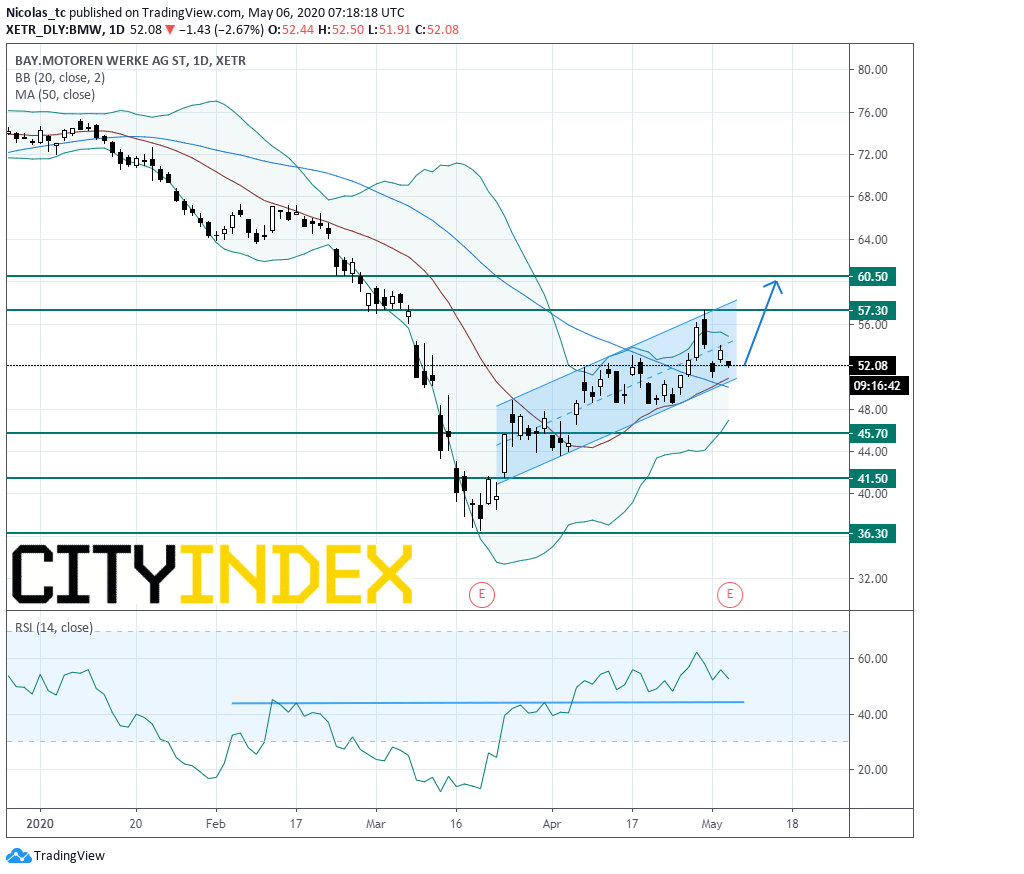

BMW remains within a bullish channel

BMW, an automobile group, said it still expects group profit before tax "to be significantly lower than in 2019", while lowering automotive segment EBIT margin to 0% - 3% from 2% - 4% previously. The company added: "The decisive factor for the adjustment is that the measures to contain the corona virus pandemic are lasting longer in several markets and are thus leading to a broader negative impact than was foreseeable in mid-March. It is therefore apparent that delivery volumes in these markets will not - as was previously assumed - return to normal within a few weeks. The highest negative impact is expected in the second quarter of 2020."

Meanwhile, the company reported that 1Q net income slipped 2.4% on year to 574 million euros, while EBIT jumped to 1.38 billion euros from 589 million euros in the prior-year period on revenue of 23.25 billion euros, up 3.5%.

From a technical perspective, the stock price has completed its pullback to the 50-day simple moving average and is posting a rebound. Prices remain within a short term bullish channel. Prices need to stand above 45,7E to maintain the bullish bias. The daily Relative Strength Index (RSI, 14) is holding above its horizontal support. Next resistance zone is set between 57,3E and 60,5E.

Meanwhile, the company reported that 1Q net income slipped 2.4% on year to 574 million euros, while EBIT jumped to 1.38 billion euros from 589 million euros in the prior-year period on revenue of 23.25 billion euros, up 3.5%.

From a technical perspective, the stock price has completed its pullback to the 50-day simple moving average and is posting a rebound. Prices remain within a short term bullish channel. Prices need to stand above 45,7E to maintain the bullish bias. The daily Relative Strength Index (RSI, 14) is holding above its horizontal support. Next resistance zone is set between 57,3E and 60,5E.

Caution: A break below 45,7E would call for a reversal down trend towards March 19th low at 36,3E.

Source: GAIN Capital, TradingView