When is the Bank of England interest rate decision?

The BoE will announce its monetary policy decision on Thursday at 12:00

What to expect?

The BoE meeting on Thursday is the most unpredictable interest rate decision in years. This could be the meeting when policy makers vote to raise interest rates amid surging inflation.

Inflation in Britain is currently sat at 3.2% and is expected to continue rising to over 5%, well over the BoE’s 2% target rate.

Supply chain bottlenecks, labour shortages and surging energy prices have contributed to elevated inflation. None of these contributing factors look set to ease anytime soon.

What are the policy members saying?

Over the past few weeks, hawkish rhetoric from BoE policy makers has increased. BoE Governor Andrew Bailey has spoken of the need to rein in inflation, two other MPC policy makers have voiced similar opinions.

The other 6 members have not been so vocal is their opinion which is making it harder to predict how the votes will be cast.

Rate rise?

The broad expectation is that if the BoE did hike rates, they would do so by 0.15% taking it to 0.25% up from its historic low level of 0.1%.

If the BoE did vote in favour of hiking rate this would be a sharp change from the September meeting when all 9 MPC members voted to keep rates on hold and just 1 voted to slow the bond buying programme.

Market certain, analysts not

According to the CME BoE watch tool a rate hike of 0.15% is fully priced in. This means that the risk lies in the BoE leaving interest rates unchanged sending GBP/USD lower. Yet whilst the market has fully priced it in analysts and economists remain unsure.

In both Reuters and Bloomberg surveys analysts were roughly split over whether the BoE would move to hike rates at the November meeting.

Learn more about the BoEOther factors affecting GBP/USD

Whilst the BoE interest rate decision is the main even for GBP, keep in mind that the Fed will be announcing their monetary policy decision tomorrow. The Fed is expected to announce the start of scaling back its bond purchases.

Separately Brexit headlines are also driving GBP amid elevated French – British fishing tensions.

Where next for GBP/USD?

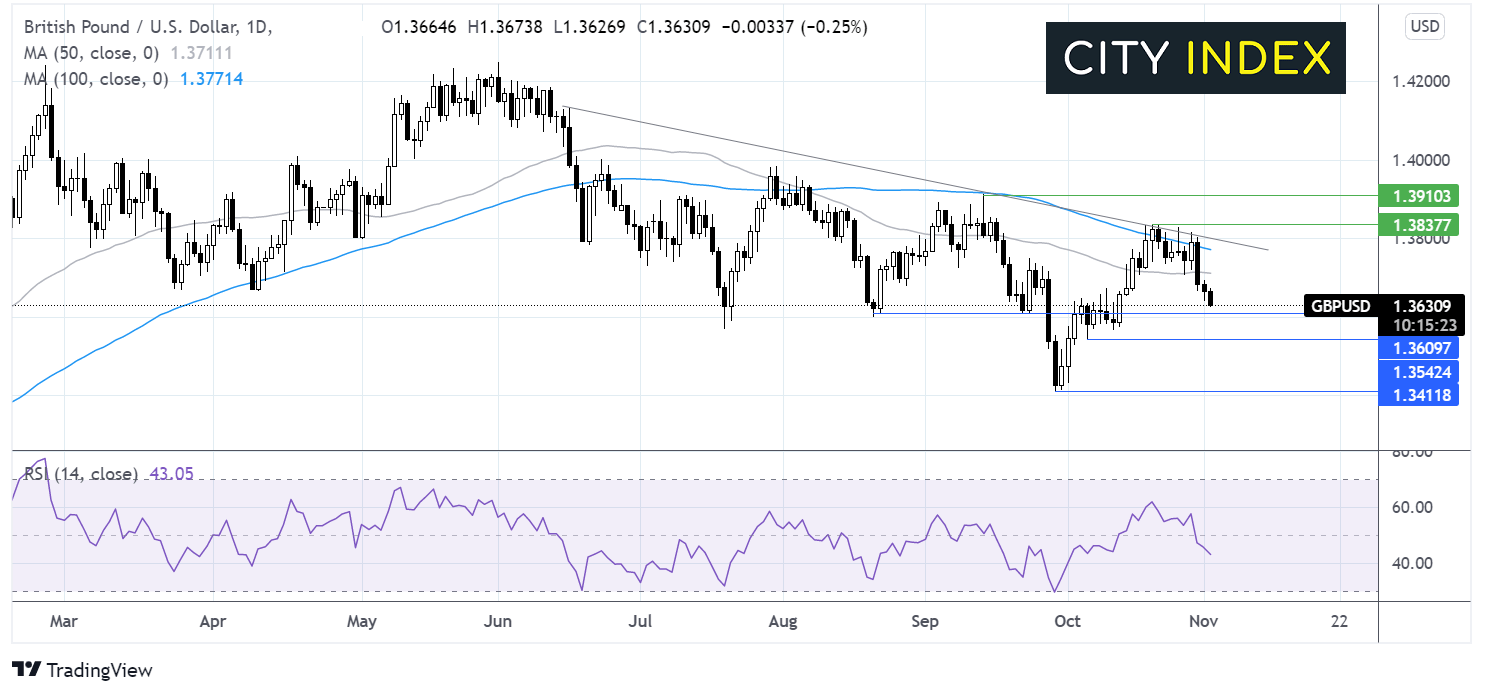

After facing rejection at the multi-month descending trendline GBP/USD is extending its move lower for a third straight session. The breakdown of the 50 sma combined with a bearish RSI are keeping the sellers optimistic of further losses.

A break-through support at 1.36 could prompt a deeper selloff to 1.3545 the low Oct 5.

Any meaningful recovery would need to retake 1.3670 swing high Oct 11 to expose the 50 sma at 1.3710 and the 100 sma at 1.3770.

How to trade with City Index

Follow these easy steps to start trading with City Index today:

- Open a City Index account, or log-in if you’re already a customer.

- Search for the market you want to trade in our award-winning platform.

- Choose your position and size, and your stop and limit levels

- Place the trade.