The Pound has moved between narrow gains and losses hovering around the $1.29 mark as Boris Johnson tells the UK to prepare for a no trade deal Brexit. However, with more talks due to start in London on Monday, the question arises as to whether anything has changed?

Talks again on Monday

In response to Boris Johnsons remarks EC Commission President Ursula von der Leyen will send a team to London to intensify talks. Chief EU negotiator Michel Barnier is due to meet with his UK counterpart David Frost later today. The fact that talks are seemingly continuing is underpinning the Pound and by Monday it could be as if Brinkmanship never happened.

In response to Boris Johnsons remarks EC Commission President Ursula von der Leyen will send a team to London to intensify talks. Chief EU negotiator Michel Barnier is due to meet with his UK counterpart David Frost later today. The fact that talks are seemingly continuing is underpinning the Pound and by Monday it could be as if Brinkmanship never happened.

Political posturing

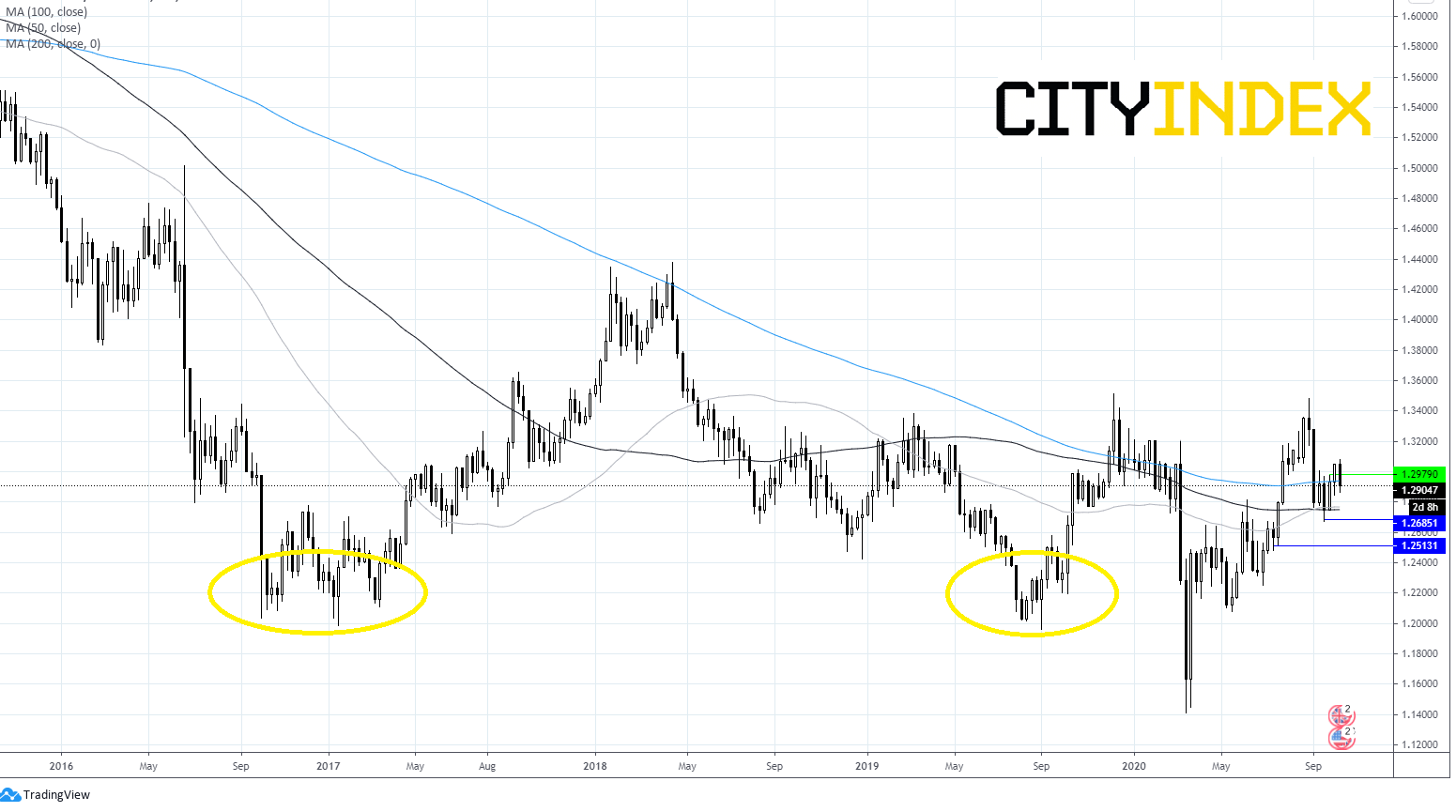

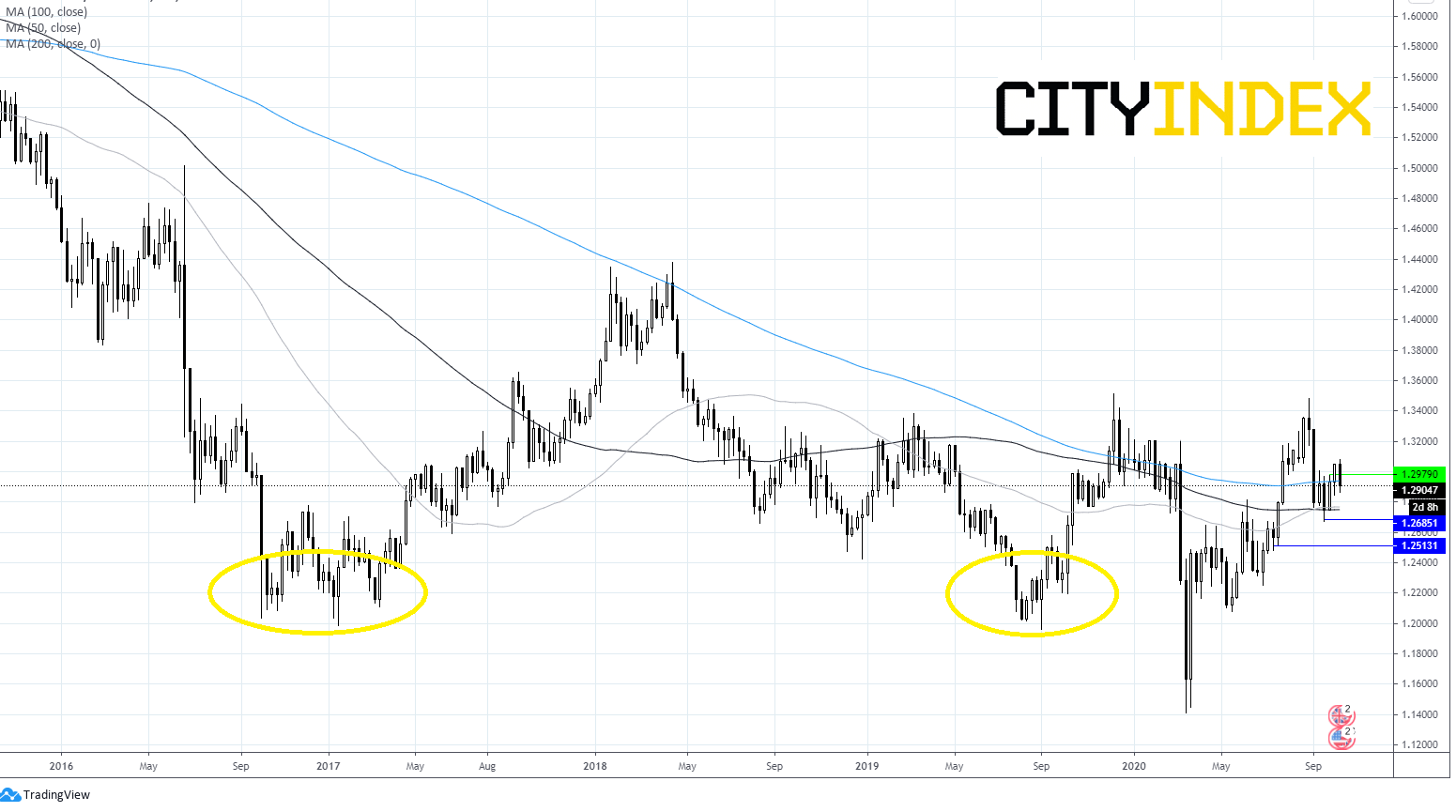

The Pound hasn’t slumped back towards $1.25/20 levels which it traded at when a no deal Brexit probability rises. This could be because the markets are still reading this as political posturing rather than anything more serious at this point. However, this jittery nature of trading in #GBP this morning suggests that the markets believe that we are moving towards a pivotal moment.

Let’s not forget that the Brexit saga has been dragging on for 4 years which means that the markets have grown accustomed to a certain type of behaviour from politicians surrounding the issue and a certain amount of political posturing.

The Pound hasn’t slumped back towards $1.25/20 levels which it traded at when a no deal Brexit probability rises. This could be because the markets are still reading this as political posturing rather than anything more serious at this point. However, this jittery nature of trading in #GBP this morning suggests that the markets believe that we are moving towards a pivotal moment.

Let’s not forget that the Brexit saga has been dragging on for 4 years which means that the markets have grown accustomed to a certain type of behaviour from politicians surrounding the issue and a certain amount of political posturing.

Pound ready to move on?

The absence of a sell off could also mean that Pound traders are ready to move on to the next stage after four long years of Brexit rhetoric. However, that seems a little less likely given the perfect storm of no trade deal Brexit, tightening covid restrictions and surging unemployment which could hit the UK economy at the end of the year.

With the Pound trading at this level, it’s fair to say that the market assumption is a bare bones deal will be scraped together at some point before it’s too late.

The absence of a sell off could also mean that Pound traders are ready to move on to the next stage after four long years of Brexit rhetoric. However, that seems a little less likely given the perfect storm of no trade deal Brexit, tightening covid restrictions and surging unemployment which could hit the UK economy at the end of the year.

With the Pound trading at this level, it’s fair to say that the market assumption is a bare bones deal will be scraped together at some point before it’s too late.

UK equities weaker

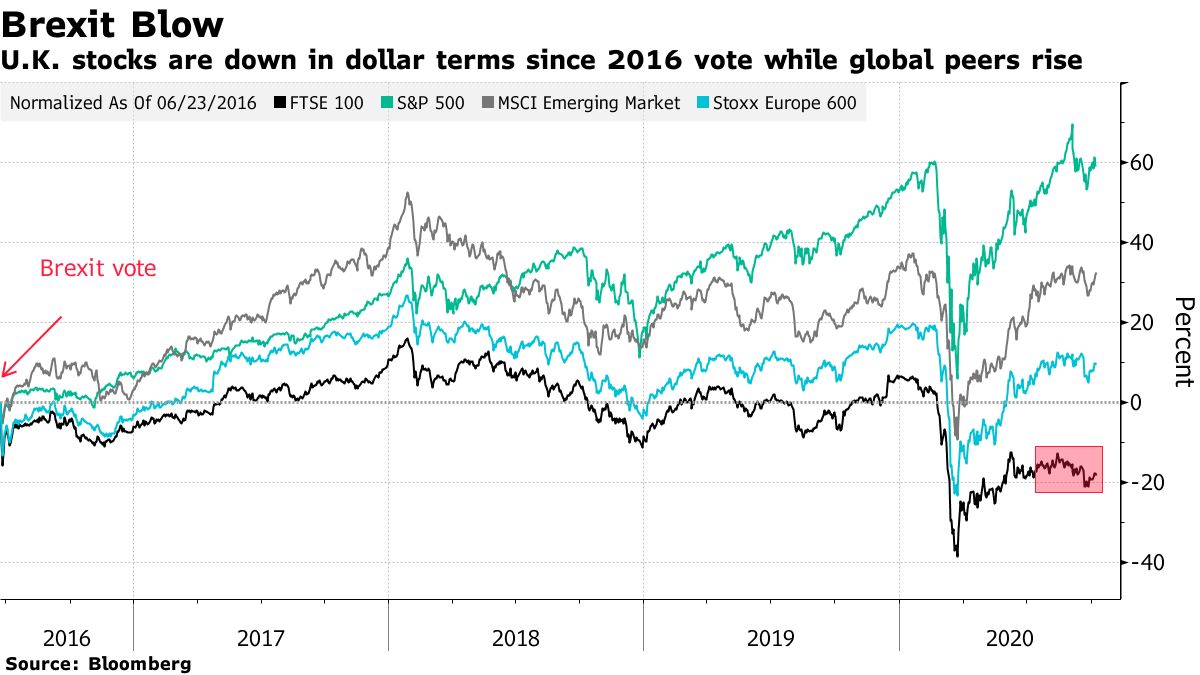

It’s not just GBP which is being impacted by the continued Brexit uncertainty. UK equities might be trading some 1% higher today. However, they have been shunned in favour of international peers over the past four years since the Brexit vote. The UK’s recovery from the covid crisis has been weaker than its peers as Brexit uncertainty looms.

Latest market news

Yesterday 01:23 PM

Yesterday 06:01 AM

April 18, 2024 11:27 PM

April 18, 2024 04:46 PM