Medium-term technical outlook on CAD/JPY

click to enlarge charts

Key Levels (1 to 3 weeks)

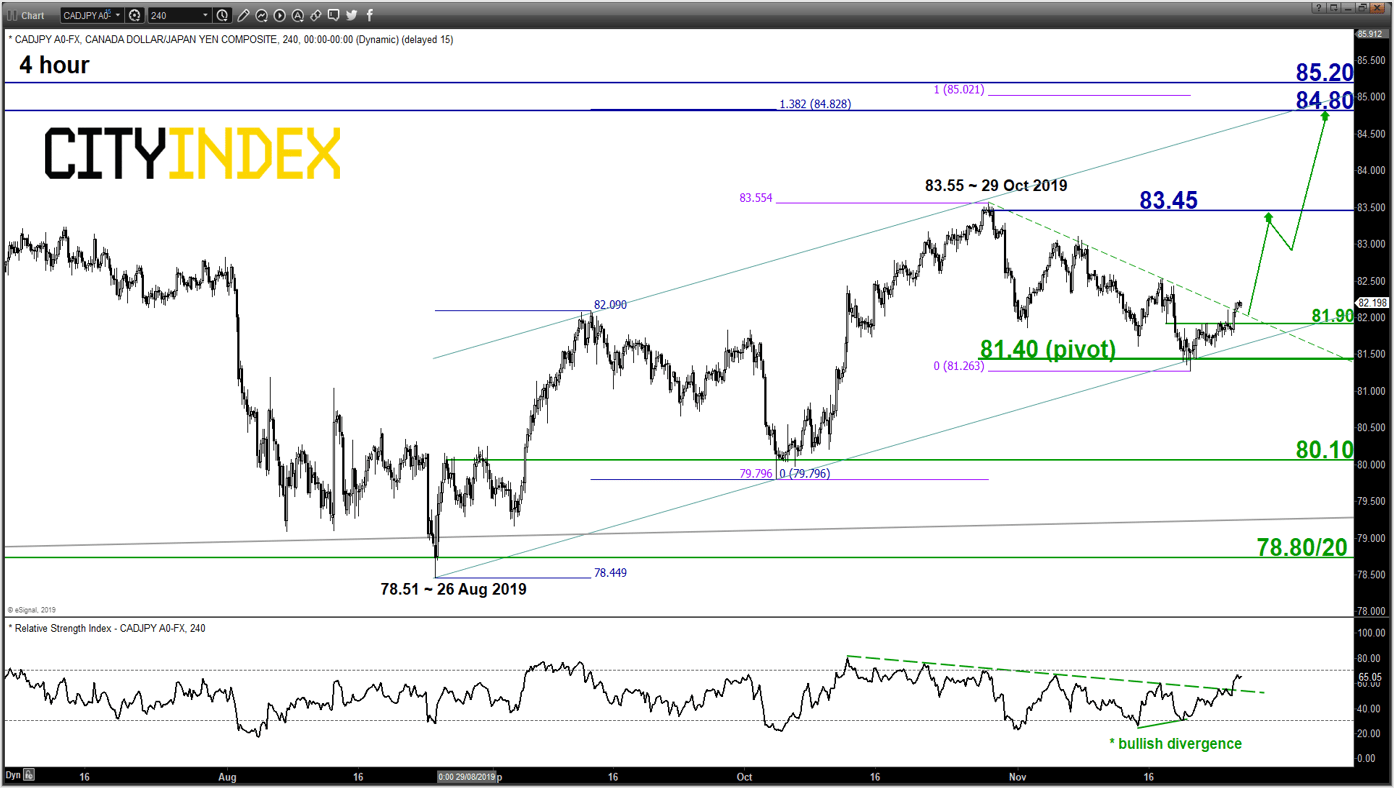

Intermediate support: 81.90

Pivot (key support): 81.40

Resistances: 83.45, 84.80 & 85.20

Next supports: 80.10 & 78.80/20

Directional Bias (1 to 3 weeks)

Bullish bias in any dips above 81.40 key medium-term pivotal support for another round of potential upleg to retest the recent 29 Oct swing high area of 83.45 before targeting 84.80 next.

On the other hand, a break with a daily close below 81.40 invalidates the bullish scenario for a choppy push down towards 80.10 support (03 Oct 2019 swing low & close to 61.8% Fibonacci retracement of the on-going up move from 26 Aug low to 29 Oct 2019 high).

Key elements

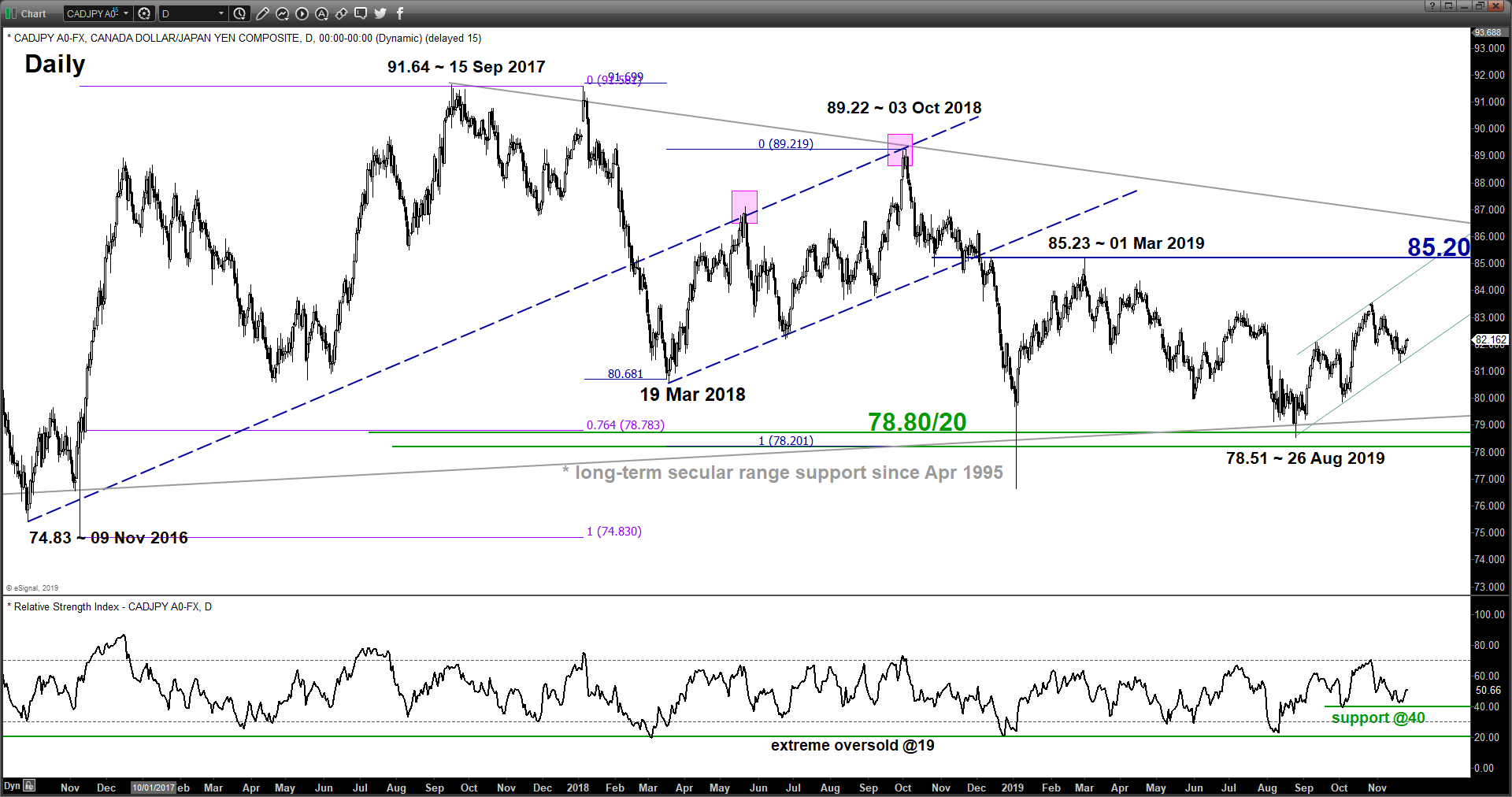

- The CAD/JPY cross pair has started to evolve into a medium-term ascending channel in place since 26 Aug 2019 low within a long-term secular range configuration in place since Apr 1995.

- Recent price action has staged a rebound from the medium-term ascending channel support at 81.40 with positive momentum. The daily RSI oscillator has bounced off from a parallel support at the 40-level coupled with a bullish divergence seen in the 4-hour RSI oscillator at its oversold region.

- The cross pair has also staged a bullish breakout yesterday, 26 Nov from its former minor descending resistance from 29 Oct high now turns pull-back support at 81.90.

- The 84.80 significant medium-term resistance is defined by the upper boundary of the medium-term ascending channel and a Fibonacci expansion cluster.

Latest market news

Yesterday 03:30 PM

Yesterday 01:23 PM

Yesterday 11:00 AM

Yesterday 08:15 AM