BT group suspends dividend – Symmetrical triangle pattern maintains downward pressure

Reported profit before tax £2,353m down year on year; includes charges of £95m as a result of Covid-19 mainly reflecting increased debtor provisions.

Final dividend suspended for 2019/20 and all dividends for 2020/21 to create capacity for value-enhancing investments and managing confidently through the Covid-19 crisis; expect to resume dividends in 2021/22 at an annual rate of 7.7 pence per share."

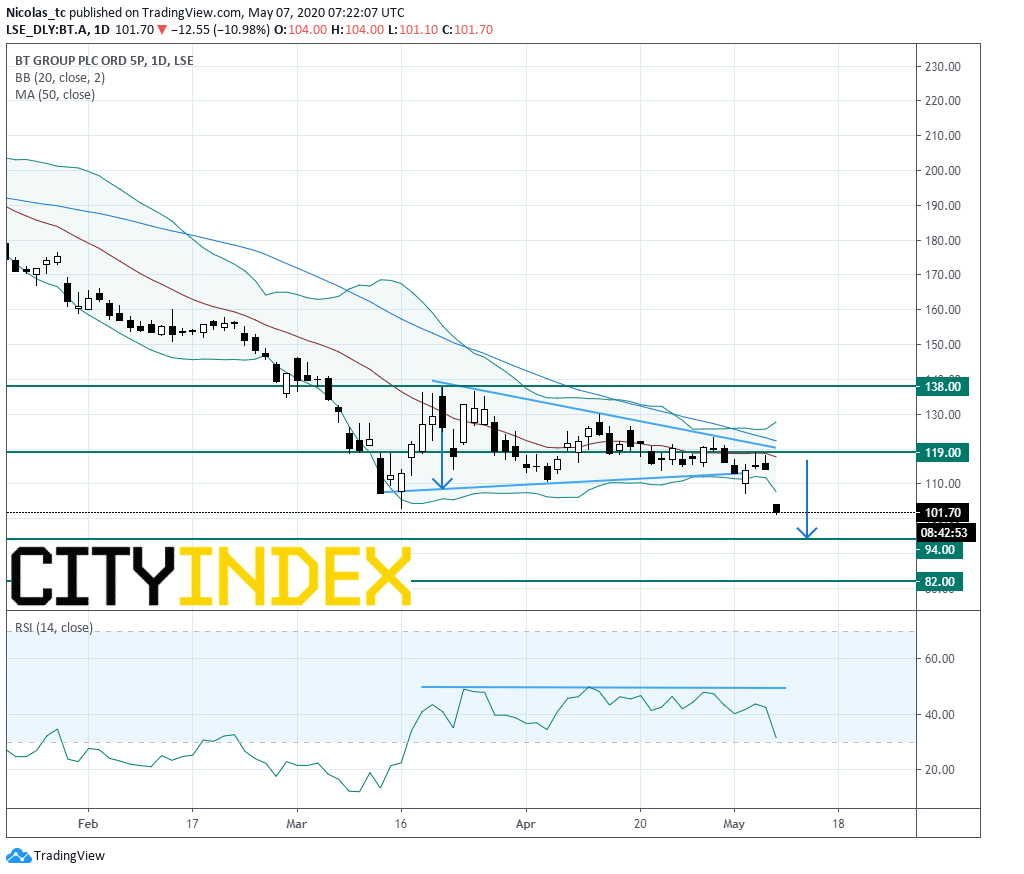

From a technical perspective, the stock price escaped from a symmetrical triangle pattern. The daily Relative Strength Index (RSI, 14) remains capped by a horizontal resistance at 50%. The trend remains bearish. Measured down move target of the triangle pattern is set at 94p.

Alternatively, a break above 127p would call for a reversal up trend with 138p as first target.

Source: GAIN Capital, TradingView