Mexico US progress

Mexico’s President announcing that talks with the US over immigration and trade were going well was the first bit of good news that markets have had for a while. With an agreement expected between the two nations by the June 10th deadline sentiment lifted boosting investor appetite for those riskier assets which had been dumped across May. However, this doesn’t change the more deeply concerning issue with China. Until there is an improvement on the US – Sino trade front we view this rally with caution and as more of a sell the peaks than buy the dips play.

Dollar pares gains as Fed Powell omits “patient stance”

Also helping the case for equities was the prospect of a rate cut by the Fed. Weaker manufacturing data and dovish comments by the Fed’s James Bullard in the previous session had investors expecting an interest rate cut as the next move by the Fed. Fed Jerome Powell’s omittance of the phrase “patience stance” has investors second guessing a rate cut is around the corner. Following his comments, global equities took a step higher.

A more dovish ECB to come?

The Dax moved higher despite disappointing eurozone data. Inflation dipped to a lacklustre 1.2%, down from 1.7% and below the 1.3% forecast. Weak inflation and stagnating economic growth could inspire a more dovish tone from Draghi on Thursday. Whilst weak data can hit sentiment in general, a weaker euro could actually prove beneficial for the Dax given the large number of exporters on the index.

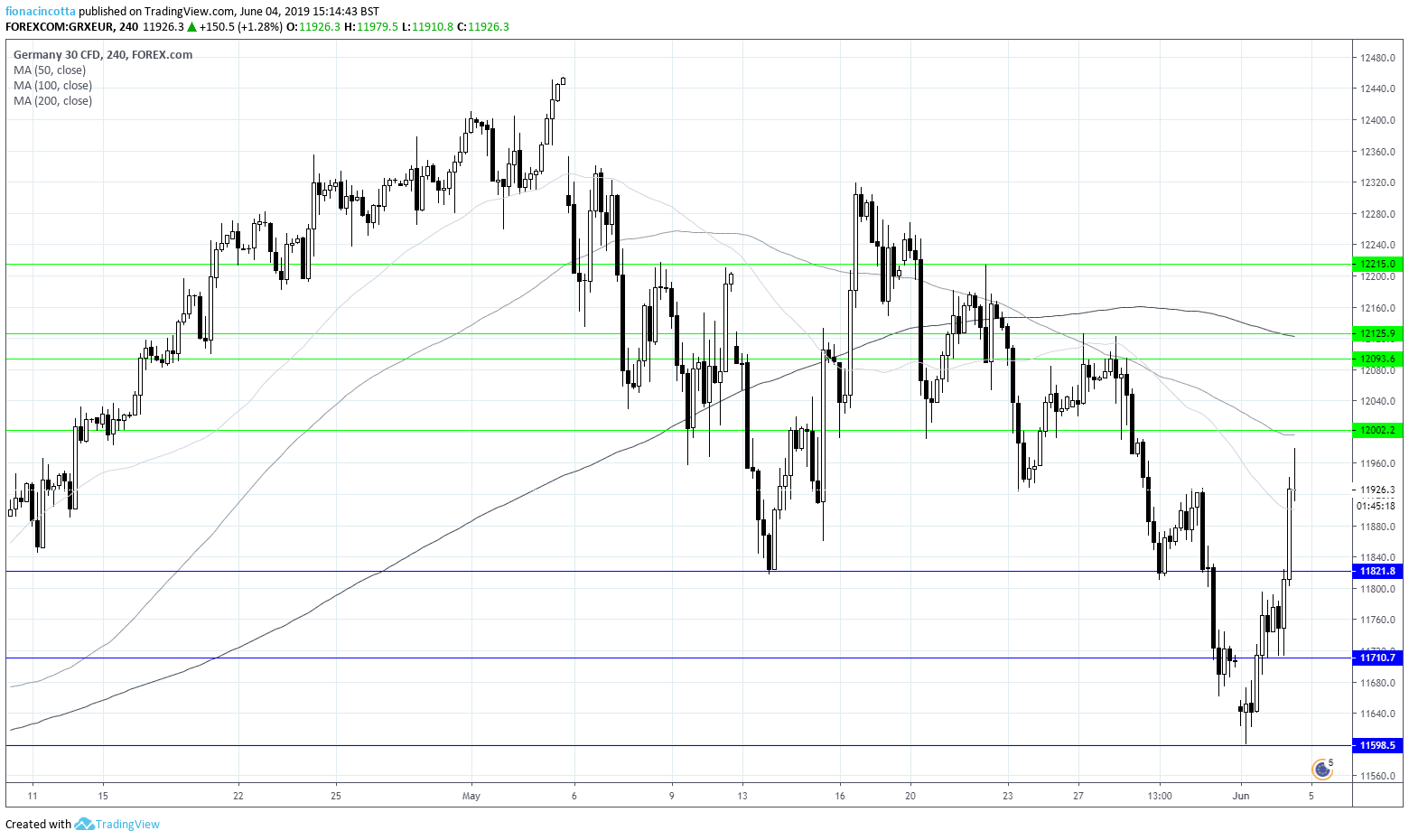

Dax levels to watch:

The Dax is rebounding for a second straight session as it looks to test resistance at 12000. A close above this level would be key for a bullish trend to continue. A convincing move through 12000 could open the doors to 12093 prior to 12125. On the downside support can be seen in the region of 11821 before 11710.