Crude oil is up 4% and the tone in global markets is turning cautious following an escalation in US – Iran tensions. Iran has promised a harsh retaliation to US airstrikes and the killing of Qasem Soleimani a feared Iranian general, which has deepened the risk off atmosphere days into the New Year.

BP – Oil strong correlation

With a 4% rally in oil, attention will naturally turn to oil majors. BP’s upstream earnings are impacted by the price of oil. Consequently, BP is positively correlated to the price of oil with a coefficient of 0.58. This means that 58% of the time BP’s share price has moved in the same direction as oil. BP’s correlation coefficient is higher than that of Exxon Mobile and Royal Dutch Shell whose coefficients are 0.49 and 0.52 respectively. This means that BP’s correlation with oil is stronger than that of its peers.

With a 4% rally in oil, attention will naturally turn to oil majors. BP’s upstream earnings are impacted by the price of oil. Consequently, BP is positively correlated to the price of oil with a coefficient of 0.58. This means that 58% of the time BP’s share price has moved in the same direction as oil. BP’s correlation coefficient is higher than that of Exxon Mobile and Royal Dutch Shell whose coefficients are 0.49 and 0.52 respectively. This means that BP’s correlation with oil is stronger than that of its peers.

Q3 Earnings disappoint

BP reported Q3 underlying profits before tax of $4.5 billion, 32.5% behind the same period last year. This reflected lower production and lower oil and gas prices upstream and reduced refining margins downstream. Oil prices were lower on average year on year by some 12%.

BP reported Q3 underlying profits before tax of $4.5 billion, 32.5% behind the same period last year. This reflected lower production and lower oil and gas prices upstream and reduced refining margins downstream. Oil prices were lower on average year on year by some 12%.

December rebound

Trade optimism and planned deeper OPEC cuts helped boost oil prices in the final quarter where average oil prices were just 6.3% lower year on year.

Looking ahead the price of oil is expected to be supported amid the elevated middle eastern tensions, a US – China trade deal and deeper OPEC cuts. As a result, BP could push higher.

Trade optimism and planned deeper OPEC cuts helped boost oil prices in the final quarter where average oil prices were just 6.3% lower year on year.

Looking ahead the price of oil is expected to be supported amid the elevated middle eastern tensions, a US – China trade deal and deeper OPEC cuts. As a result, BP could push higher.

Analysts’ recommendations

Of 11 analysts:

8 recommend strong buy

2 recommend buy

1 is neutral

Of 11 analysts:

8 recommend strong buy

2 recommend buy

1 is neutral

Levels to watch:

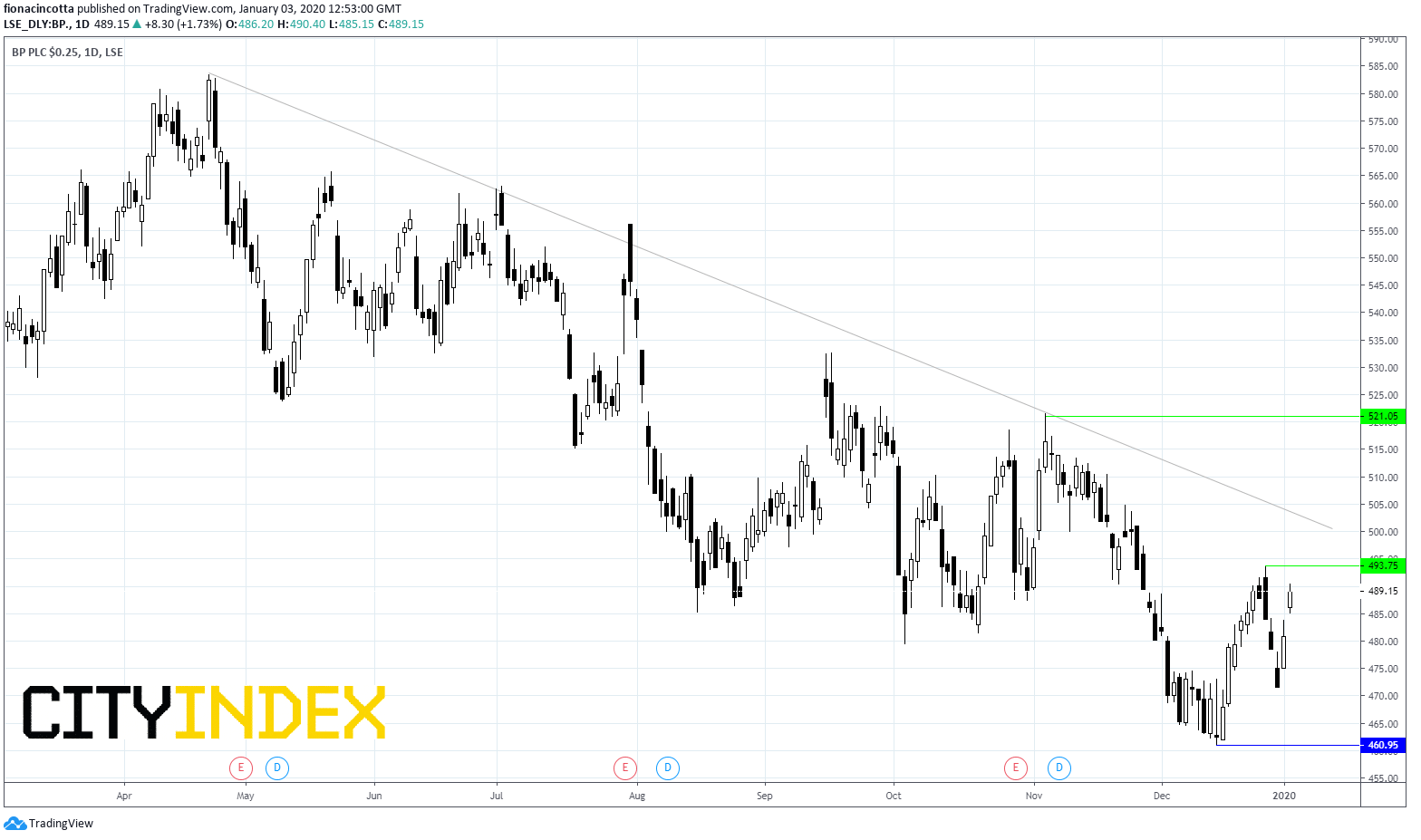

BP share price dropped 5% across the previous year and tumbled 19% from last year’s high of 583p in April to the end of the year.

The stock price has jumped 1.7% across the morning session. Despite the jump, BP remains below its 50, 100 & 200 sma. A break above resistance at 493p could see BP push above 500 and negate the current downward trend. Support can be seen at 460p.

Latest market news

Yesterday 10:48 PM

Yesterday 02:00 PM

Yesterday 01:14 PM

Yesterday 12:00 PM