BREXIT: Hints of Clarity as the UK Enters an 11-Month Transition Period

For traders who have gotten caught up in all the news around US-China trade relations, fears of military conflict in the Middle East, the spread of coronavirus, or US company earnings, I have a reminder: The UK will officially leave the European Union on Friday, 31 January.

What will change?

Essentially nothing, at least at first!

For the “transition period” over the rest of the year, free movement and free trade between the UK and EU will continue unencumbered. The UK will still contribute to the EU’s budget. The UK will still be obligated to abide by EU laws.

The real changes won’t be felt until the end of the 11-month transition period. Between now and New Year’s Day 2021, UK and EU negotiators will have to determine the shape of a new trade pact between the two countries (not to mention UK-specific trade deals with other trading partners, including the United States), create new passports, and develop a full border/immigration plan, among countless other tasks.

After it took more than three-and-a-half years, including multiple delays, to make Brexit official, color me skeptical that UK authorities will be able to iron out all of the above details this year.

Market Implications

Much like the (lack of) immediate changes to the general UK populace, financial markets are unlikely to see an immediate reaction to Brexit becoming official. After all, traders are a forward-looking bunch, and the formal Brexit date has been known for weeks. Therefore, market reactions to Brexit are likely to play out over a more extended timeframe.

When it comes to UK markets, the ultimate impact of Brexit remains to be seen. Whether or not Brexit ultimately proves to be a net benefit for the UK economy relative to the pre-June-2016 status quo, the new state of affairs will almost certainly be an improvement over the last three years, when UK businesses and households were operating under a massive cloud of uncertainty. Not knowing the regulations, impact on international consumers, or even whether Brexit truly would take place, UK businesses have been curtailing longer-term investments, including capital equipment and hiring decisions, while UK consumers similarly put off larger purchase decisions.

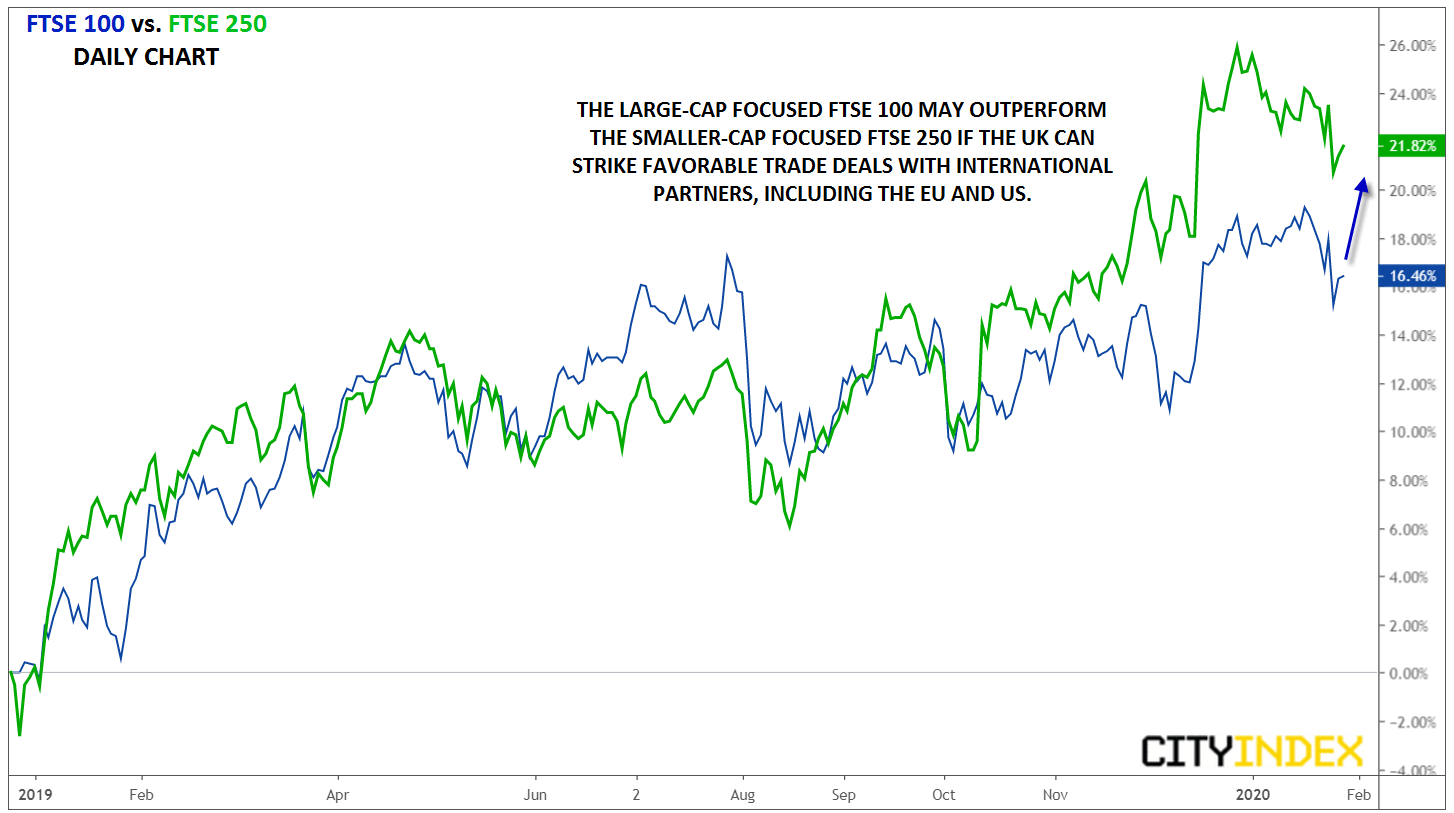

Therefore, as traders get more clarity on the new “rules of play” over the coming months, we may see those pent-up investments finally get made, potentially boosting UK stocks and indices. In particular, larger firms with more extensive international revenues (such as those that make up the FTSE 100) may outperform against smaller, more domestically-focused companies (such as those that make up the FTSE 250):

Source: TradingView, GAIN Capital. Please note these products may not be available in all regions.

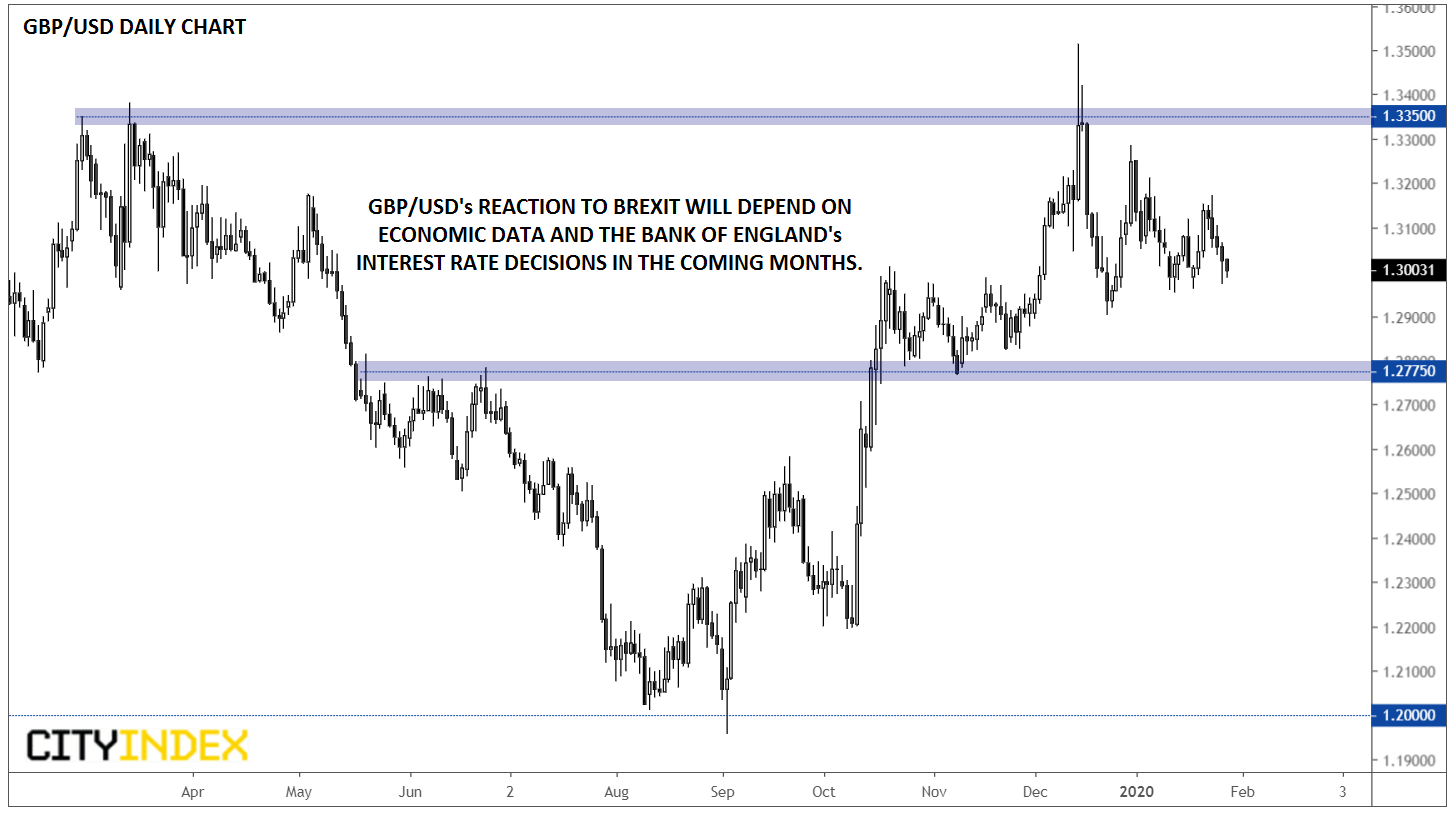

When it comes to sterling, the biggest outcome of Brexit itself may be for the Bank of England, which was reticent to make any changes to monetary policy while the uncertainty around Brexit lingered. As it stands, traders are pricing in the potential for interest rate cuts this year from the BOE, but the exact timing remains an open question. If UK economic data is disappointing and the BOE is forced to make interest rate cuts sooner rather than later, GBP/USD could fall back toward previous-resistance-turned-support in the 1.2775 area. On the other hand, improving incoming figures could limit the scope, or at least delay the timeline, for any BOE interest rate cuts. In that scenario, GBP/USD could quickly run back toward its multi-year highs starting around the 1.3350 area:

Source: TradingView, GAIN Capital