Brilliance China (1114-hk): Gathering Upside Momentum

China Passenger Car Association reported that retail passenger vehicle sales in China grew 1.9% on year to 1.639 million units in May, the first increase since June last year. The industry group said the ongoing recovery is expected in June, supported by reopening of vehicle exhibitions.

In fact, Macquarie said Chinese automobile group Brilliance China's (1114-hk) joint venture BMW Brilliance kept outperforming the Chinese auto market in May, with double-digit growth in retail sales and wholesale shipments, benefiting from resilient demand from higher-income groups.

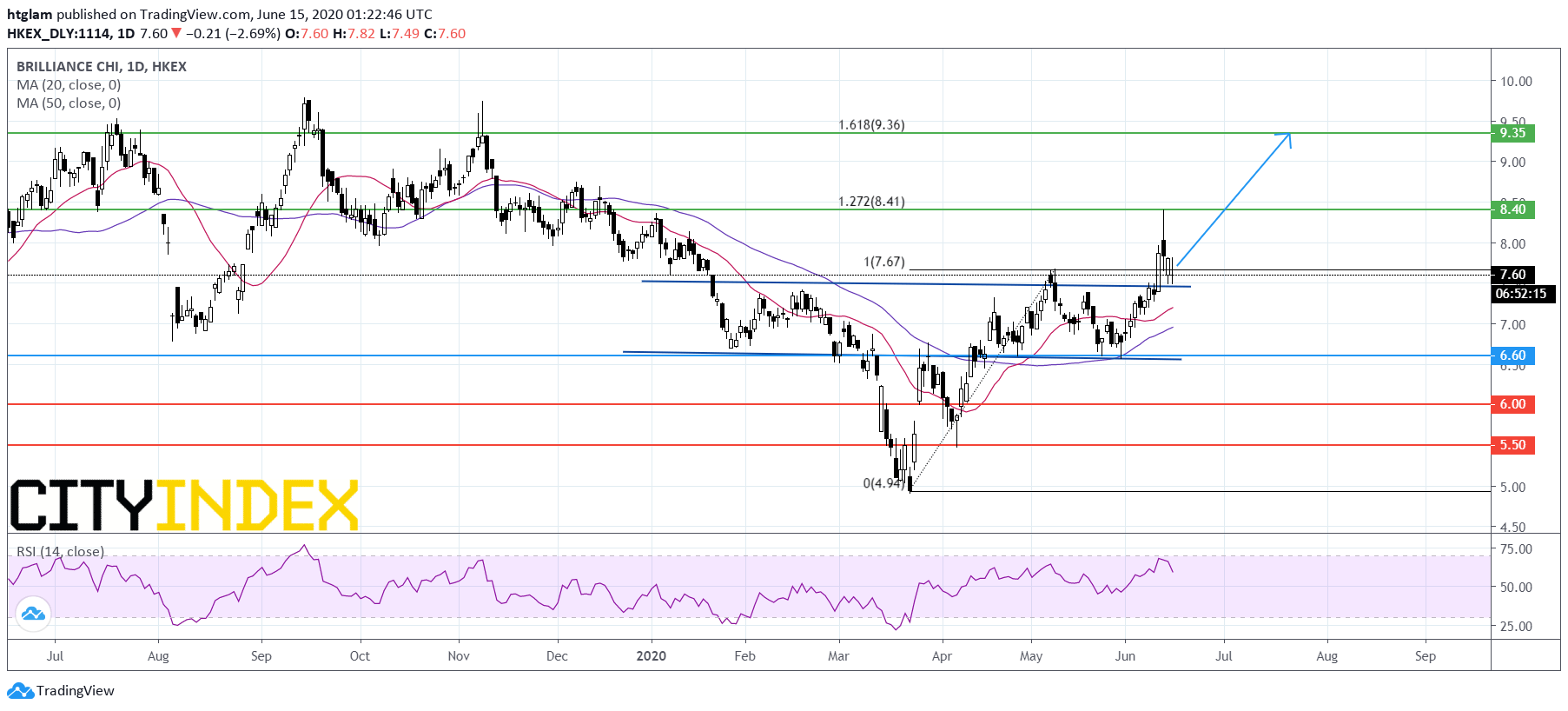

From a technical point of view, Brilliance China (1114-hk) is gathering upside momentum as shown on the daily chart. It has broken above a head and shoulder bottom pattern, with both 20-day and 50-day moving averages heading upward. The level at $6.60 might be considered as the nearest support, and a break above the nearest resistance would open a path to the next resistance at $9.35. Alternatively, losing $6.60 may trigger a pull-back to the next support at $6.00.