Burberry 8217 s 8216 exceptional 8217 UK retail boost buys time

Burberry acknowledges it has benefited from “exceptional” retailing factors that attracted increased footfall to its UK businesses in its most recent quarter.

Burberry acknowledges it has benefited from “exceptional” retailing factors that attracted increased footfall to its UK businesses in its most recent quarter.

Whilst positive, the comment also has a built in signal of caution about how sustainable the advantage might be—particularly in light of the likely stabilisation of sterling in the coming months, now that a portion of Brexit uncertainty has been lifted.

Burberry itself has noted its fortuitous combination of circumstances since Britain’s referendum last June devalued the pound, making its luxuries cheaper to buy here for affluent customers in Asia, particularly China, where the group retains much valuable brand cachet.

It remains the most pressing project, in our view, for the group’s incoming CEO to sort out. Marco Gobbetti is likely to deploy some of the most sophisticated methods in the luxury purveyor’s lexicon—or at least that’s how his expertise have been sold. The point is that the bar has been raised, replete with investor expectations—some of which account for the group’s resilient stock price advance over the last half year. In other words, disappointment is an increasing risk in the face of some of the group’s more intractable challenges.

Still, there are good grounds to expect that Burberry shares can remain mostly on the up for the time being, after their 60% rise since mid-June.

Forecast-beating comparable sales, cost measures remaining on track, the return of APAC growth, and most importantly, an affirmation that adjusted profit before tax will meet market expectations, should all help. The stock may not escape some flak in the near term entirely though, on chances that sterling can strengthen further in the wake of its spectacular bounce on Tuesday.

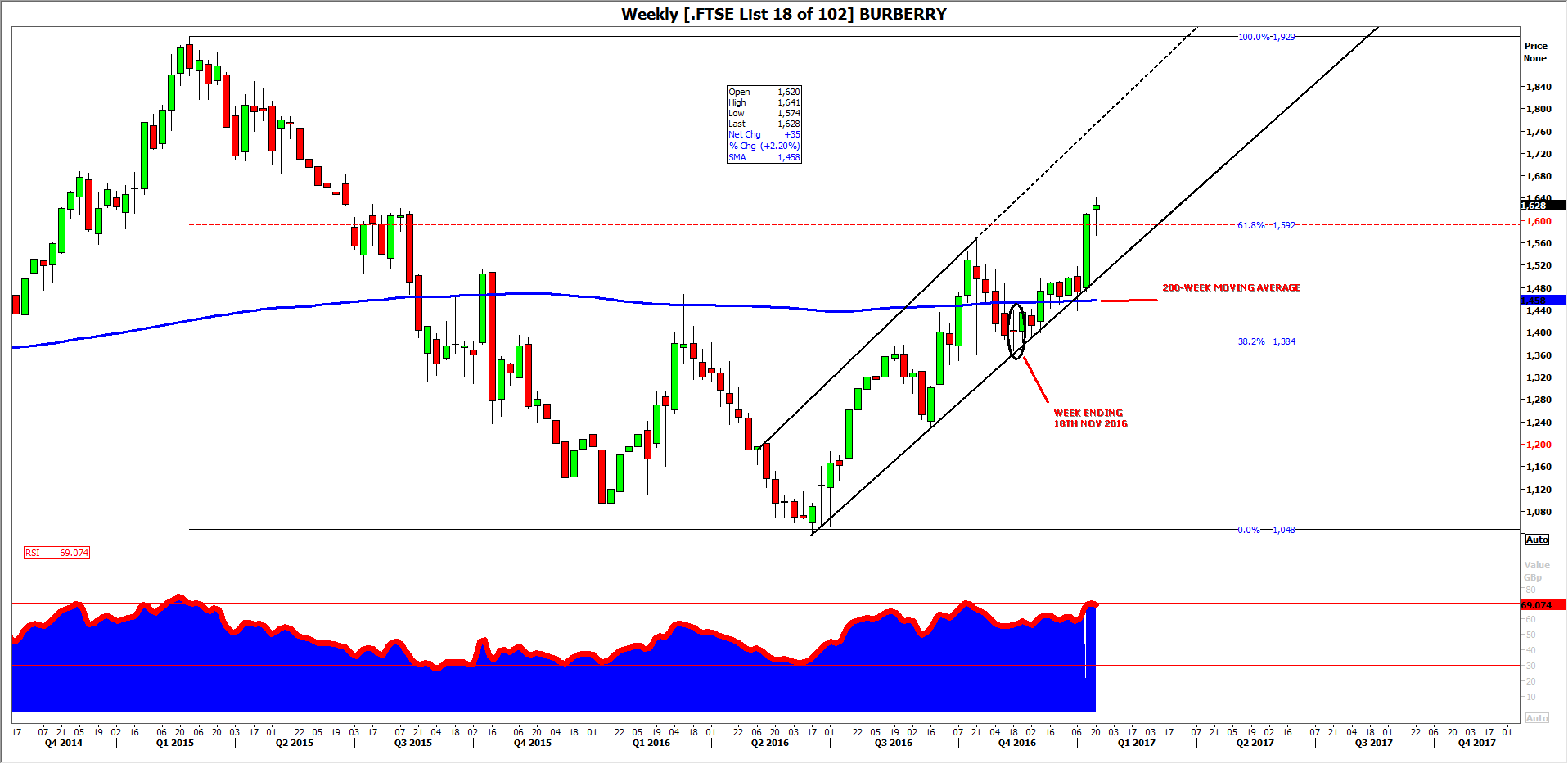

Burberry’s chart suggests the stock is setting up for a consolidation of the latest up leg, including a run of more than 10% in a week. Even excluding the fact that the stock has reached the closely eyed 61.8% retracement of the early 2015-to early-2016 decline, momentum is dwindling around the same region as it did last Autumn and also during an earlier attempted recovery in August 2015.

A ‘simple’ consolidation would suggest continued support at the price’s 200-week moving average, currently at c. 1460p, as per the middle of last month and the beginning of January. In our view, however, considering Burberry’s still challenged fundamentals, combined with the likely stabilisation of the pound, suggesting the draining of foreign exchange benefits that propped the top line up last year, BRBY’s correction is likely to be deeper.

The first sign that our pessimistic view is correct would be the return of prices into the 1613-1472p range, and a subsequent break below. That would also take the stock out beyond the standard deviation (AKA price channel) seen during its rise off lows in mid-June 2016 to date.

Attention further out would fall on support implied by the pivotal doji during the week ending on 18th November 2016.

source: Thomson Reuters, please click image to enlarge

source: Thomson Reuters, please click image to enlarge