With just under three weeks left until the end of the 11 month transition period, and with “very large gaps” remaining including the EU’s demand that the UK follow future changes in the EU's rules, Johnson's warning has heightened Brexit anxiety.

Although discussions are scheduled to continue until Sunday, Johnson said “There’s now the strong possibility we will have a solution that's much more like an Australian relationship with the EU than a Canadian relationship with the EU.” An inference that the UK would fall back on the rules of the WTO and face tariffs as well as quotas when the transition period ends on December 31st.

Whether the latest developments confirm the probability that a no-deal Brexit has increased, or rather is the latest instalment in brinkmanship aimed to foster compromise, GBP/USD has fallen back towards 1.3300 at the time of writing.

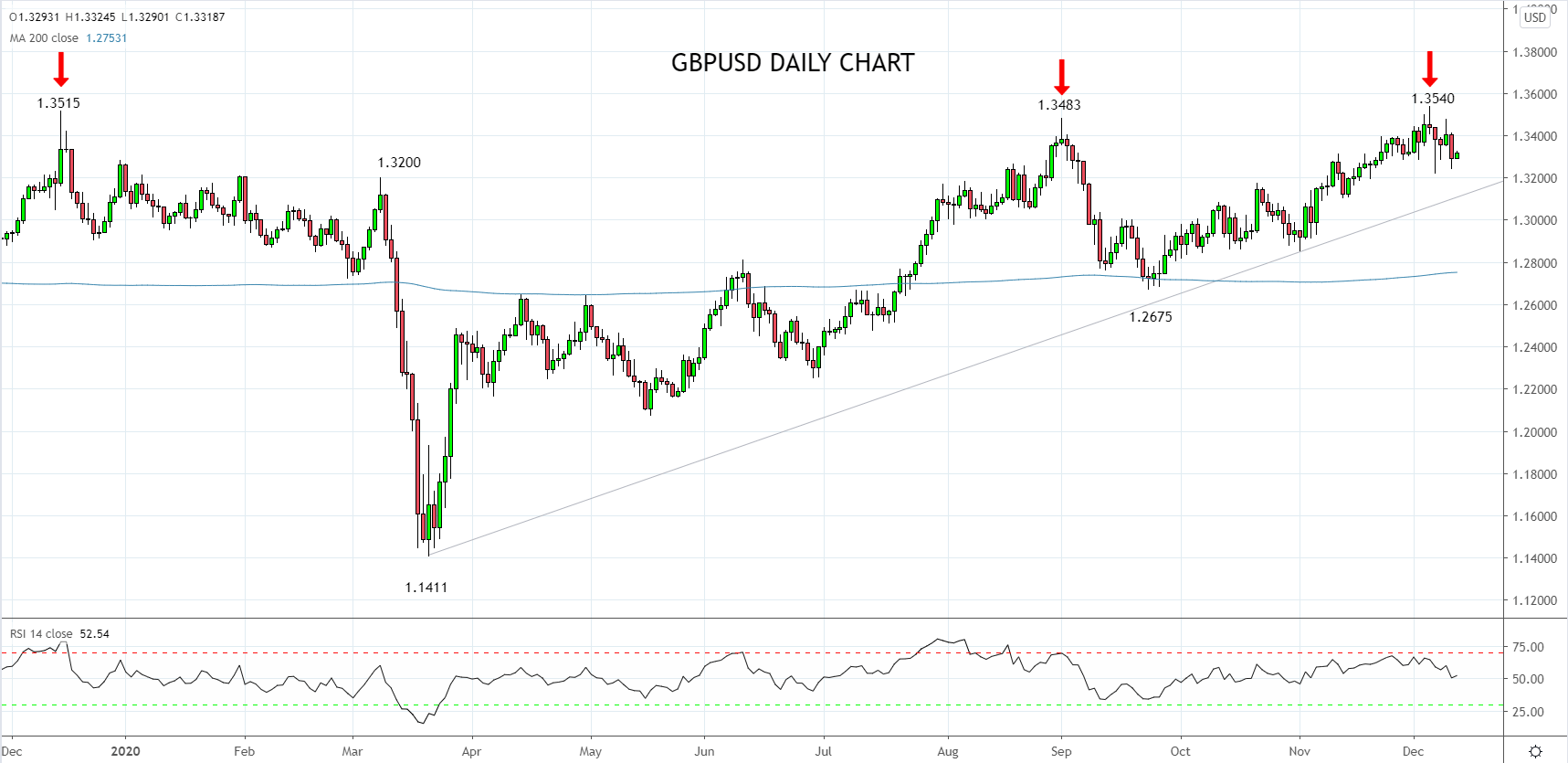

The latest setback in GBP/USD leaves last week's 1.3540 high outstanding as another failed attempt to break the cluster of resistance 1.3480/1.3520 that includes several highs since June 2018 and also picks up the January 2009 low of 1.3503. This resistance band is ultimately favoured to give way in due course.

Trendline support from the March 2012, 1.1411 low is viewed towards 1.3100 and is expected to attract buyers - more so given a disorderly Brexit is off the table after the withdrawal of controversial clauses in the Internal Markets Bill.

However, should GBP/USD see a sustained break of the 1.3100 support level, there is room for the decline to extend towards a band of support 1.2750/1.2675 coming from the 200-day ma and the September 1.2675 low.

Source Tradingview. The figures stated areas of the 11th of December 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation