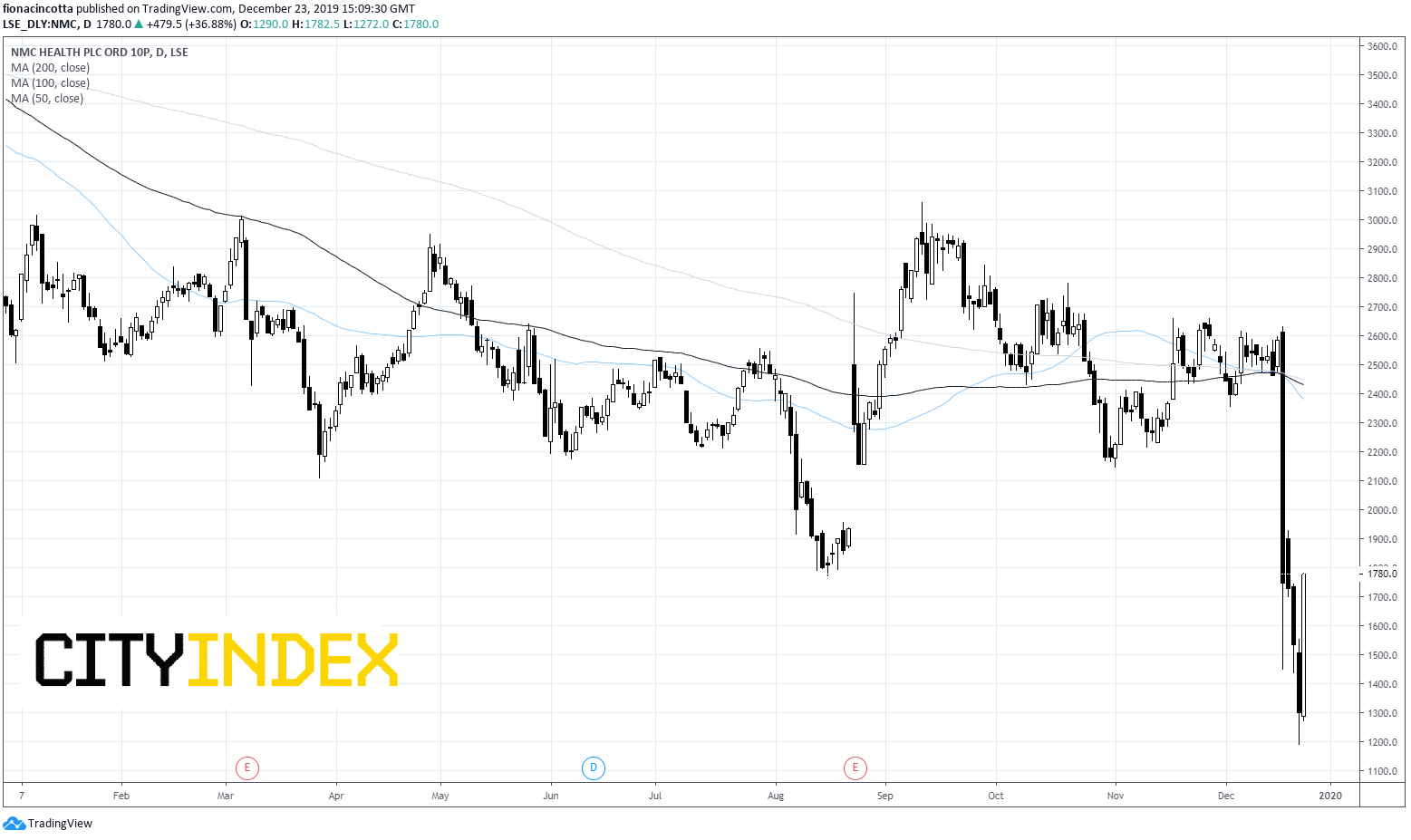

NMC Health shares dived over 50% across the previous week, wiping £2.7 billion from the company’s value. Today the stock has jumped over 20%. What is causing such high levels of volatility and is it time to buy?

The share price of the UAE based healthcare provider collapsed last week following scathing research report by short seller Muddy Waters.

Excessive debt is a key risk for the company. Part of Muddy Water’s hypothesis is that NMC has substantial debt which it keeps off its balance sheet in a similar way that Carillion did, and which contributed to its collapse. Questions over fraud and theft of company assets were also brought up by Muddy Waters.

Given investors’ reaction to the Muddy Waters accusations, it would appear that many agreed.

Given investors’ reaction to the Muddy Waters accusations, it would appear that many agreed.

NMC's rebuttal on Friday did little to stop the run on shares, investors needed more than a simple denial. However, today’s announcement that it has launched a review of its books following the Muddy Waters report appears to have quelled some fears, at least for now.

What next?

The future of NMC depends largely on whether the allegations turn out to be true. If they are true, the company’s financial outlook must be reassessed by the market.

Allegations like this often stain a company and it can take a significant amount of factual evidence to boost confidence and change opinion. It is unlikely to be a quick process to get to the bottom of this which means that the share price could struggle to recover to pre allegation levels any time soon.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM