A growth surprise is helping sterling shrug off increasingly ferocious parliamentary battles

Sterling's sustained elevation following a 3% rebound last week received fresh impetus from unexpectedly resilient growth figures, even as increasingly acrimonious Brexit politics and soft underlying economic conditions keep the pound in check.

All in, the economy managed a flat performance in the three months to July rather than the slight fall forecasters pencilled in, though the risk of a further contraction remains after Q2 saw growth reverse for the first time since 2012. Britain’s dominant service sector unexpectedly rebounded into positive territory in July after a shock dip into negative the month before. That mini expansion looks to have underpinned gains in other smaller GDP components, like construction and factory output; the latter swung 0.3% higher when a deepening slowdown equating to a 0.3% fall on the month was forecast.

To be sure, the monthly resilience is out of step with the year’s deteriorating service sector trend. The downturn has been accompanied with stagnation in the usually robust housing market and the first signs of a change of sentiment among equally redoubtable UK consumers, after retail sales disappointed. Recent BOE data showed households beginning to worry about potentially damaging price rises, particularly in light of multi-year lows in consumer savings rates since the 2016 Brexit vote. Pressure looks to have resumed on businesses too, according to the more up-to-date PMI readings out last week.

Gradual softening is likely to limit monetary policymakers' choices in months to come regardless of Brexit. After some of his most optimistic comments on the likely post-Brexit period for months, BOE governor Mark Carney concluded that growth remains “Slightly positive, but close to zero.” That suggests another cap for the currency that's not coherent with the latest price action.

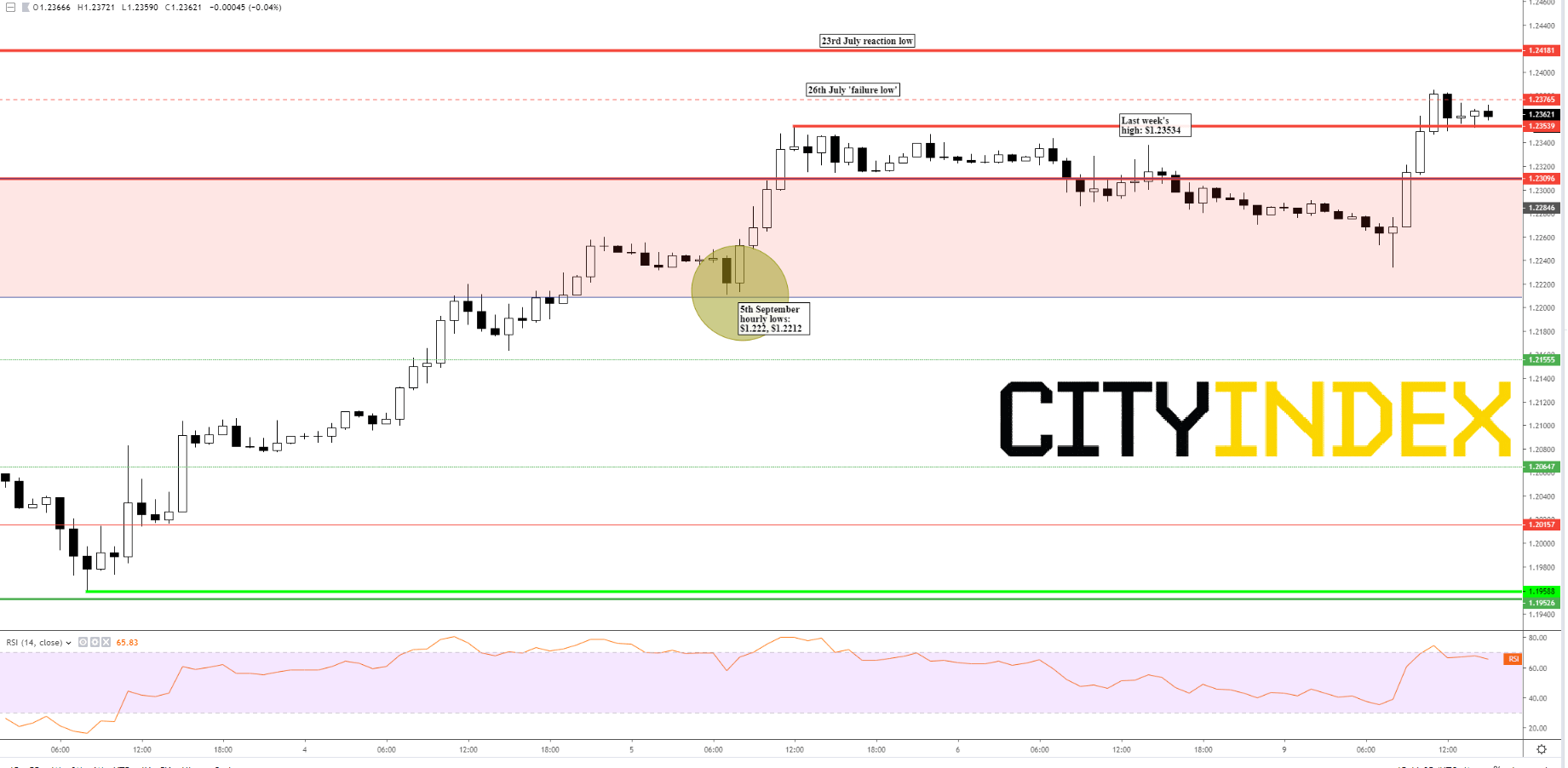

Chart thoughts

Cable has pulled further away from though is unlikely to have escaped the magnetic pull of last week’s around-three-year lows. Buyers would now ordinarily expect the grind through the region across roughly $1.22-$1.23 to have laid the groundwork for much needed protection in the days ahead. Two hourly tags towards the lower boundary of the range last Thursday—$1.2208 and $1.2212—corroborate it as ‘live’. With a 26th July ‘failure low’ at $1.23765 invalidated as GBP/USD consolidates Monday’s resumed up leg, it’s left to last week’s $1.2354 high to guard the $1.22/23 zone. For sellers, the chance that renewed weakness could take the rate down and out of the lower side of the zone will be tempting. If seen, the probabilities that follow-through could take cable back toward to high $1.20s at least, would rise.

GBP/USD – hourly

Source: Tradingview/City Index

Latest Brexit developments

- Downing Street confirms Parliament’s suspension will begin tonight, though impact on sentiment has been limited as the government is set to lose a vote to hold an election by mid-October

- Suspension won’t start until two potential emergency debates have been held. 1. Jeremy Corbyn’s call to ensure the government respects the law preventing a no-deal Brexit 2. Former Conservative Attorney General Dominic’s Grieve demand for the government to publish no-deal planning

- The speaker has allowed both debate applications. If both debates take place, a very late vote is highly likely

- PM Boris Johnson signals more focus on the domestic agenda with further announcements on public spending likely

- Government lawyers are exploring ways for the PM to get around the new law stating that Brexit must be delayed if no deal has been agreed well ahead of deadline

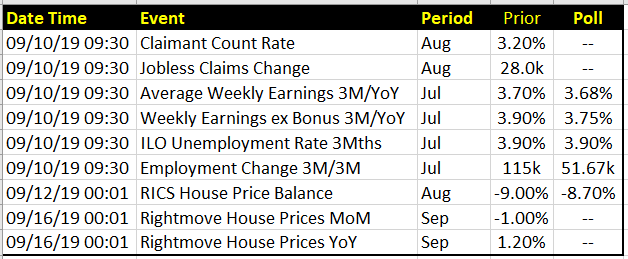

Key data this week