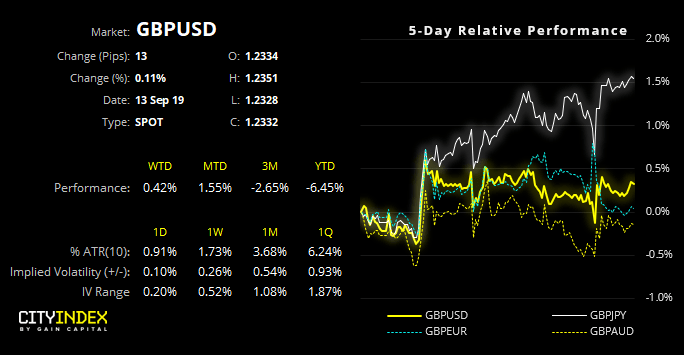

A bullish divergence and momentum shift at the lows saw GBP/USD reverse course. Now consolidating below key resistance, we’re waiting for a break above 1.24 to signal a potential long.

It should be remembered that GBP will continue to be vulnerable to headline risks surrounding Brexit, which can unfortunately make technical analysis on such pairs the more difficult. We’d also need to see the USD weaken for this to have a material impact on long GBP/USD.

Yet markets clearly are keeping an eye on the resistance zone just beneath 1.2400, so a clear break above here assumes we’re good to go to the long side.

Later today we have the University of Michigan Sentiment Index. It’s of more interest than usual, because it had such a negative print. If weak consumer sentiment is to be repeated, it could indeed have a negative reaction for the USD (initially at least) and help send cable higher.

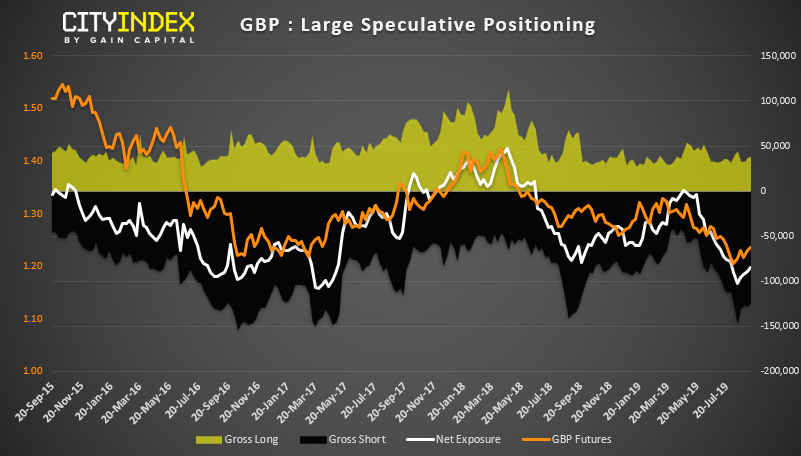

As for net-positioning on GBP, gross short exposure hit a bearish extreme a few weeks back and traders have begun to reduce their exposure to the short side. Whilst this doesn’t necessarily mean it’s a major inflection point, there are still plenty of shorts to cover should conditions warrant it, which could aid a correction on GBP/USD. For us to become more excited about a larger reversal, we’d want to see gross longs pick-up. For now, bulls appear to be on the side-lines, so any correction will more likely be from short covering.

Related Analysis:

Merkel Throws Brexit Negotiations A Bone | GBP/USD, EUR/GBP