in mind it would take a break and close initially back below .6380 and then the support from the 200 day moving .6320/00 to confirm the Kiwi has been grounded.

Source Tradingview. The figures stated areas of the 23rd of June 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation