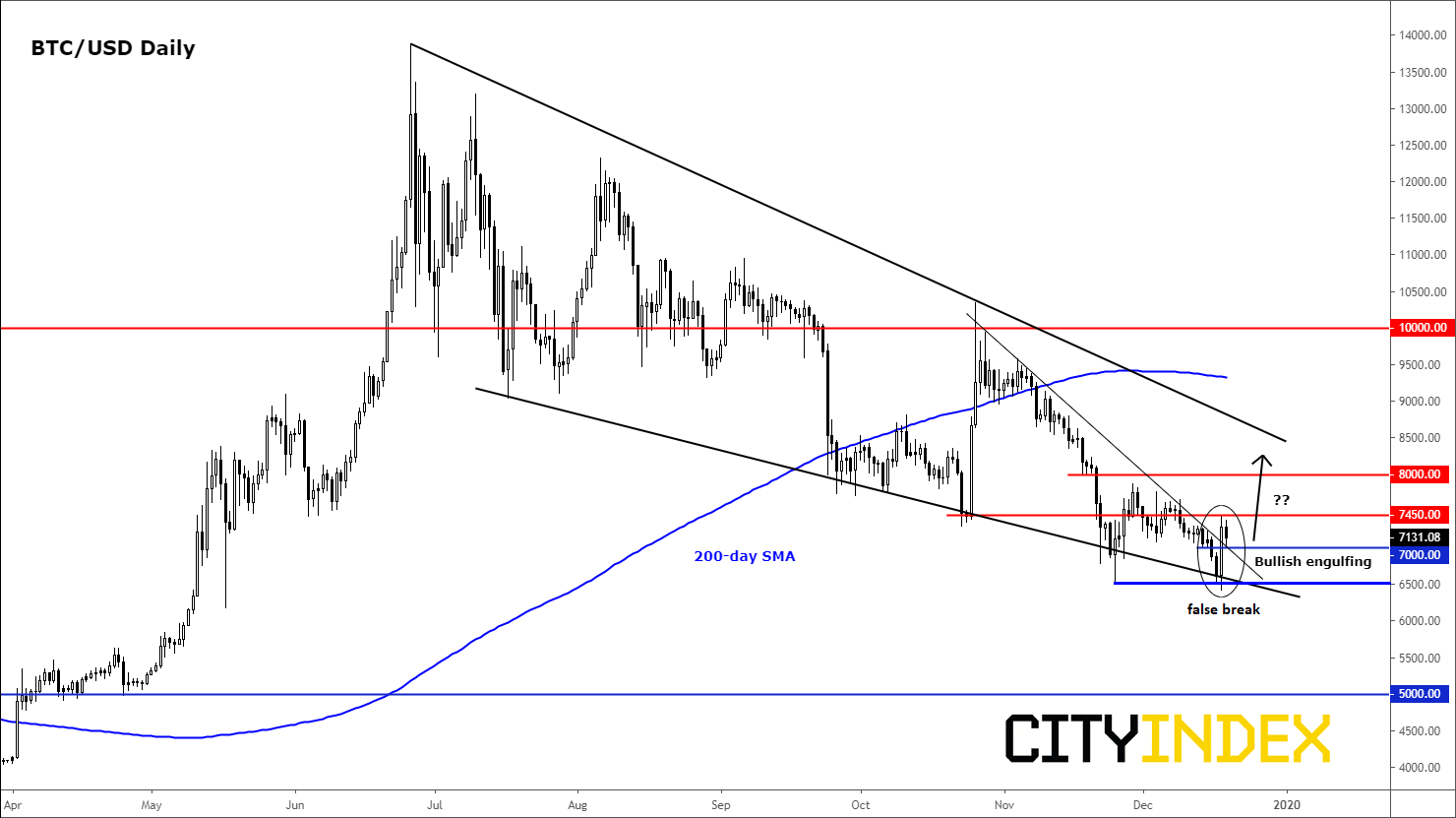

Bitcoin staged a sharp reversal on Wednesday after briefly dipping below the low of $6515 created in November. The short stay below this level meant the selling pressure had ran out of juice, with the bulls also managing to defend support around the lower trend of the long-term falling wedge pattern. Thus, a short-squeeze rally was triggered which saw BTC/USD close 10% higher on the day. The recovery helped the cryptocurrency create a large daily bullish engulfing candle, while in another bullish development a short-term bearish trend line was also taken out. Wednesday’s rally eventually come to a halt around $7450. From here, prices have drifted lower again – potentially providing another opportunity for the bulls who missed out on the rally to get on board. Key support is around $6900-$7000, the old resistance zone which must now be defended by the bulls if they are to make a serious come-back attempt in light of Wednesday’s reversal.

Source: Trading View and City Index.