Brexit Excitement Sends GBP Bid, Ready for a Short-term Correction?: GBP/USD, EUR/GBP

Today, the House of Lords struck down part of the Internal Market bill that was a crucial part of Boris Johnson’s plans for a “revised” Brexit trade deal. Although Johnson says he plans to pursue the clauses that were struck down, the Pound went bid as there is now a better chance of a trade deal getting done. Talks yesterday were encouraging as well, suggesting more optimism for the Pound. But the technicals are approaching levels for a possible reversal.

GBP/USD

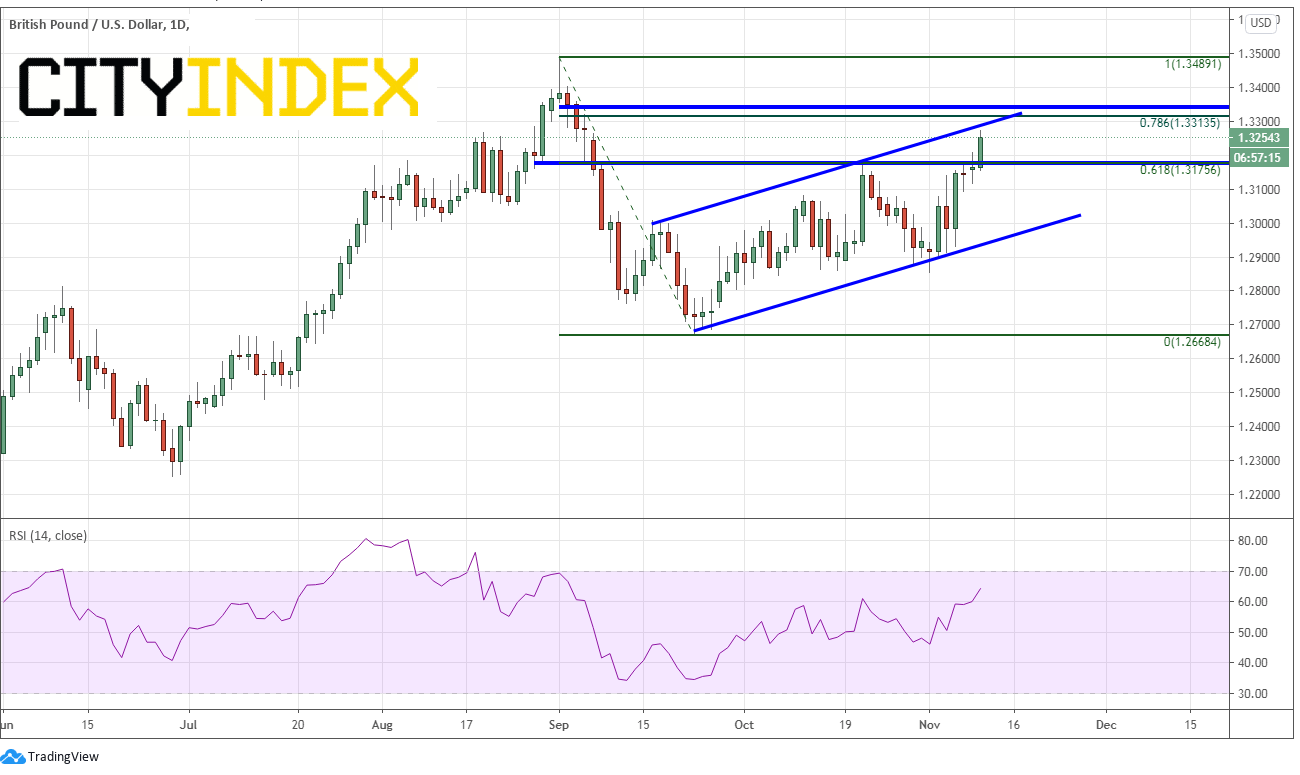

On a daily timeframe, GBP/USD has broken above horizontal resistance and the 61.8% Fibonacci retracement level from the highs of September 1st to the lows of September 23rd near 1.3175. The pair has been in a rising channel since the September 23rd lows. However, there is a confluence of resistance above at the top, upward sloping channel trendline, horizontal resistance, and the 78.6% Fibonacci retracement, level between 1.3300 and 1.3350.

Source: Tradingview, City Index

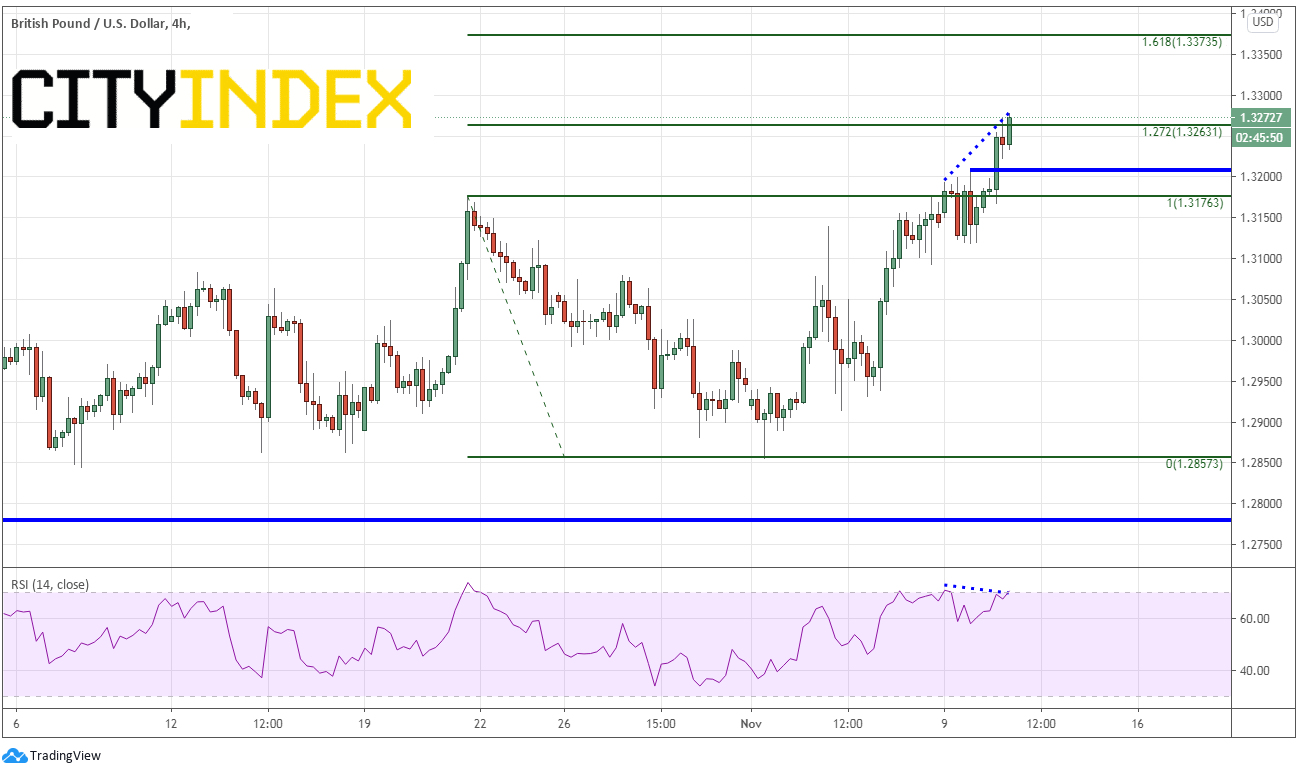

Even before the upper channel trendline though, price has just hit the 127% Fibonacci extension from the highs on October 21st to the lows of November 2nd near 1.3265. The RSI is near overbought conditions; however, it is diverging from price. Horizontal support is below near 1.3200. then at the prior inflection highs near 1.3176.

Source: Tradingview, City Index

EUR/GBP

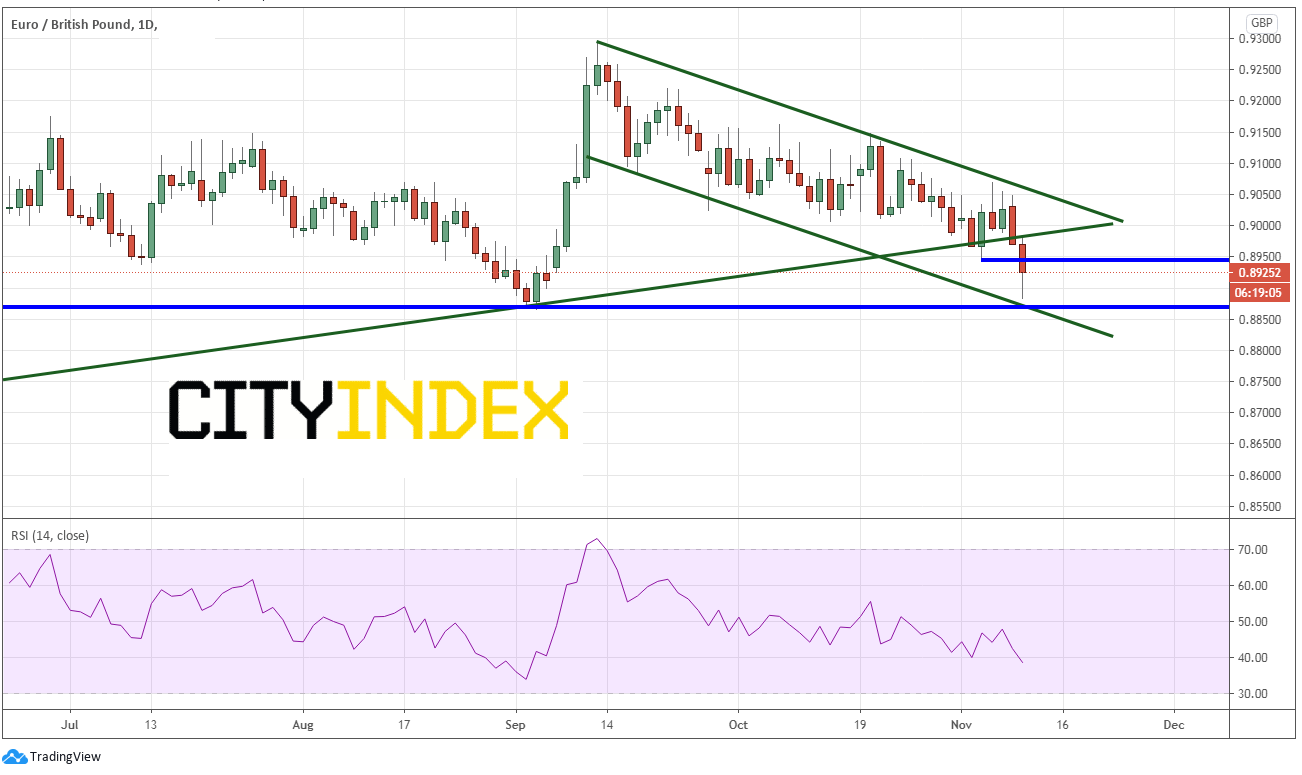

On a daily timeframe, EUR/GBP has been in a triangle formation since putting in highs on September 11th. The pair broke lower below the triangle today, as well as below recent lows at .8950. The pair has managed to hold support near .8875, which is both horizontal support and the bottom trendline of a downward sloping channel the pair has been in since also since the September 11th highs. Resistance is back at the prior support ner .8950.

Source: Tradingview, City Index

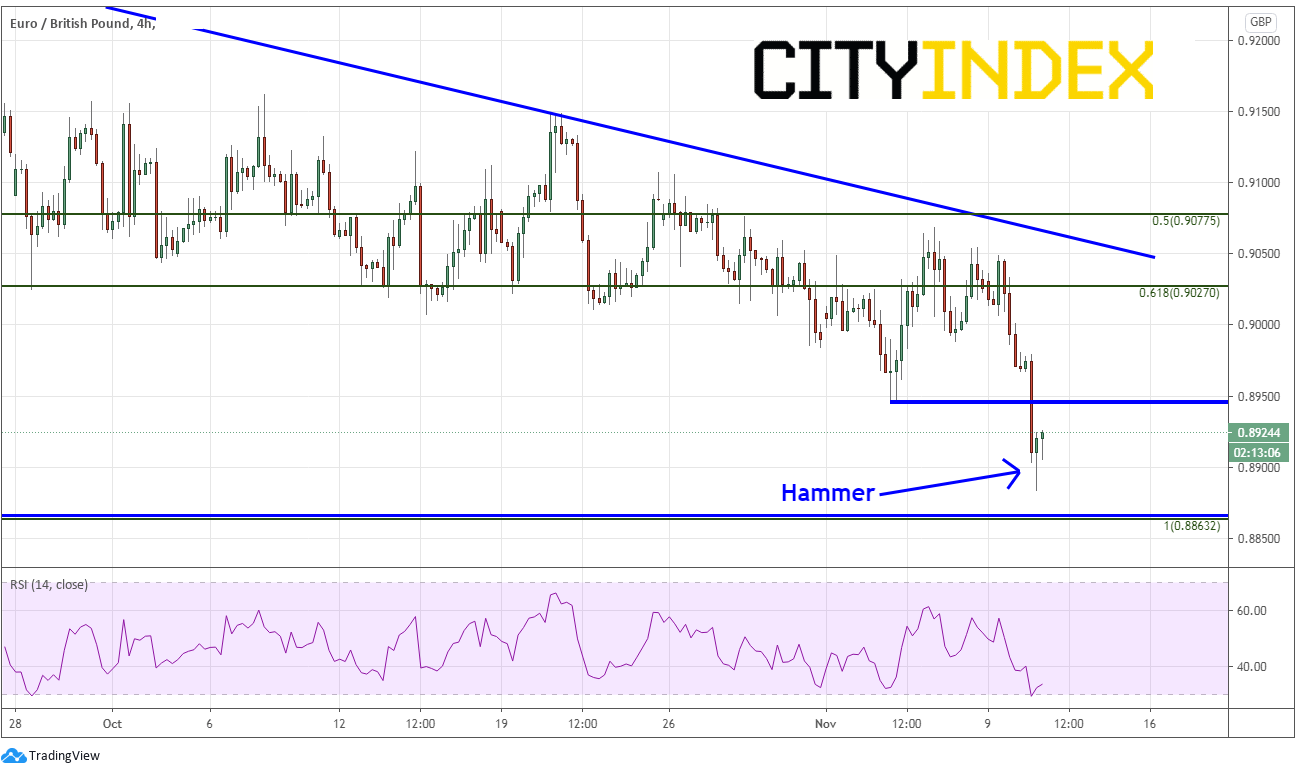

On a 240-minute timeframe, there is a clearer picture of the potential for a reversal as the low candlestick is a hammer, which indicates a possible reversal. Notice here too the clear resistance at .8950. Support is at the day’s lows near .8884, then the horizontal support near .8865.

Source: Tradingview, City Index