Budget report 2014 8211 live blog

Highlights from the 2014 budget speech, as they happen… This Wednesday, 19th March, join our expert market analysts, Joshua Raymond, Ashraf Laidi and Rosemary Okolie, […]

Highlights from the 2014 budget speech, as they happen… This Wednesday, 19th March, join our expert market analysts, Joshua Raymond, Ashraf Laidi and Rosemary Okolie, […]

This Wednesday, 19th March, join our expert market analysts, Joshua Raymond, Ashraf Laidi and Rosemary Okolie, for live updates, analysis and discussion of the UK Chancellor’s 2014/15 budget statement.

Build-up and discussion will begin at 10am and will continue throughout the Chancellor’s speech at approximately 12.30pm.

Let us know what you think of the budget by adding your comments below, or tweet the analysts via their twitter IDs: @Josh_CityIndex, @alaidi and @Rose_Cityindex.

This oage will automatically update every 5 minutes. If you’d like to refresh the content more often, please press the F5 button on your keyboard to reload the page.

Authors: Joshua Raymond – JR, Ashraf Laidi – AL and Rosemary Okolie – RO.

2pm

JR: That’s it everyone – our live blog is finished… thanks very much for joining us and for your tweets.

For a summary of the key movers and shakers, check out Rosemary’s latest article, here: Top movers following Budget speech.

1.45 pm

Here’s a snapshot of what Rosemary thinks:

There were (minor) elements of surprise; including the news about ISAs, which certainly bodes well for asset managers. The changes on pension were also a surprise.

But overall, the meat of the speech was pretty much as expected – including some of the changes aimed at boosting votes.

And from an industry perspective, the anticipation of good news for manufacturers in the form of energy bill cuts featured, as expected. That’s as well as the good news for housebuilders.

1.40 pm

UK OBR -key risk to UK deficit reduction plans is that potential output turns out to be lower than assumed.

1.39 pm

UK OBR – tax and spending measures in 2014 budget have little cumulative impact on borrowing.

1.38 pm

Some details from the office of budget and responsibility here:

UK OBR estimate UK economy was 1.7% below sustainable potential level at end of 2013, slightly narrower gap than forecast in December.

Also expect UK economy to return to normal capacity by mid-2018, a year earlier than forecast in December.

1.30 pm

JR: Have to say, I think that was a pretty great budget performance by George Osborne.

The personal tax allowance increase to £10,500 had been speculated but was a 50/50 chance. More analysis in the next 30 mins.

RO: ISA change was welcome but I agree this is a pretty good budget.

1.28 pm

RO: ISA limit raised – good news for asset management players

1.26 pm

Here’s a chart of both Ladbrokes and William Hill: both shares have tanked somewhat after the increase in fixed odds betting tax.

1.25 pm

Osborne – will offer Pensioners government savings accounts that offer 2.8% a year and 4% over three years.

1.22 pm

Osborne – will increase annual amount Britons can put in tax-free savings accounts to 15,000 pounds a year

1.21 pm

Osborne – will also raise threshold at which people pay 40% tax to £41,865 from £41,540.

1.20 pm

Osborne – will raise personal income tax allowance next year to 10,500 pounds per person from 10,000.

1.20 pm

Osborne - will cut freeze duty for Scotch whisky and other spirits and cider and raise duty in line with inflation for other alcoholic drinks – but cut duty for beer.

1.18 pm

Osborne – will cut tax on bingo gambling by half – to 10%.

Osborne – will extend horse race betting tax to offshore gambling firms.

Osborne – will extend compensation scheme for energy intensive firms – like steelmakers – for another four years.

Osborne – capping the carbon price support rate at £18 per tonne of CO2 from 2016-17 for the rest of the decade.

1.04 pm

RO: As expected, recent good news for housebuilders reiterated.

1.01 pm

AL: Austerity finally showing results but with sensibility. Next question is whether UK debt management office will plan LOWER debt issuance for 2014-15?

Bond borrowing expectations seen at £153.2bn – little changed from last year.

1 pm

Osborne – will double amount of export finance to £3bn and reduce interest rates by a third.

Osborne – all long-haul flights will carry same lower air passenger duty as flights to US.

1 pm

JR: Take a look at the GBP/USD chart – very interesting price right now!

12.59 pm

RO: This budget speech is fast living up to its reputation as the most boring one yet thus far… no surprises, no big changes, need something on tax.

12.57 pm

Osborne – will expand tax on residential properties worth over £2m to include those over £500,000 if purchased through corporates.

12.56 pm

JR: FTSE has not moved much since the speech started (red vertical line)

12.53 pm

Osborne – setting welfare cap at £119bn in 2015-16, will rise in line with inflation… excludes pensions and some unemployment benefits.

12.52 pm

AL: Gilt yields +3 bps to 2.71% while the FTSE nears positive territory as growth forecasts are lifted and borrowing projections cut back.

12.50 pm

Osborne - must substantially reduce UK public debt; need to run absolute surplus in good years.

12.49 pm

RO: £1 coin change confirmed.

12.48 pm

AL: Credit rating agencies will like this – 2014 borrowing seen £24bn less than previous forecast at £108bn.

Debt percentage of GDP is also down.

12.47pm

JR: He says he’s asked BoE to be vigilant yet there’s no doubt foreign investment without being liable to pay CGT on profits made – alongside the implementation of the Help to Buy Scheme – are both already inflating those risks into uncomfortable territory.

12.46pm

RO: Borrowing down to £108bn this year

12.45 pm - Inflation target for the BoE stays at 2%.

AL: Can earnings minus inflation regain positive territory before elections? Cameron says they’ll continue to increase.

12.44 pm

Osborne – OBR forecasts show 2014/15 public sector net borrowing of £95bn (December £96.0 – PSNB ex-Royal Mail/APF)

Osborne – OBR forecasts show 2013/14 public sector net borrowing of £108bn (December 111.2 BLN STG – PSNB ex-Royal Mail/APF)

Osborne – OBR forecasts show 2015/16 public sector net borrowing of £75bn (December £78.7bn – PSNB ex-Royal Mail/APF)

12.43 pm

Osborne - OBR forecasts show 2013/14 budget deficit of 6.6% OF GDP (December forecast 6.8% – PSNB ex-Royal Mail/APF)

Osborne – OBR forecasts show 2014/15 budget deficit of 5.5% OF GDP (December 5.6% – PSNB ex-Royal Mail/APF)

Osborne – OBR forecasts show 2015/16 budget deficit of 4.2% of GDP (December 4.4% – PSNB ex-Royal Mail/APF)

Osborne – OBR forecasts show 2016/17 budget deficit of 2.4 PCT OF GDP (December 2.7% – PSNB ex-Royal Mail/APF)

12.42 pm

Osborne – OBR have revised down UK underlying deficit in every year of forecast.

12.41 pm

Osborne – “we are getting Britain working”.

12.39 pm

Osborne – escalation of tensions in the Ukraine risk causing lower growth and higher inflation in UK.

12.37 pm

AL:

Osborne says UK GDP is forecast to grow by 2.7% in 2014 and 2.3% in 2015.

12.36 pm

Osborne – OBR forecasts show 2014 GDP growth of 2.7% (DEC FORECAST 2.4%)

Osborne – OBR forecasts show 2015 GDP growth of 2.3% (DEC 2.2%)

Osborne – OBR forecasts show 2016 GDP growth of 2.6%(DEC 2.6%)

Osborne – OBR forecasts show 2017 GDP growth of 2.6% (DEC 2.7 %)

12.35 pm

Osborne – support for savers is at the centre of this budget

12.34pm

Osborne – in the coming year deficit will be down by a half from peak

12.33 pm

Osborne – UK economy is recovering faster than forecast

Osborne – country is borrowing too much, not exporting or saving enough.

12.29 pm

AL: GBP/USD hourly technicals looking better.

12.29 pm

12.19 pm

JR: Don’t underestimate the impact of ‘slack in the economy’ on the numbers announced by OBR.

12.13 pm

AL: Yields on UK 10-yr government bonds continue to exceed their US counterparts despite lower GDP growth. Upside economic surprises from UK data have been more consistent than in the US, while the pace of the decline in UK unemployment has exceeded that in the US.

Finally, UK inflation stands at 1.9% vs 1.1% in the US, suggesting more need for policy tightening from the BoE.

12.10 pm

JR: Perhaps a big hint there from David Cameron, when replying to a question from a Liberal Democrat MP on raising the personal tax allowance, he said “I look forward to hearing more from the Chancellor on it.”

Rumours it could be raised even further to £10,500 from next year (just before election)

12 noon

JR: PMQs happening right now. Of course, no one is really watching this for a change. It’s all about what the man sitting next to Cameron has to say at 12.30pm – Mr George Osborne.

11.45 am

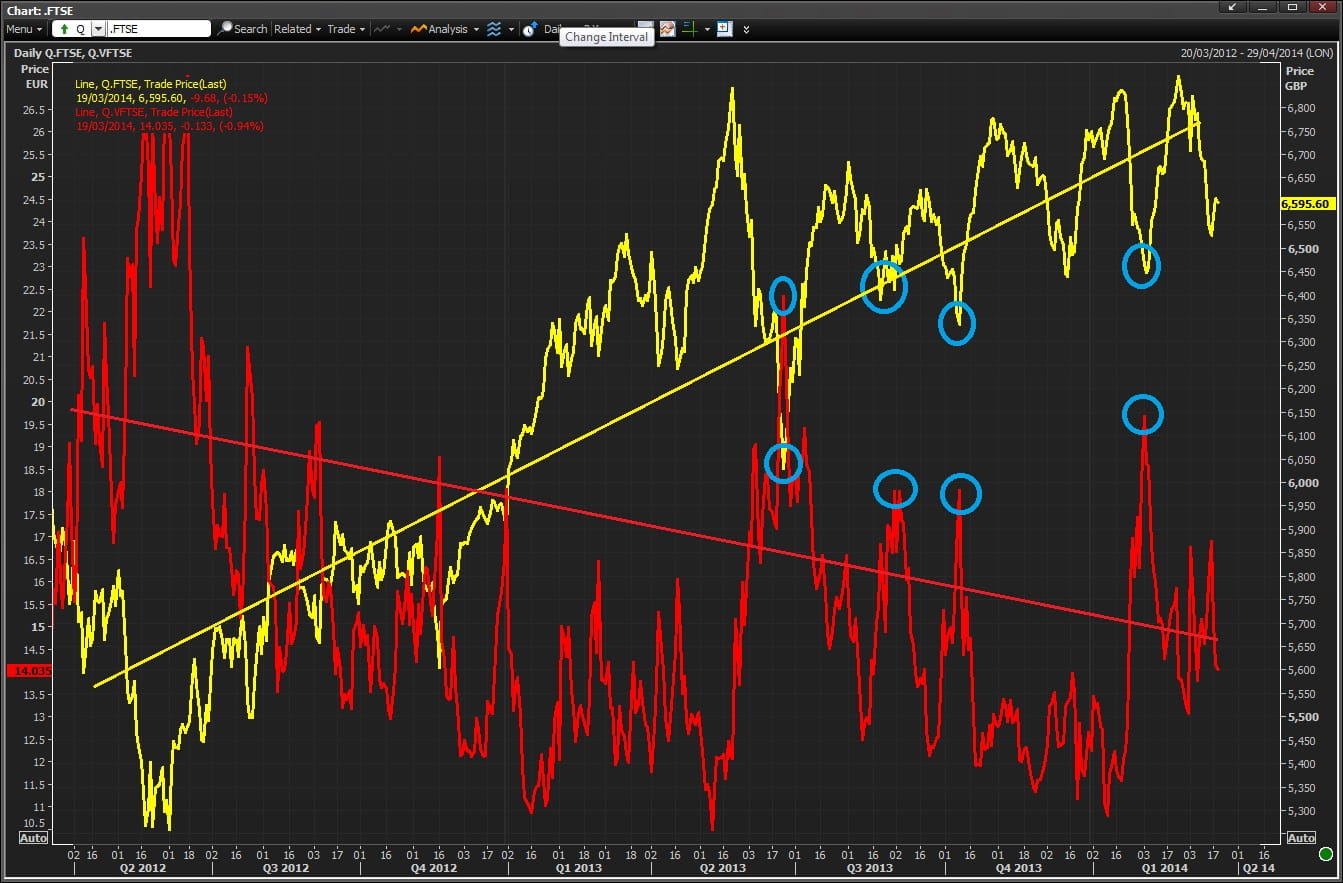

JR: While we’re waiting for Prime Minister’s Questions – which begins at 12 noon in the House of Commons – take a look at the chart below.

Sometimes this is missed by new investors but the correlation between a stable VIX or Volatility Index and a healthy, rallying FTSE 100 index is as clear as daylight.

In the chart below, the FTSE is denoted by yellow and the VIX by red.

The blue circles indicate correlations between spikes in the VIX and aggressive falls in the FTSE 100.

11.39 am

JR: From my experience, you never really see the FTSE 100 spike a huge amount in reaction to a budget speech.

However, you do tend to see individual shares jump around depending on what’s announced. Keep an eye on oil stocks with an exposure to North Sea exploration/drilling, bank stocks, and also the pound sterling – which could jump depending on revisions to both GDP and borrowing.

11.37 am

RO: FTSE 100 still around the same levels as it was at Josh’s previous update. No large trades expected for now, anyway – awaiting FOMC announcement later.

11.20 am

AL: UK’s debt repayment obligations (principal & interest) are more evenly distributed across the maturity spectrum, unlike in France, whose obligations are concentrated in the short term.

UK has so far preserved its AAA credit rating from S&P, situated two notches above that of France but both countries share the same ratings from Fitch & Moody’s.

11.10 am

RO: The build-up continues – along with chatter regarding a potential surprise from Mr Osborne – questions regarding what colour tie he’ll be wearing are also making the rounds.

10.52 am

AL: Good earnings news on UK budget day: UK REAL earnings (earnings – inflation) still negative at -0.60% but the highest since October 2012.

10.38 am

JR: Why would Osborne and the Tory party announce a major change to income tax now and not the election budget of 2015? I can think of 3 reasons:

1. To distance themselves from being seen as populist by announcing too close to the election.

2. Labour will also announce their own version of tax cuts around the same time, so any Tory move risks being seen as potentially weaker or less powerful.

3. To be used to gain momentum in the polls as a pre-emptive strike on Labour’s inevitable move on income tax.

Time will tell but there’s perhaps validity for making a move on this front now.

10.28 am

RO: Red briefcase day! Points of interest include how Mr Osborne intends to deal with rising energy prices. Of course, tax and any stamp duty reforms are also on everyone’s lips.

We already know some of what’s to come so don’t expect any major surprises. Also, not expecting markets to move much on the back of the speech.

10.26 am

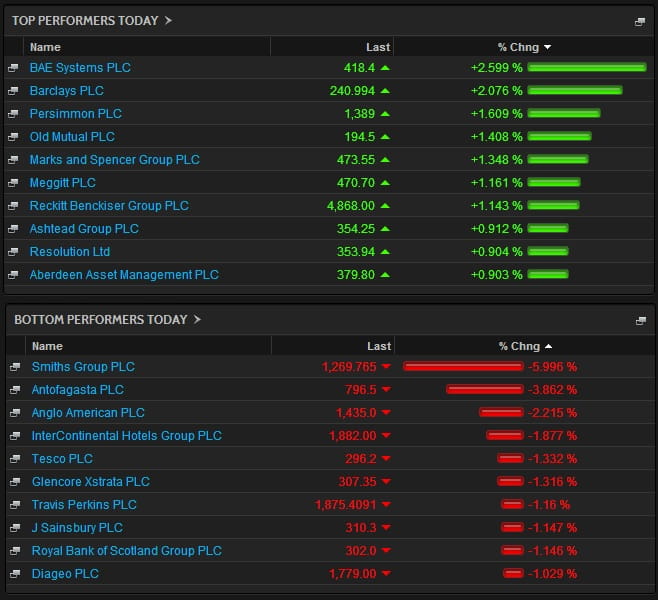

JR: Quick markets check:

FTSE 100 is currently lower by just 11pts. Tight trading range of 25pts so far – meaning trading has been very choppy. Similar trading has been seen in the French and German indices as well.

Here’s a snapshot of the top risers and fallers in the FTSE 100 today so far:

10.17 am

JR: There have been rumours this morning, spearheaded by BBC business editor, Robert Peston, that there will be an income tax surprise which will grab most of the headlines from the speech.

Really not sure what to make of that. There’s been lots of speculation in the run up to the budget concerning raising the threshold for the 40p tax rate. At the same time, I do expect the personal allowance tax threshold to be raised from £10,000 to £10,500, but so do many others so that wouldn’t necessarily be a surprise.

Equally, there has also been calls for Capital Gains Tax to be enforced on foreign buyers and sellers of UK homes.

Guess we will see at 12.30pm.

10.05 am

JR: Hey guys, welcome to our live budget blog page. Feel free to tweet me your comments, opinions and thoughts on what Osborne delivers via @Josh_Cityindex.

So far, we know the following will be announced: