Breakout Play: Invesco

On Friday, Invesco (IVZ), a provider of investment management services, gapped up 5.6% at the opening bell after The Wall Street Journal reported that Trian Fund Management has accumulated a 9.9% stake in the company.

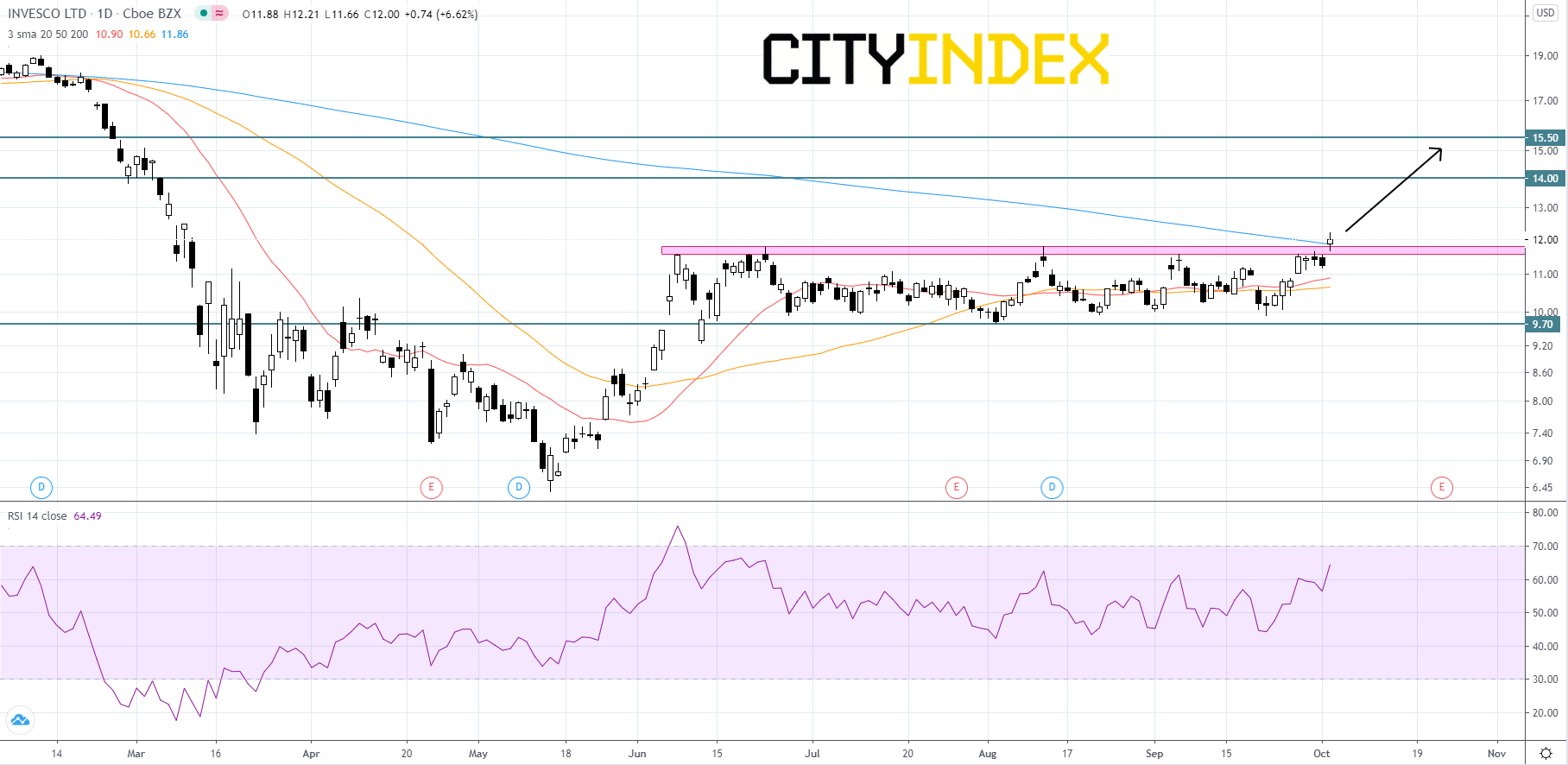

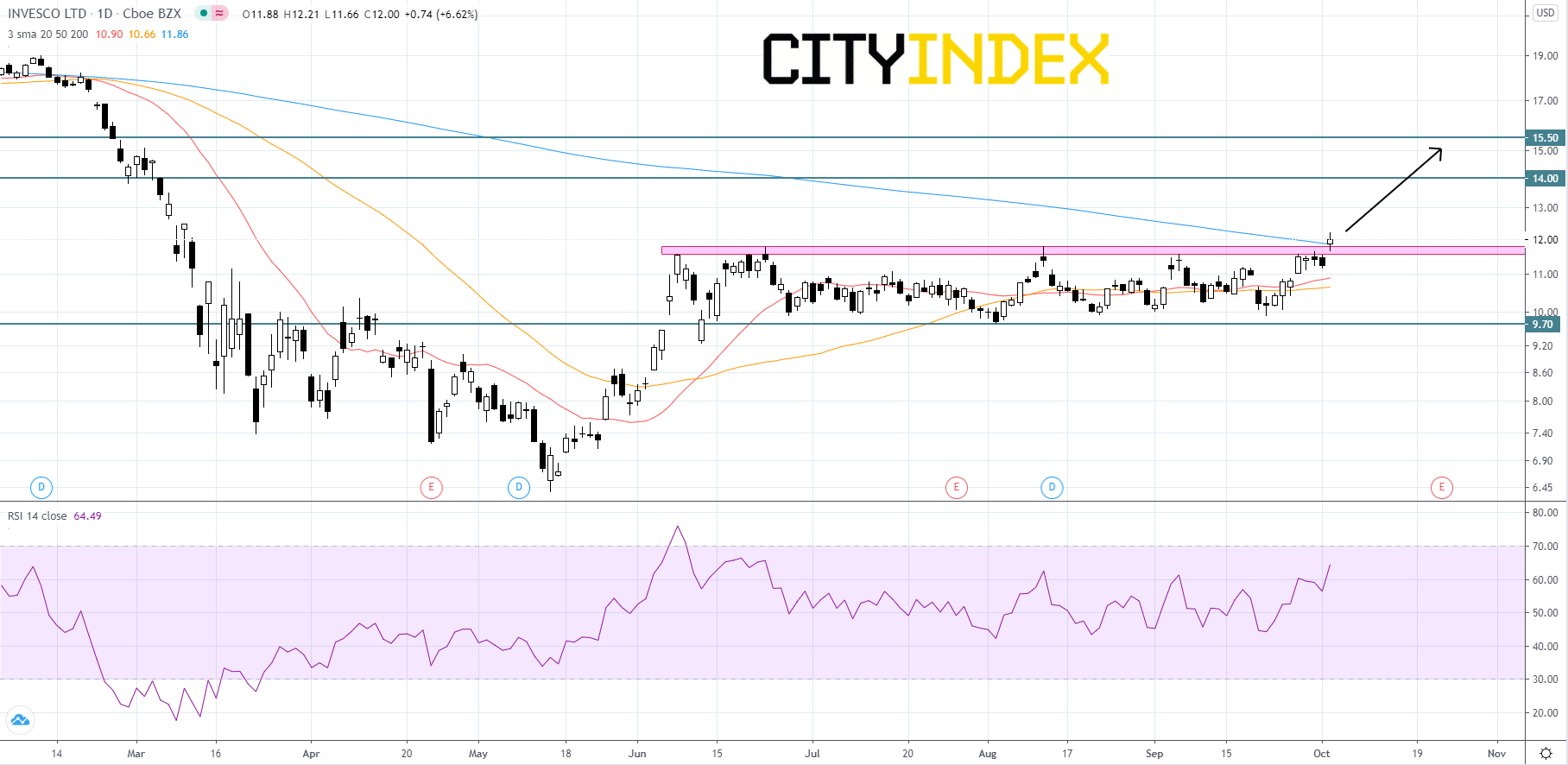

Looking at a daily chart, Invesco's stock price has just broken out to the upside of a resistance band ranging from 11.56 to 11.78 that price has been holding beneath since June. Price has also penetrated above its 200-day simple moving average (SMA) and the RSI is showing upside momentum. As long as the closing price can hold above the lowest level of the resistance band at 11.56 price will likely advance. If price can reach its 14.00 resistance level and breakout to the upside, we could see a run for 15.50. If price can get above 15.50, price could continue rising. If price closes below 11.56, then the breakout has failed. Price will then probably re-enter its consolidation area under the resistance band and above 9.70. If price holds above 9.70 it could potentially try for another breakout above the resistance band. If price breaks out below 9.70, it would be a bearish signal that could send prices tumbling down.

Source: GAIN Capital, TradingView

Looking at a daily chart, Invesco's stock price has just broken out to the upside of a resistance band ranging from 11.56 to 11.78 that price has been holding beneath since June. Price has also penetrated above its 200-day simple moving average (SMA) and the RSI is showing upside momentum. As long as the closing price can hold above the lowest level of the resistance band at 11.56 price will likely advance. If price can reach its 14.00 resistance level and breakout to the upside, we could see a run for 15.50. If price can get above 15.50, price could continue rising. If price closes below 11.56, then the breakout has failed. Price will then probably re-enter its consolidation area under the resistance band and above 9.70. If price holds above 9.70 it could potentially try for another breakout above the resistance band. If price breaks out below 9.70, it would be a bearish signal that could send prices tumbling down.

Source: GAIN Capital, TradingView

Latest market news

Yesterday 08:33 AM