Bundesverfassungsgericht Questions ECB

Germany’s Constitutional Court, Bundesverfassungsgericht, officially questioned whether the ECB legally purchased 2 trillion Euros worth of government debt during its Quantitative Easing (QE) Program. The Constitutional Court also questioned whether or not it was done proportionally. The 7-1 ruling gives the ECB 3 months to prove the purchases were necessary and proportional. If the ECB cannot prove its actions were justified, the Bundesbank will bail on the QE program. Its important to note that this vote was NOT about the Pandemic Emergency Purchase Program (PEPP) which was set up recently to provide economic stimulus to European nations, but rather the years of QE that preceded it!

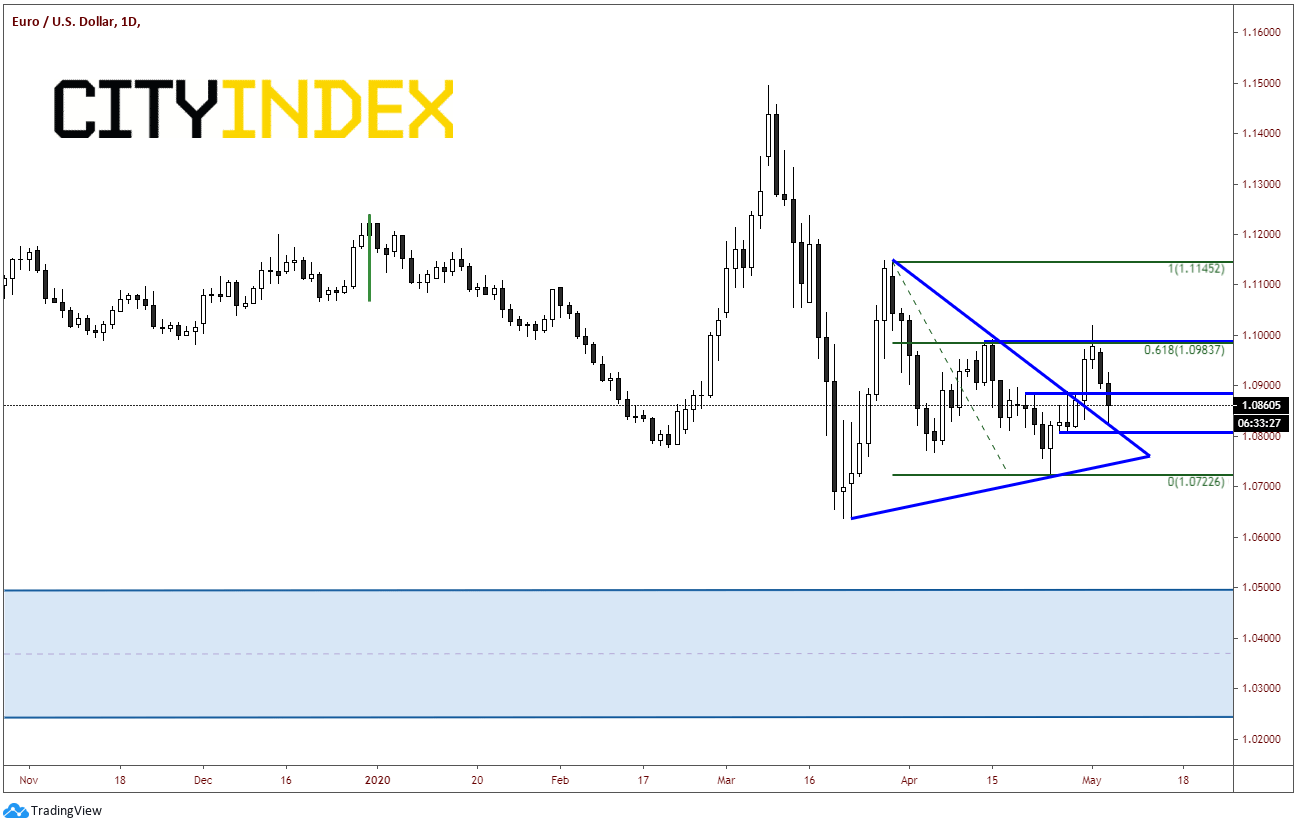

Although it was known that the vote was going to take place today, the 7-1 ruling took the markets by surprise as EUR/USD traded from near 1.0920 down to near 1.0825, roughly a 95-pip selloff. EUR/USD had already been under pressure after it failed to breakout above the 61.8% Fibonacci retracement from the highs of March 30th to the lows of April 24th, near 1.0983. Horizontal resistance and the psychological 1.1000 sits at the failed breakout level as well. On Thursday EUR/USD had broken out of a symmetrical triangle the pair has been in since March 23rd. During today’s selloff, the pair held the retest of the downward sloping upper trendline of the triangle.

Source: Tradingview, City Index

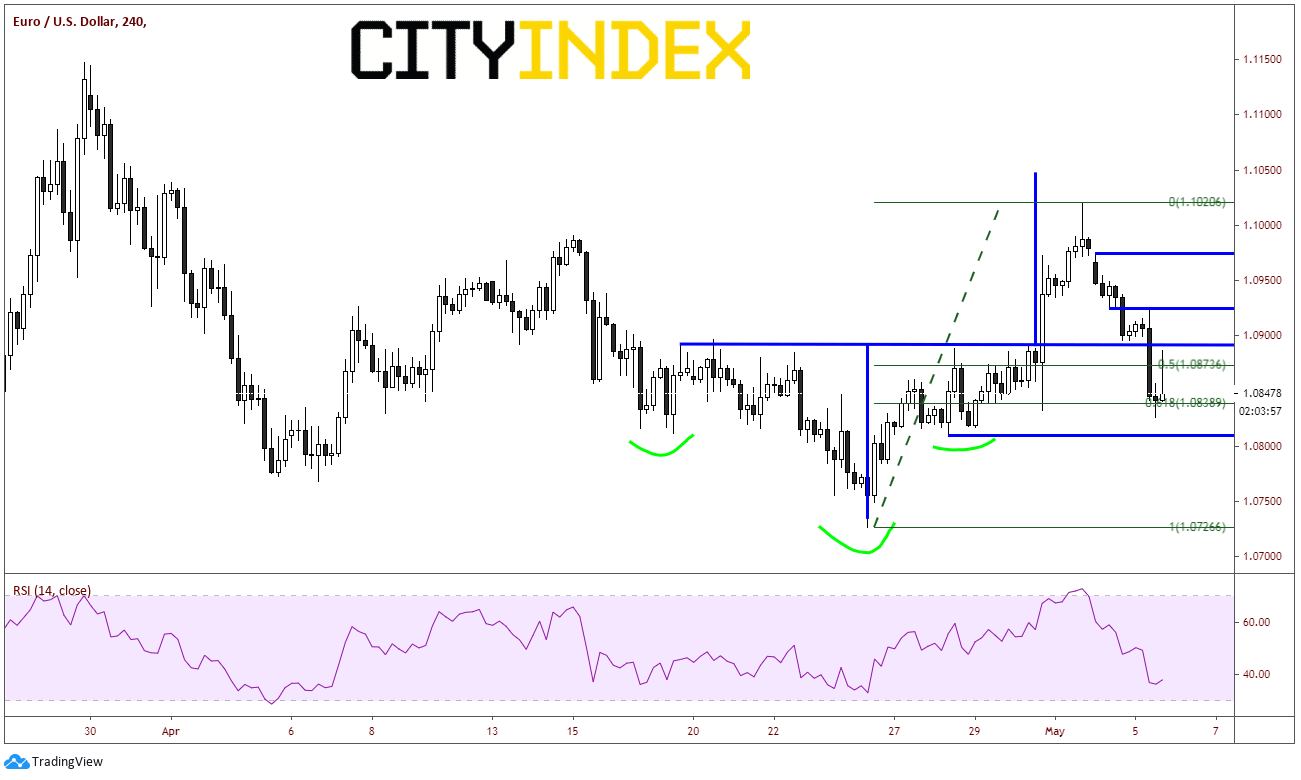

On a shorter 240-minute timeframe, EUR/USD came within 30 pips of reaching its inverse head and shoulders target on Friday before putting in a shooting star reversal formation and heading lower. Just as price held the trendline on the daily timeframe, it also held the 61.8% Fibonacci retracement level from the lows of April 24th to Friday’s highs.

Source: Tradingview, City Index

Horizontal resistance lies above at the neckline of the previous inverted head and shoulders formation near 1.0900. The next level is horizontal resistance and todays highs near 1.0925 and then again at Monday’s opening near 1.0975. Final, short term resistance is Friday’s highs near 1.1020. Support comes across at previously mentioned lows of 1.0825/1.0850. Horizontal support is below there at 1.0810. If price breaks 1.0800, it opens the floor and there is room for the pair to fall to 1.0725, April 24th lows.

The ECB has been given 3 months to prove to the Bundesverfassungsgericht that QE was necessary and proportional. However, a near 100 pip selloff has already been felt. In the near-term, there are obviously more pressing events will influence the direction of EUR/USD. Just keep in mind to be on the lookout for a response from the ECB sometime in the next few months!