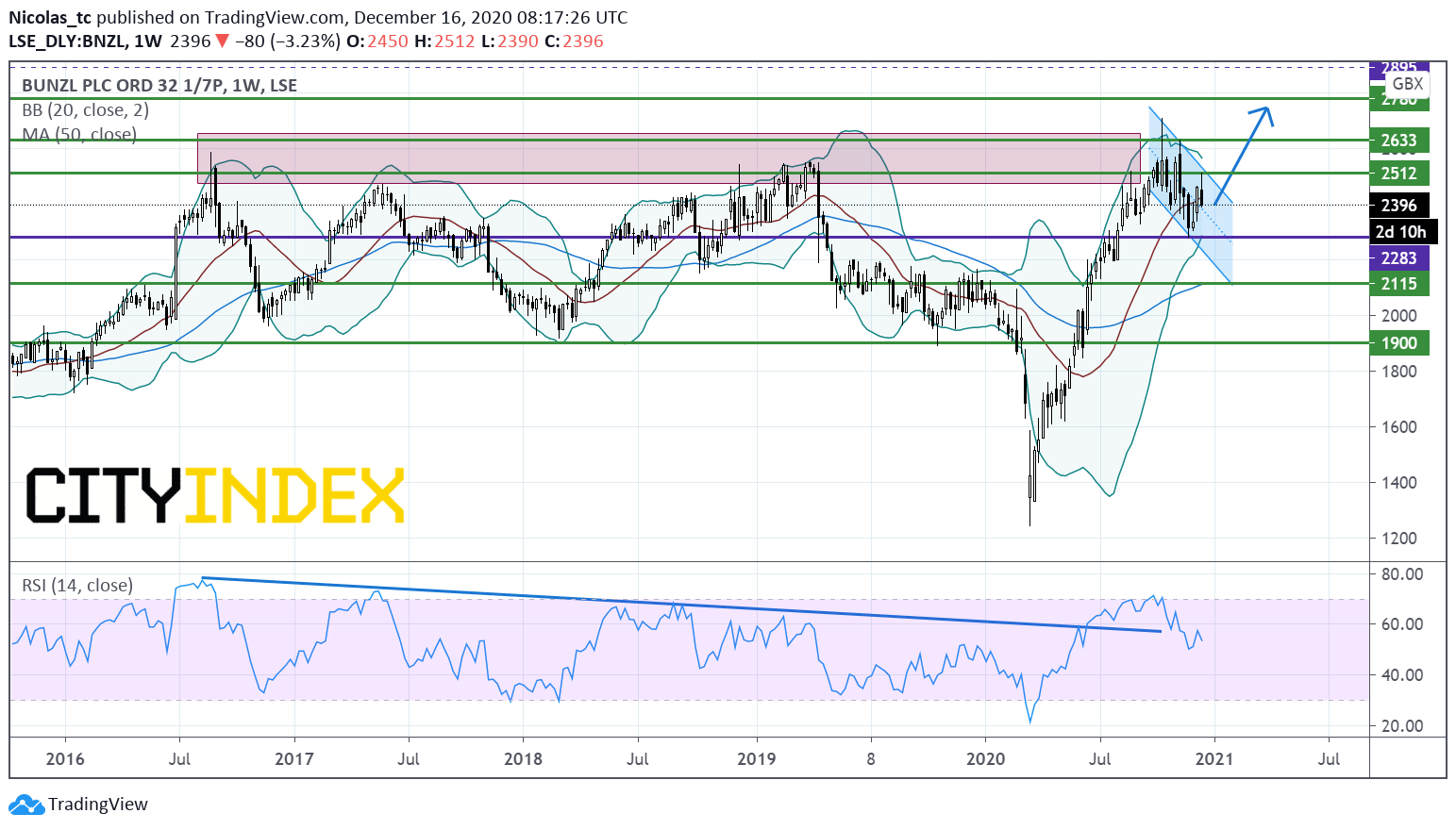

Bunzl: new up leg in sight?

Bunzl, a multinational distribution and outsourcing company, said that “group revenue for the year is expected to increase by approximately 8% at actual exchange rates and by approximately 9% at constant exchange rates, due to similar levels of growth from both the increase in organic revenue and the impact of acquisitions.”

The group added that “the operating margin in 2020 has continued to benefit significantly from the mix of products sold and is expected to be higher than the prior year."

From a technical point of view, the stock price is under consolidation within a downward-sloping channel. Prices failed to break above a key horizontal resistance threshold near 2633p. A key support base has formed at 2283p (Bollinger + overlap) . A breakout confirmation of the consolidation pattern would call for a new up leg. 1512p is trigger point for acceleration towards 2633p and 2780p. Prices need to stand above 2283p to maintain the bullish bias.

Source: TradingView, Gain Capital

Latest market news

Yesterday 08:33 AM