Results

- Q4 earnings -26% to $2.6 billion vs $2.08 billion

- FY profits -21% $10 billion vs $12.7 billion 2018

- Dividend +2.4% to 10.50 cents per share

Falling energy prices

Higher production has failed to offset lower oil and gas prices. The average oil price across 2018 was $71 per barrel, whereas in 2019 this was down at $64 per barrel, an almost 10% difference – even with a 3% increase in production, there is no escaping that squeeze.

The results come following disappointing numbers from Shell, Exxon Mobil and Chevron as falling energy prices and reducing chemical industry margins hit the sector hard.

The price of oil has been under pressure already at the start of this year and could slip lower with the coronavirus outbreak potentially having a significant impact on demand for oil. Crude oil prices dived 15% across January and are already down 1.5% in February.

Divestment

BP is in the process of a $10 billion divestment programme to end 2020. The programme aims to reconfigure BP's portfolio of assets in order to strengthen the balance sheet following the BHP shale assets deal. Q4 Divestment totalled $800 million, in addition to $600 million from sale of 49% stake in Australian retail property portfolio.

BP impressed by saying that it was ahead of target and plans an additional $5 billion by mid-2021.

Debt

Since the BHP deal BP’s debt levels have come increasingly under the spotlight, gearing has fallen from 32% in Q3 to 31% in Q4 and is expected to move to mid-20% in 2020. There had been concerns that the higher debt levels could dampen prospects of cash being returned to investors. However, this fear doesn’t appear to be materialising.

Bob Dudley Steps Down

These were the last results with Bob Dudley at the helm; he leaves after 10 years a chief executive. Bernard Looney, head of exploration and production will take over. The timing seems fitting as BP looks to steers its course towards for sustainable forms of energy in a rapidly changing landscape.

Chart thoughts

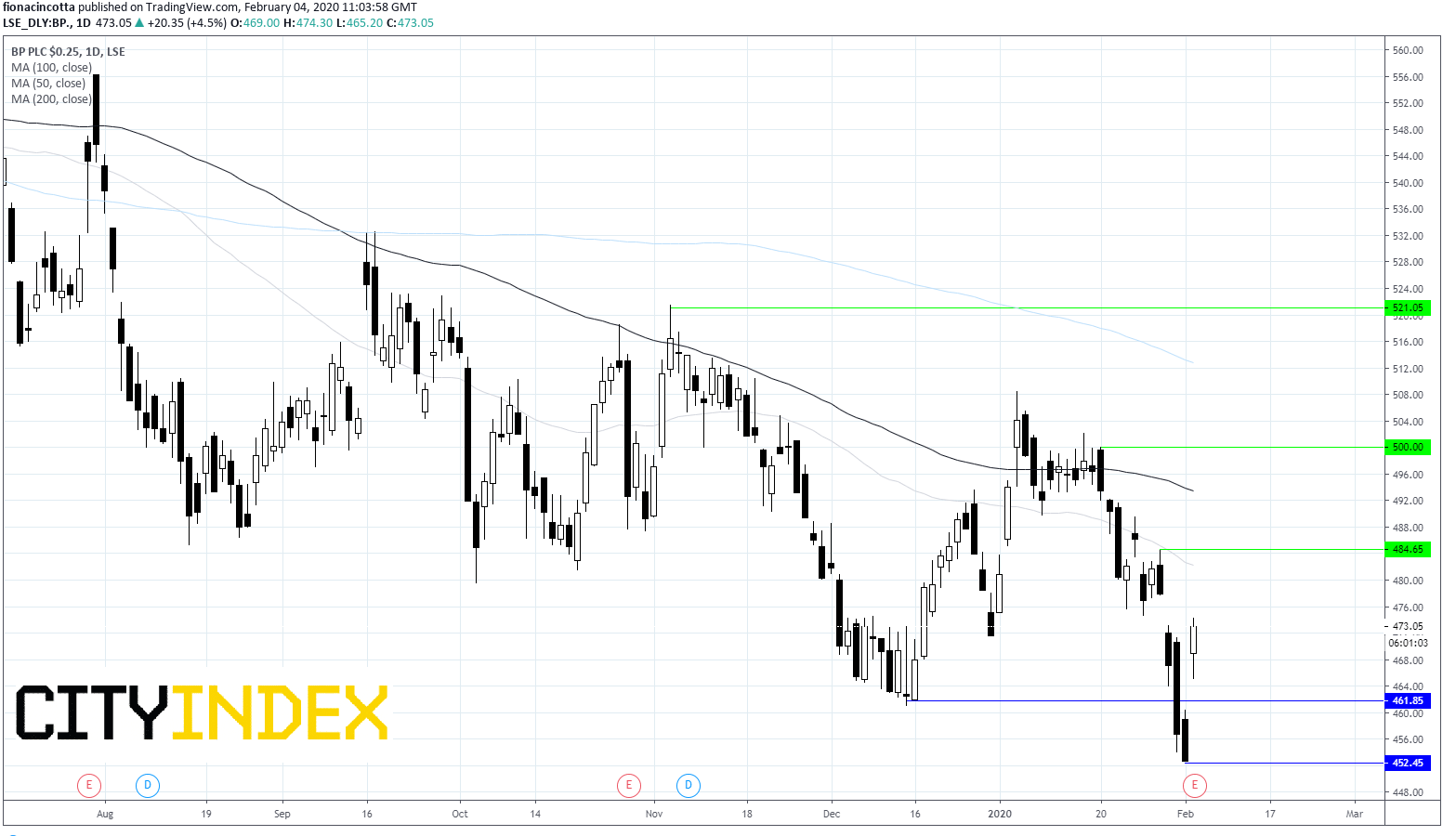

BP has jumped 4% higher in early trade on Tuesday. However BP continues trading below its 200, 100 on 50 sma on a bearish daily chart.

A break above resistance around 483-5p (29th Jan high, 50 sma) could negate the current bearish trend. Resistance is then at 500p (high 20th Jan) and 521p (5th Nov high).

Support can be seen at around 460p a level which provided support mid-December, before 452p, yesterday’s low.