Burberry shares challenging immediate resistance at 1732p

Burberry, the luxury fashion house, posted 1H adjusted EPS declined 88% on year to 4.6p and adjusted operating profit dropped 75% to 51 million pounds on revenue of 878 million pounds, down 31% (-30% at constant exchange rates). Retail comparable store sales were down 25% on year (1Q: -45%; 2Q: -6%). The company added: "With the brand resonating and attracting new and younger consumers, we have taken the decision to reduce markdowns and this will be a revenue headwind in H2 FY2021 with the main impact in Q3 FY2021 but will serve the long term interest of the brand."

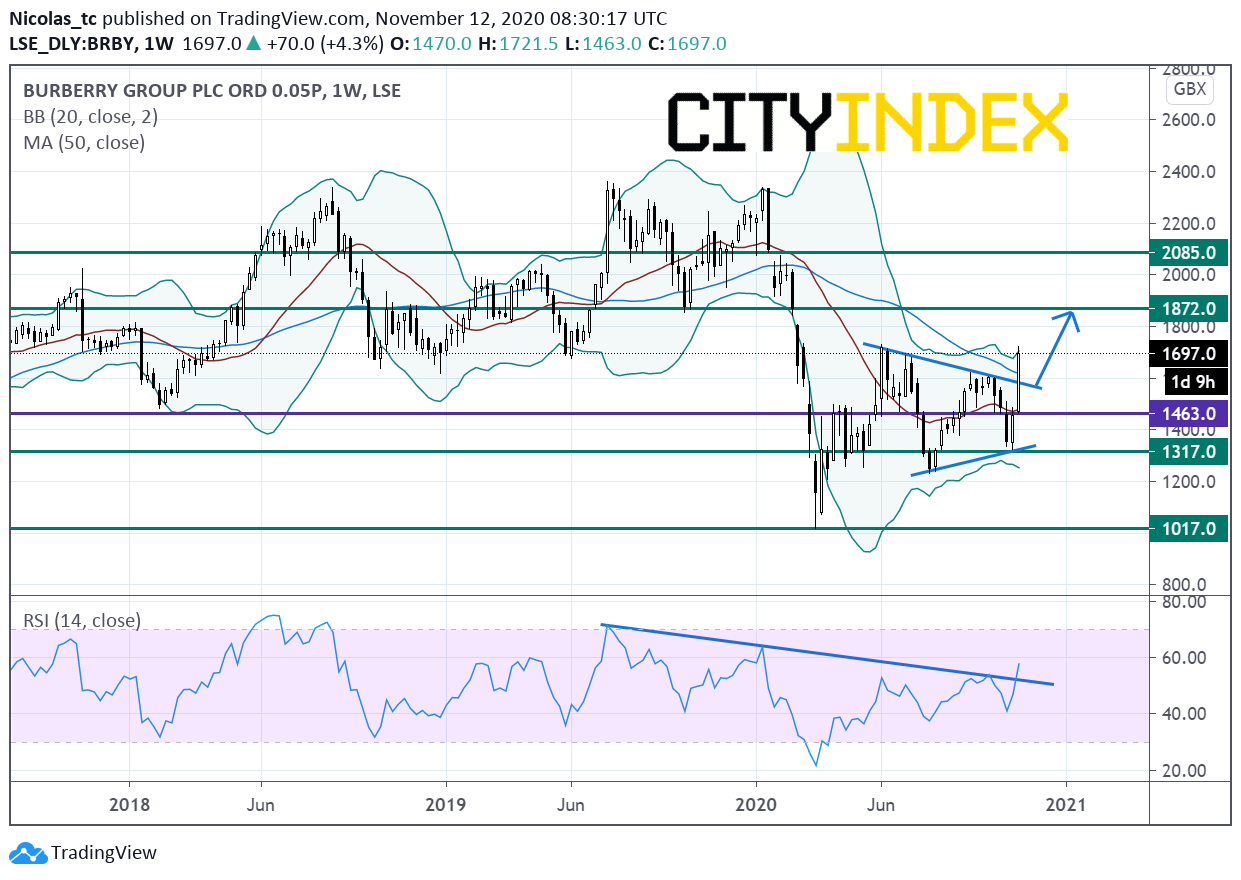

From a chartist’s point of view, the stock price escaped from a symmetrical triangle pattern (bullish event) and is now nearing the upper Bollinger band and the former high at 1732p (June 5 2020). The weekly RSI (14) has pushed above its declining trend line. A price pullback to the trend line support near 1530p could be seen as a buying opportunity with targets at 1872p and 2085p. Alternatively, a break below 1463p would invalidate the bullish view and would call for a reversal down trend towards 1317p and 1017p.

Source: GAIN Capital, TradingView