- Revenue £719 million

- Like for like sales +3% compared to same period in previous year

- Increased forecasts for year end

Europe, Middle East, India and Africa saw sales grow by high single digit percentage. US sales remained stable.

Sales in mainland China rose 10% compensating for the slowdown in Hong Kong. Burberry’s new collections under Riccardo Tisci are being well received. The new marketing drive in addition to Marco Gobbetti’s plan to shift the brand further upmarket are resonating well with the very important Chinese customer.

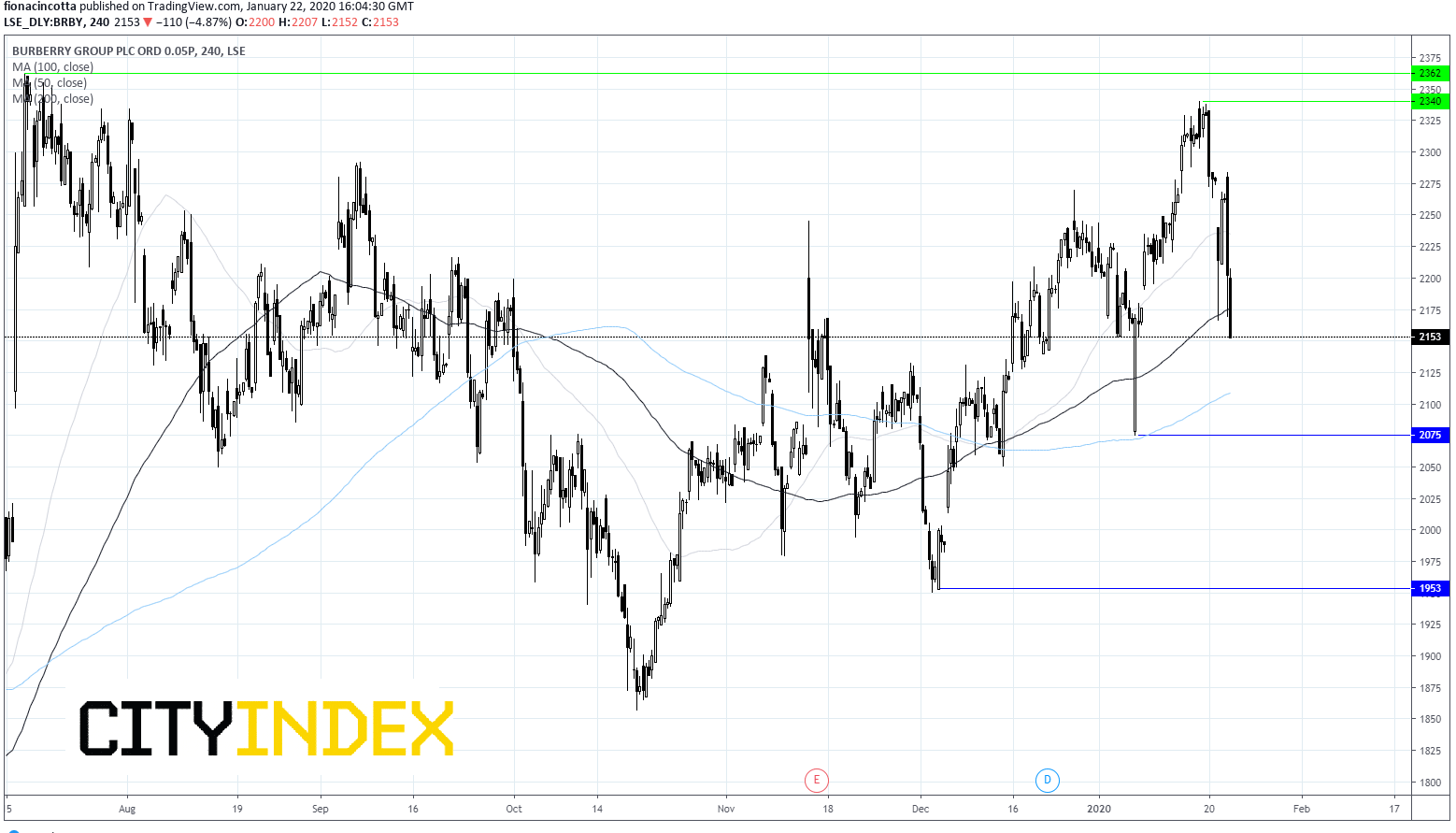

However, fears that the coronavirus could weigh on tourism and consumption on mainland China, particularly across Lunar New Year could mean more problems ahead for Burberry, even if temporarily. Investors will be watching closely to see how the coronavirus situation unfolds on mainland China.

Burberry’s results show that despite the macroeconomic environment, the luxury fashion retailer is making good progress in its turnaround programme 2 years in. However, it still lags behind peers. Questions remain over whether the current brand revitalisation will be sufficient to grab market share from rivals.