Buy the Rumor, Sell the Fact after NFP

After Wednesday’s ADP Non-Farm Employment Change, which was 291K vs 156K expected, traders were looking for a better headline NFP number today. Markets have been in risk on mode over the last few days, so anything short of “better than expected” probably would have caused markets to sell off. Today’s Non-Farm Payroll number did not disappoint for January, which was +225K vs +160K expected. Average hourly earnings (MoM) was 0.2% vs 0.3% expected. The unemployment rate up ticked slightly from 3.5% to 3.6%.

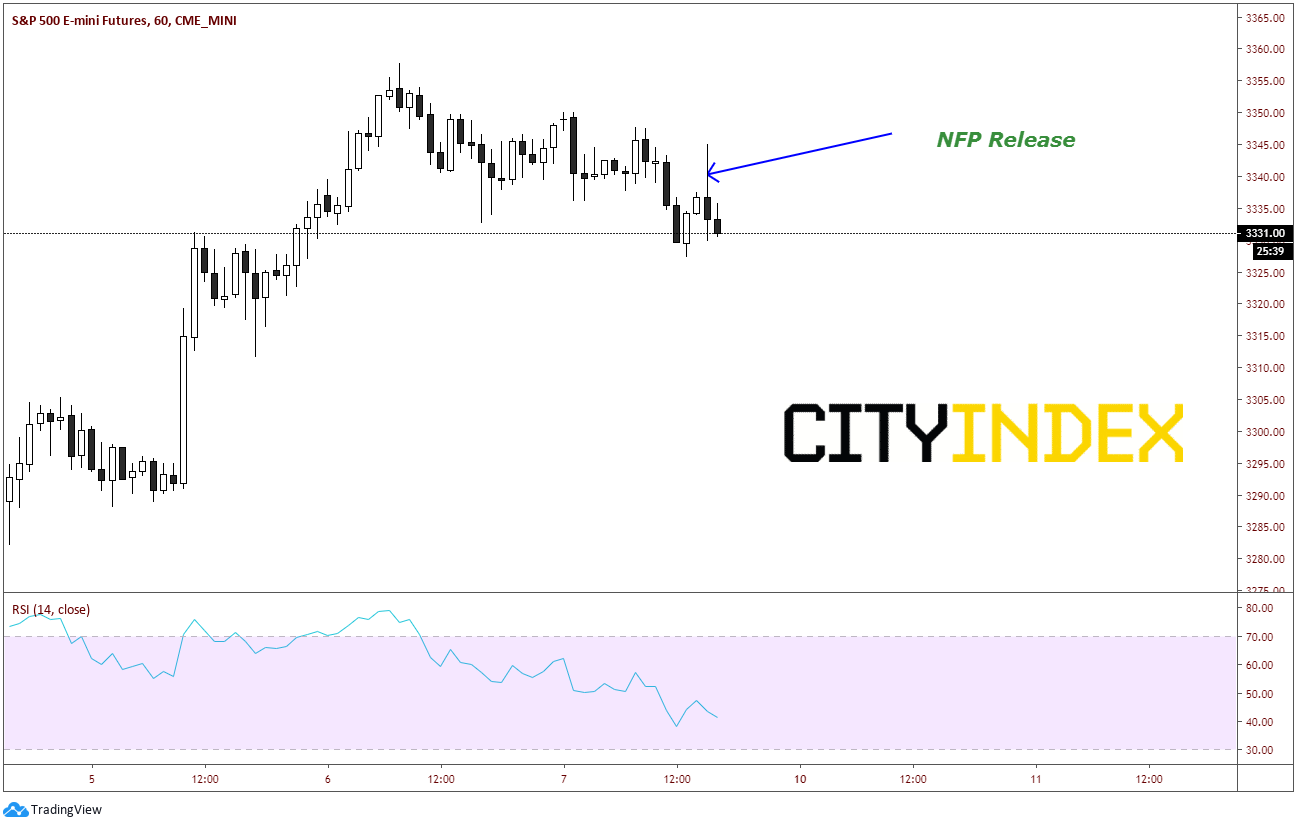

S&P Futures were slightly lower after the data, a sign that traders have been buying, while looking for a better number.

Source: Tradingview, City Index

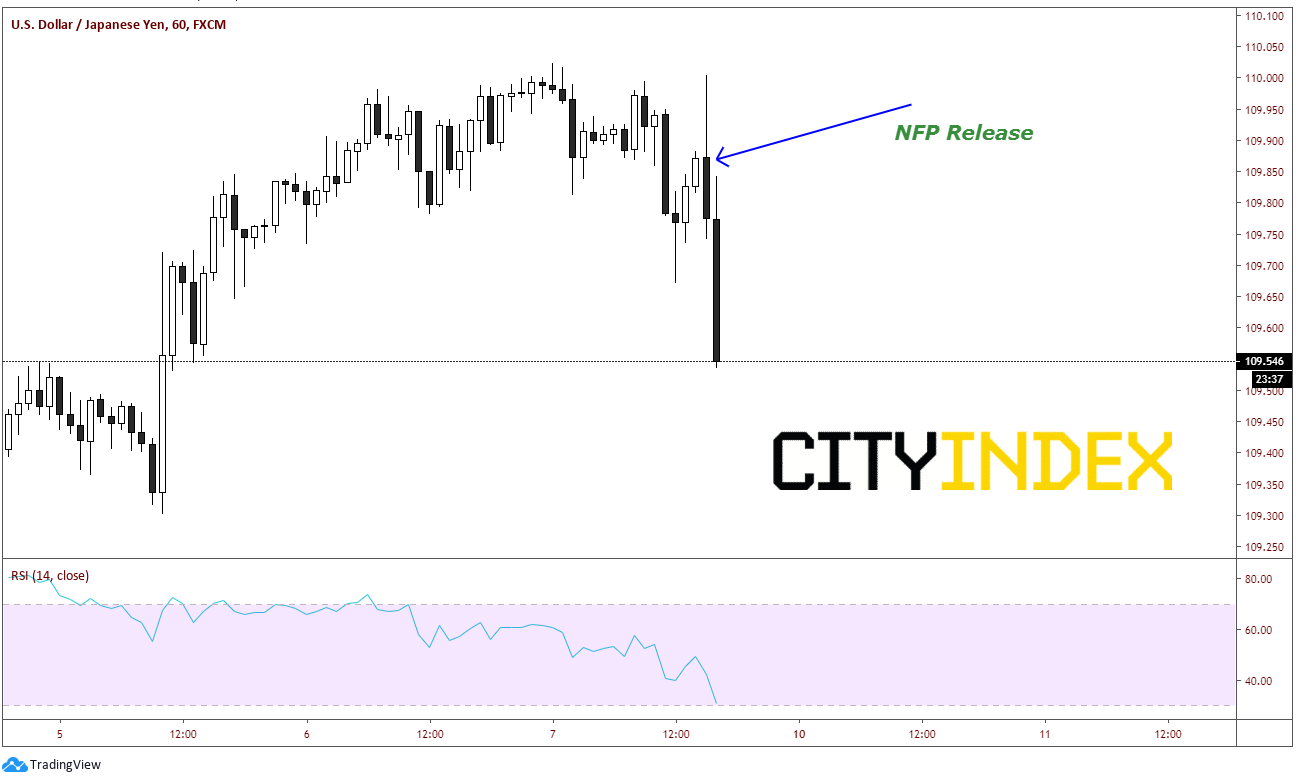

In addition, the failure of USD/JPY to push above 110.00 after the data was also a signal of “Buy the Rumor, Sell the Fact”. The pair flirted with the big round number for the past 24 hours, only to be rejected on the release of the data and trade lower.

Source: Tradingview, City Index

The Fed doesn’t meet again until March 18th. Before then, we will get a look at the February NFP data. These numbers, along with fallout from the Coronavirus will help shape the view of Fed Policy going forward. Earlier in Asia, S&P lowered its 2020 Chinese growth forecast to 5% from 5.7%. Fitch also lowered China’s 2020 GDP from 5.9% to a range of 5.2%-5.7%, depending on the speed in which the virus is contained.

Any moves today will more likely be a result of how well the markets feel the Coronavirus will be contained. If the markets feel new cases could be peaking and a vaccine is right around the corner, stocks could push to all time new highs and USD/JPY could push above 110. The alternative case is that uncertainty still prevails, and markets wait until after the weekend to make a new move higher. Either way, as the better than expected NFP was already baked in, this should have minimal effect on price action.