Despite all three main US indexes on Wall Street booking a record close on Friday, European markets are heading for a broadly lower start to the week; only the FTSE looking to kick off the week on the front foot. The downbeat start comes amid rising US – Sino geopolitical tensions and as German factories face a gloomier production outlook. Meanwhile the Brexit weakened Pound is giving the FTSE a leg up in addition to optimism surrounding the roll out of Pfizer’s Covid vaccine which starts this week.

Brexit drags GBP boosting FTSE

The Pound is slipping lower as those betting on a Brexit trade deal being achieved this weekend were left disappointed. Not all hope is gone as a possible compromise over the sticky point of UK fishing waters could be emerging. Headlines have been mixed as the two sides struggle to agree on the post Brexit relationship, with some suggesting that the chances of a deal being achieved are still only 50/50. This is the week that we could find out whether Prime Minister Boris Johnson is prepared to press the n o deal button. What is certain is that this is last chance saloon and we can expect heightened volatility across the coming days. GBP/USD trades -0.2%, finding support at $1.34 at the time of writing

The softer tone surrounding the Pound is beneficial to multinationals on the FTSE 100 which earn abroad. This accounts for over 70% of the index, boosting it higher.

UK vaccine roll out

The roll out of the Pfizer BioNTech covid vaccine, which starts tomorrow is adding to the more upbeat mood towards the FTSE. Vaccine developments sent global stocks soaring across November, so a good deal of the vaccine news is already priced in. However, the administering of the jab marks the start of a new phase along the road out of the pandemic and back towards pre-pandemic growth levels.

China sanctions

He might be on his way out of the White House but Trump is keen to pile the pressure on China’s Xi Jinping in the weeks before he leaves. Reports that the Trump administration is preparing to sanction a dozen or so Chinese officials is hitting risk sentiment with the trade sensitive Dax leading the charge southwards. The market feared that Trump could apply some final retributions on China on his way out of office and those concerns are turning into a reality.

Brexit drags GBP boosting FTSE

The Pound is slipping lower as those betting on a Brexit trade deal being achieved this weekend were left disappointed. Not all hope is gone as a possible compromise over the sticky point of UK fishing waters could be emerging. Headlines have been mixed as the two sides struggle to agree on the post Brexit relationship, with some suggesting that the chances of a deal being achieved are still only 50/50. This is the week that we could find out whether Prime Minister Boris Johnson is prepared to press the n o deal button. What is certain is that this is last chance saloon and we can expect heightened volatility across the coming days. GBP/USD trades -0.2%, finding support at $1.34 at the time of writing

The softer tone surrounding the Pound is beneficial to multinationals on the FTSE 100 which earn abroad. This accounts for over 70% of the index, boosting it higher.

UK vaccine roll out

The roll out of the Pfizer BioNTech covid vaccine, which starts tomorrow is adding to the more upbeat mood towards the FTSE. Vaccine developments sent global stocks soaring across November, so a good deal of the vaccine news is already priced in. However, the administering of the jab marks the start of a new phase along the road out of the pandemic and back towards pre-pandemic growth levels.

China sanctions

He might be on his way out of the White House but Trump is keen to pile the pressure on China’s Xi Jinping in the weeks before he leaves. Reports that the Trump administration is preparing to sanction a dozen or so Chinese officials is hitting risk sentiment with the trade sensitive Dax leading the charge southwards. The market feared that Trump could apply some final retributions on China on his way out of office and those concerns are turning into a reality.

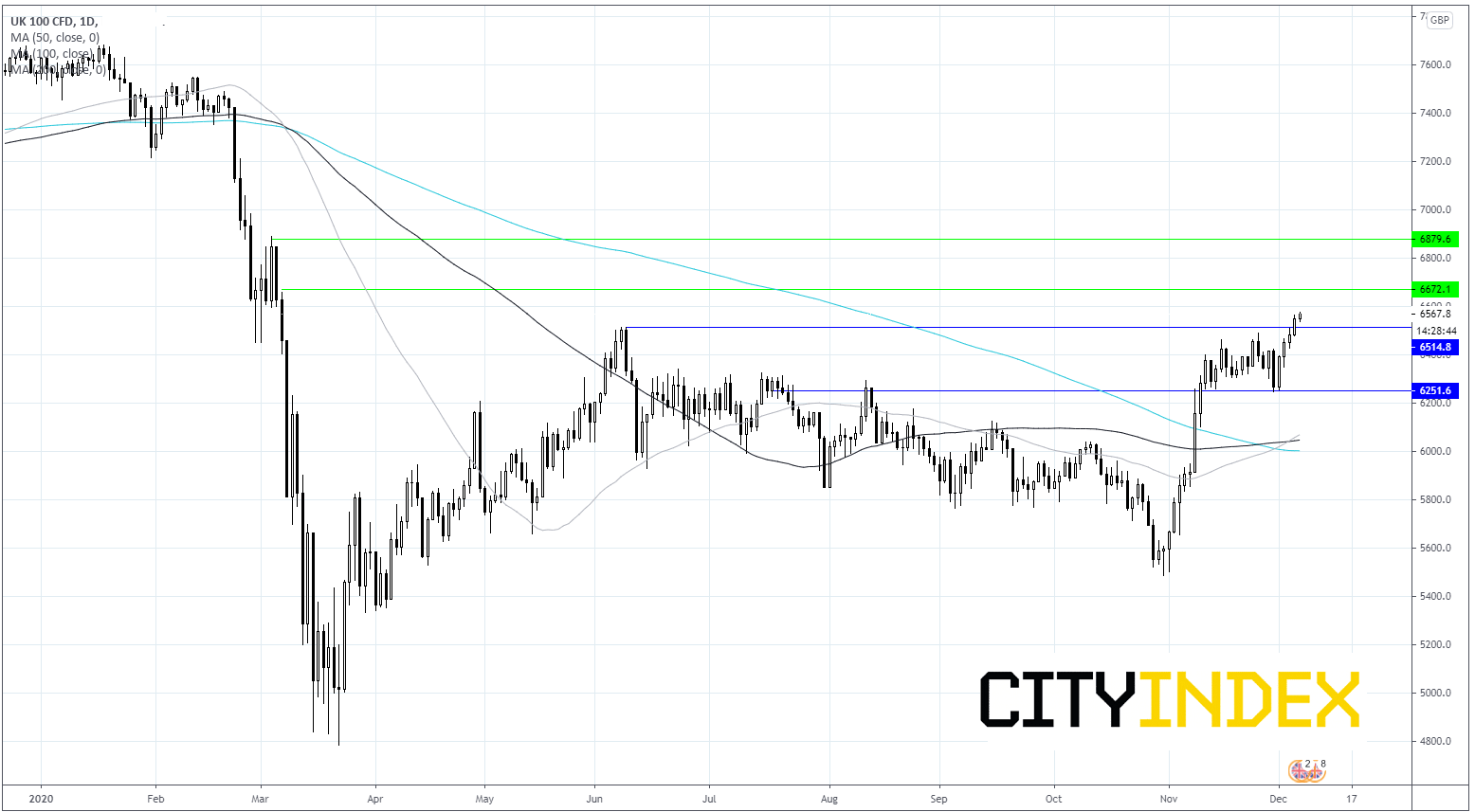

FTSE Chart

Latest market news

Today 05:45 AM

Yesterday 11:09 PM

Yesterday 11:01 PM

Yesterday 04:00 PM

Yesterday 01:15 PM