Short-term technical outlook on CAD/JPY

click to enlarge charts

Key Levels (1 to 3 days)

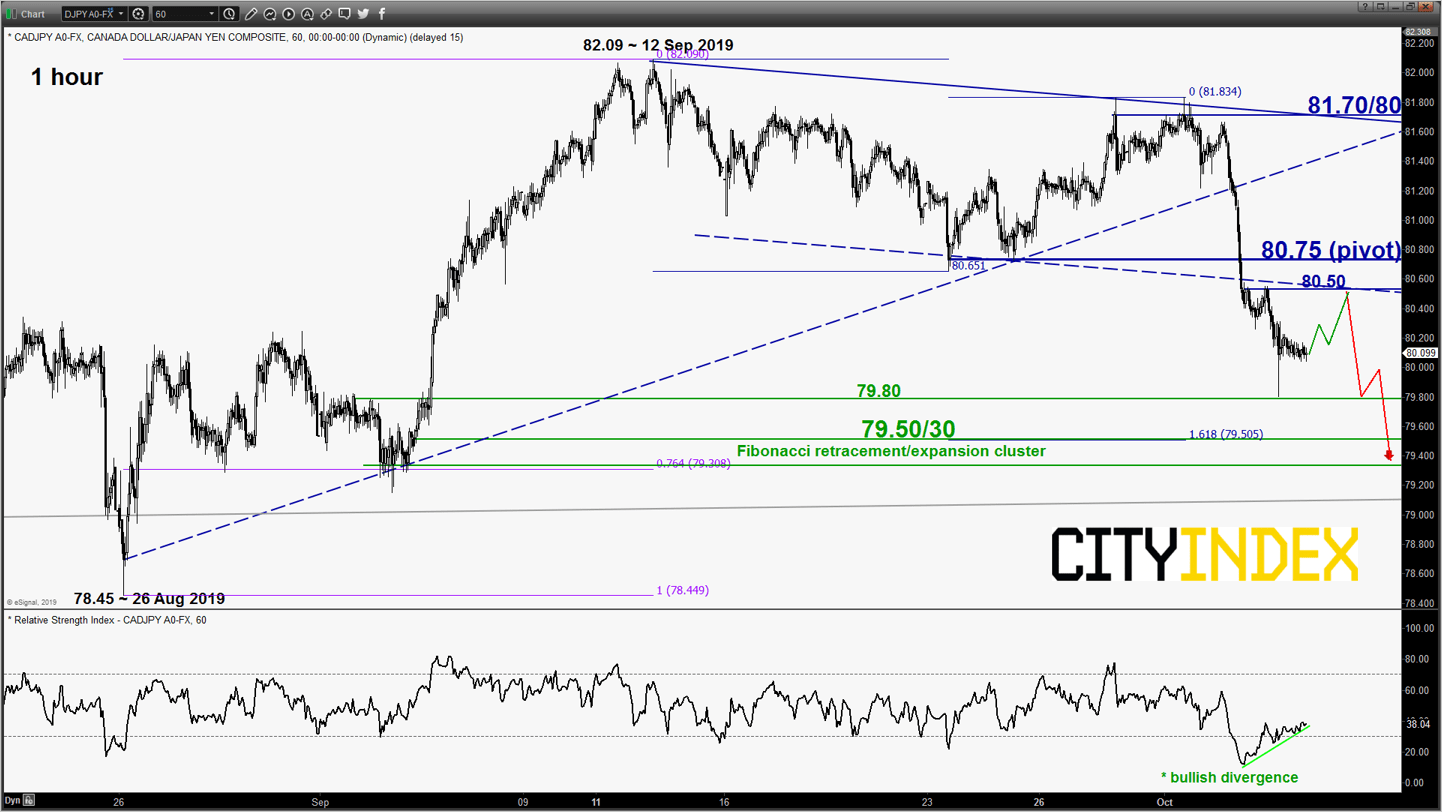

Intermediate resistance: 80.50

Pivot (key resistance): 80.75

Supports: 79.80 & 79.50/30

Next resistance: 81.70/80

Directional Bias (1 to 3 days)

The CAD/JPY is now at risk of a minor corrective rebound to retrace the recent 2-day of steep decline from 81.83 high of 01 Oct 2019 to 79.80 low of 03 Oct 2019 towards the 80.50 intermediate resistance with a maximum limit set at the 807.75 key short-term pivotal resistance before another potential downleg sequence to target the next significant near-term support at 79.50/30.

However, a clearance with an hourly close above 80.75 put the bears on hold for a steeper corrective rebound towards the 81.70/80 key medium-term resistance (also the minor descending channel resistance from 12 Sep 2019 high).

Key elements

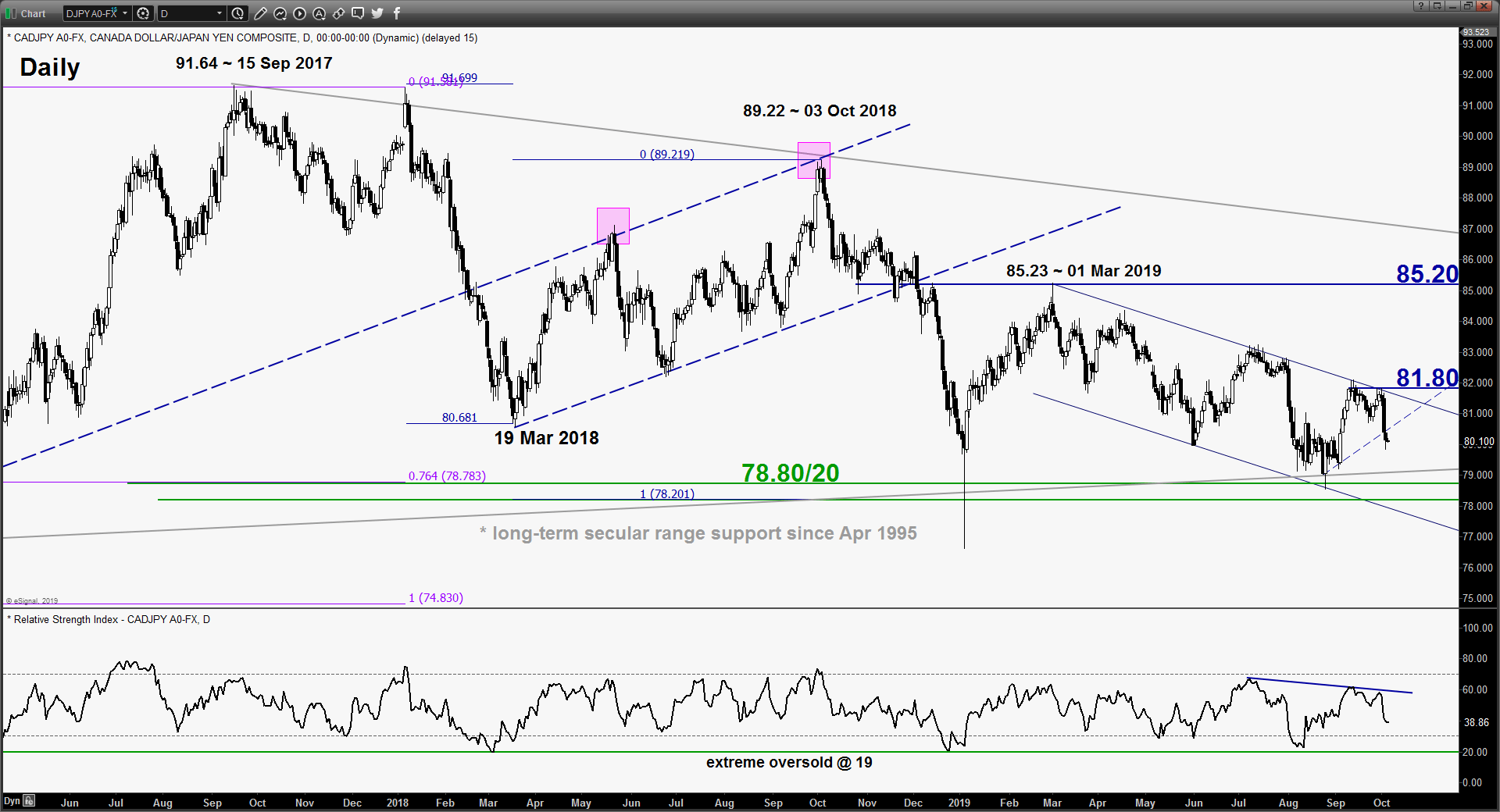

- The CAD/JPY is still evolving within a medium-term downtrend phase since 01 Mar 2019 high of 85.23 within a long-term secular range configuration in place since Apr 1995.

- The hourly RSI oscillator has shaped a bullish divergence signal after it hit an extreme oversold level and sees has further room to manoeuvre to the upside before its reaches its overbought region. These observations increase the probability of a minor rebound at the 79.80 level.

- The 87.75 key short-term resistance is defined by the former swing low area of 23/25 Sep 2019 and close to the 50% Fibonacci retracement of steep decline from 01 Oct 2019 high to 03 Oct 2019 low.

- The 79.50/30 significant near-term support is defined by the minor swing low areas of 28 Aug/03 Sep 2019 and a confluence of the 76.4% Fibonacci retracement of the prior rebound from 26 Aug low to 12 Sep 2019 high and the 1.618 Fibonacci expansion of the decline from 12 Sep high to 23 Sep low projected from 01 Oct 2019 high.

Charts are from eSignal