After two downbeat sessions investors are once again in a buying mood showing immunity to a whole host of reasons to remain bearish.

After two downbeat sessions investors are once again in a buying mood showing immunity to a whole host of reasons to remain bearish.

Following on from a higher close on Wall Street, European bourses are pointing to a stronger start as investors brush off rising US – Sino geopolitical tensions instead focusing on the bright spots in mixed Chinese data which provided further insight int the post-lockdown economic recovery.

Data from China was a mixed bag. A better than forecast industrial production reading showed that heavy industry was rebounding in the world’s second largest economy. However, the same cannot be said for retail sales, which declined a worse than forecast -7.5% in April. Although, this as a significant improvement on last month’s -15.8% decline. The improvement in industrial production indicates that stimulus measures are working. However, this will take longer to trickle down to improving consumer confidence and lifting sales.

What we can take away from the Chinese data and apply to other economies is that improvements in economic activity will be gradual.

Concerns over a second wave of infections which have weighed on sentiment over much of the week, continued to play out in China and South Korea where clusters of outbreaks are causing a problem. Fears of infections rising in Germany have also weighed on risk appetite as the economy gradually reopens.

Trump threatens to cut ties with China

The markets have largely brushed off Trump threatening to cut off relations with China. The flare up in US – Sino tensions come amid Trump’s efforts to pint the blame of the coronavirus outbreak on China. Whilst traders are sweeping these comments under the carpet today, it is highly unlikely that we have heard the end of this. The US – Sino relations theme could well hamper market sentiment across Q2.

The markets have largely brushed off Trump threatening to cut off relations with China. The flare up in US – Sino tensions come amid Trump’s efforts to pint the blame of the coronavirus outbreak on China. Whilst traders are sweeping these comments under the carpet today, it is highly unlikely that we have heard the end of this. The US – Sino relations theme could well hamper market sentiment across Q2.

German GDP & US Retail Sales

German GDP is expected to show -2.2% decline in the first quarter, a level last seen in 2009. However, this will only capture the start of lockdown with a 10% contraction forecast for the second quarter of the year.

German GDP is expected to show -2.2% decline in the first quarter, a level last seen in 2009. However, this will only capture the start of lockdown with a 10% contraction forecast for the second quarter of the year.

Investors will turn their attention to US retail sales. Expectations are for sales to decline-12.5% month on month in April the month of lockdown. This comes after a 8.7% decline in March. With the US economy gradually starting to reopen, today’s data should represent the bottom for retail sales. This news will be largely priced in. Only a significant beat or miss could provoke a movement in the market.

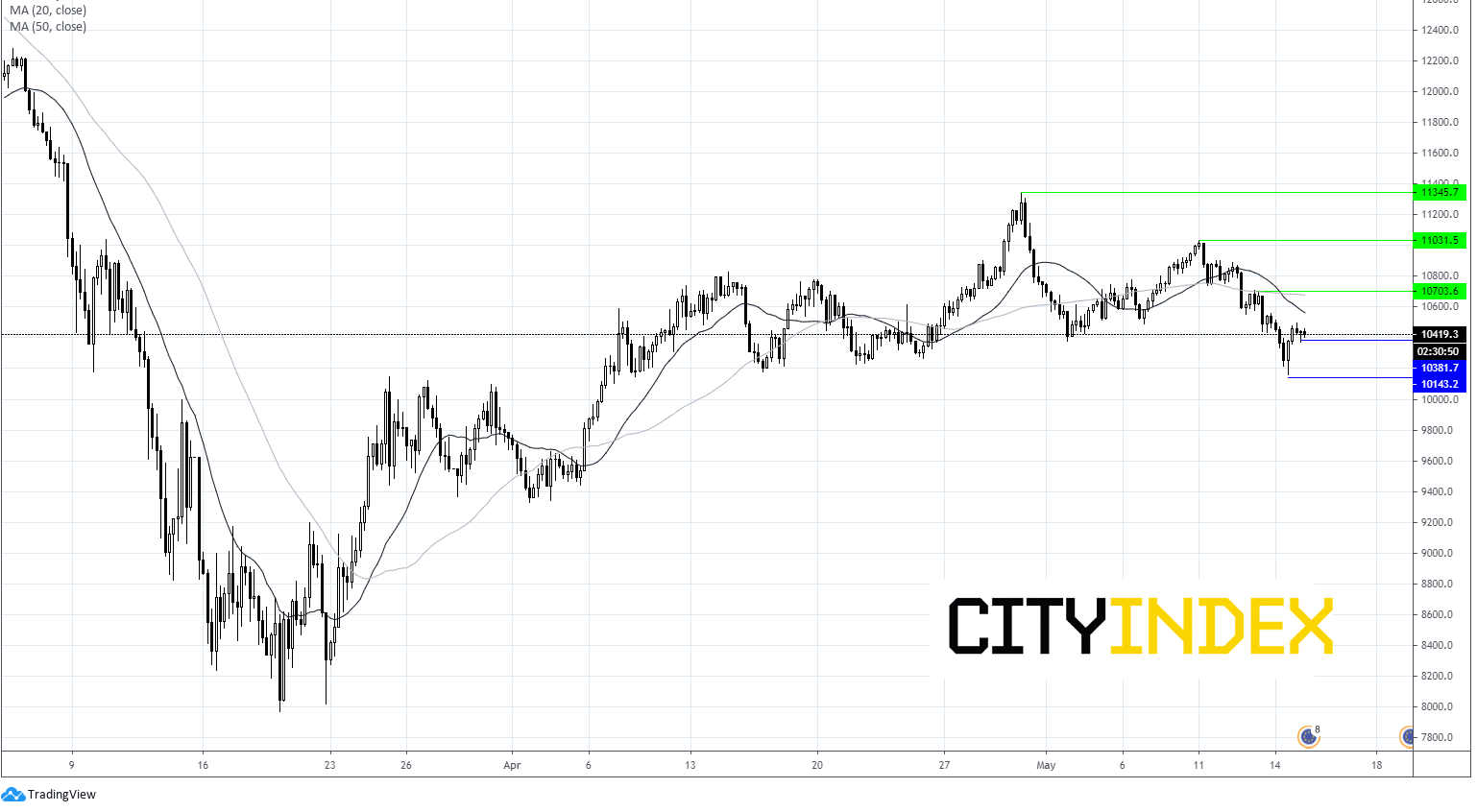

Dax levels to watch:

After two days of losses, the Dax is trading below its 20 & 50 sma on 4 hour chart. Immediate support can be seen at 10372 (overnight low) prior to 10141 (yesterday’s low).

Resistance can be seen at 10560 (20 sma) prior to 10685/10700 (50 sma & high 13th May) and 11030 (high 11th May).

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM