News that a Brexit deal has been agreed sent the pound surging. The pound looks to target $1.30 at time of writing, although there could well be more wind in the sails, with a move towards $1.34 not inconceivable.

Interestingly, the FTSE, which often trades inversely the pound, given its high number of multinationals that earn abroad, has also pushed higher on the news. This is in sharp contrast the Brexit referendum when we saw the pound dive and the FTSE soar as multinationals benefited from the more favourable exchange rate

The fact the FTSE is rising despite the stronger pound underscores the relief felt by traders that a no deal Brexit could well be avoided. Risk appetite has lifted boosting demand for riskier assets such as equities. Domestically focused banks and house builders are dominating the upper reaches on the FTSE100 as these are the stocks which are more vulnerable to the fortunes of the UK economy

What next?

The volatility in the pound and the UK markets won’t stop here. This is just half the battle. Traders will now turn their attention to the chances of Boris Johnson’s Brexit deal making it through Parliament.

The volatility in the pound and the UK markets won’t stop here. This is just half the battle. Traders will now turn their attention to the chances of Boris Johnson’s Brexit deal making it through Parliament.

The DUP, whose vote is critical to Johnson to get the Brexit deal through the House of Commons has already clearly rejected the deal as stands. Bojo needs to bring them onside to secure the deal. Even then, there is a chance that the agreement could get through Parliament, but as we have seen several times before it is by no means a sealed deal yet.

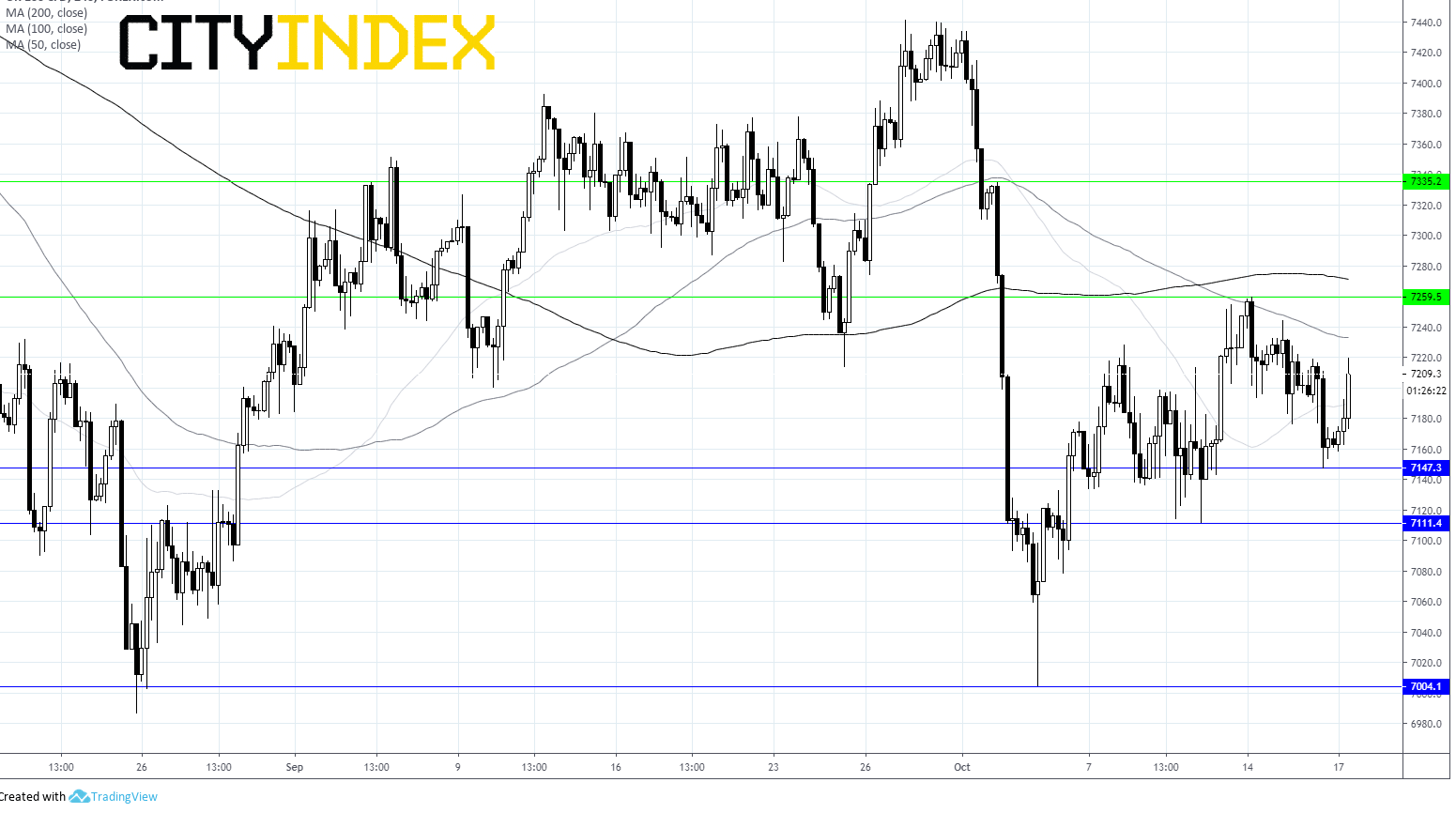

Levels to watch:

The FTSE rebounded off a low of 7147 on the news that a Brexit deal has been agreed. The UK index is currently up 0.6% at 7210 but still remains below its 100 & 200 sma. A break above 7250 could indicate a more bullish outlook. On the downside, support can be seen at 7150 prior to 7110.

Latest market news

Yesterday 03:00 PM

Yesterday 01:12 PM

Yesterday 11:14 AM