Oil was on the rise as the new week kicked off following escalating tensions in the middle east and on growing optimism over US – Sino trade negotiations. However, gains could be limited following a dismal OPEC demand outlook report.

Boosting the price oil:

Weighing on the price oil:

Boosting the price oil:

- A drone attack by Yemeni separatists on a Saudi Arabian oil field over the weekend stoked fears that geopolitical tensions were on the rise again in the region. Whilst oil production has not been affected this time, a risk premium is being priced in. This risk premium could prove to be relatively short lived given there was no apparent supply disruption. Iran related tensions could ease further since Gibraltar released the Iranian oil tanker seized in July.

- Reports that the US and China are still talking raised hopes of a trade deal, after tensions escalated earlier in the month. Any sense of progress between the two largest economies in the world is considered a positive for global trade, economic growth and therefore oil demand

- The prospect of stimulus to sure up major economies which are facing slowing economic growth is offering support to the price of oil. Germany has pledged €55 million in extra spending should it fall into recession. Perhaps more importantly China has unveiled reforms to reduce corporate borrowing costs. The ECB looks set to ease policy when it meets in September and all eyes will be on Fed Jerome Powell on Friday to see whether he resets monetary policy expectations to bridge the gap between what the market is pricing in and what the Fed said at its last meeting.

Weighing on the price oil:

- Global recession fears amid the ongoing trade dispute can’t be ignored. These fears have seen oil decline over 5% so far this month.

- OPEC cuts its demand growth by 40,000 bpd for 2019 and indicated that the market would be in surplus in 2020. Such a bearish forward view will pile the pressure on OPEC to consider continuing supply cuts into next year or deepen currently production cuts further.

- Whilst the middle east geopolitical tensions and US – Sino trade optimism are driving prices higher, the demand growth outlook report is significantly gloomy to cap any gains and potentially pull oil southwards.

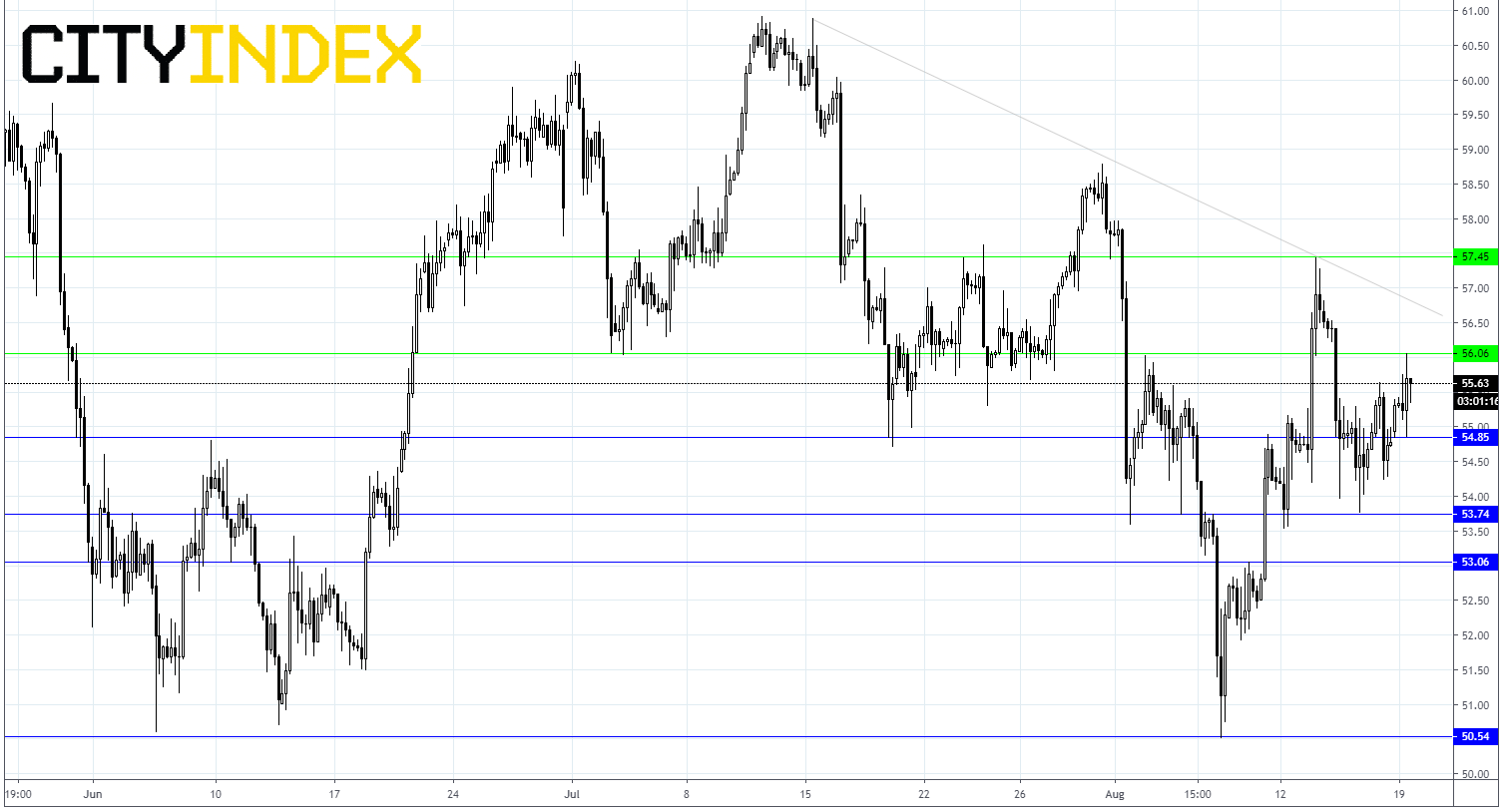

Support can be seen at $54.80. A break through this level could see the price decline to $53.77 prior to $53 and then $50.50. On the upside a break above $56 could see the price of oil propelled to $57.40.

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM