Bitcoin continues to defy gravity after piercing $11k on Friday. Yet with prices looking stretched, we suspect a retracement could be due before its trend continues.

That said, Bitcoin has shown its ability to not look back once a move is underway so we cannot rule out an attempt from bulls to push it to new highs. But we’d suggest caution at these high levels, given the lack of pullbacks since the June low.

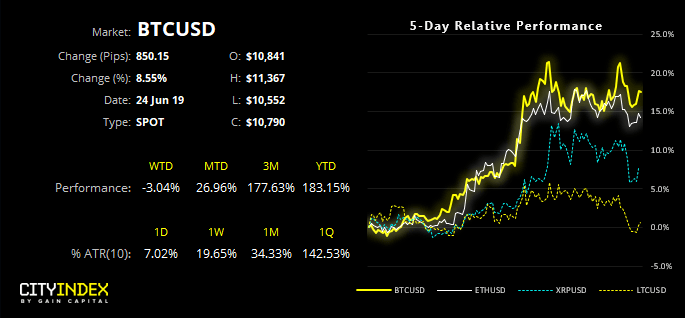

We can see on the relative performance charts that crypto currencies are highly correlated. Year to date, Bitcoin has rallied over 180%, most of which has occurred these past three months. Yet even these eye watering numbers pale in comparison to Litecoin which has rallied a staggering 356% over the same period.

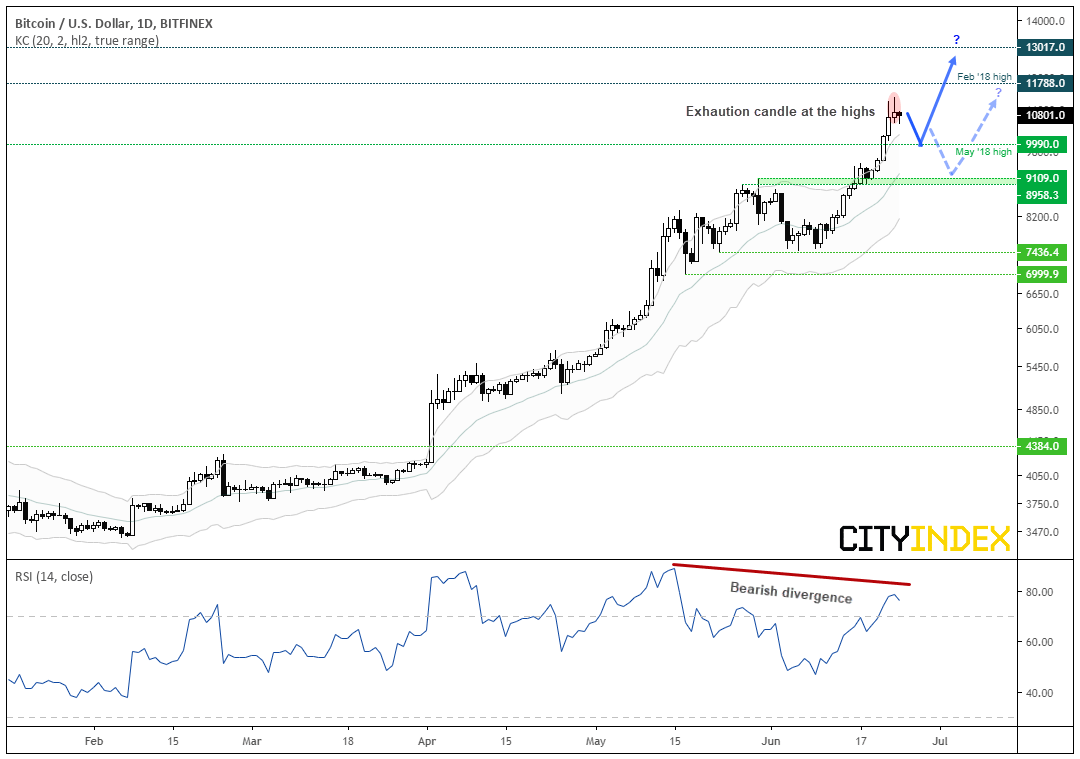

Still, there are signs that the move could be in need of a pause.

- Friday failed to close above $11k

- A bearish hammer has formed beyond the upper Keltner band to warn of price exhaustion

- A bearish divergence is forming on the RSI

Please note this product may not be available to trade in all regions.

From here’s we’d like to see prices stabilise and retrace towards the May high before considering long positions on the daily chart. If a deeper correction is to occur, look for prices to hold above the support zone around 9,100. Although the trend remains bullish above the 7,436.40 low.