I am frequently asked by private traders in our City Index educational webinars if I believe bank and hedge fund traders target the stop loss orders of retail traders. My answer to this is always no. After the events this past week, I can no longer say that I have never seen the reverse occur.

Learn more about our trading courses here

A strong appetite for risk taking by traders during January has not been confined to stocks. It was preceded in early January by a brisk rally in cryptocurrencies, including Bitcoin.

To some, the current level of volatility across riskier assets are indicative of a level of speculation and leverage creeping into markets that was last seen prior to the start of the Global Financial Crisis, over a decade ago.

Promoting warnings that the January rallies in speculative assets will be left exposed and vulnerable in the months to come. A “ring the bell” type moment if you will.

While I don’t dispute an increased level of speculation has helped Bitcoin higher, the fundamental argument for holding cryptocurrencies to hedge against the debasement of fiat money remains compelling.

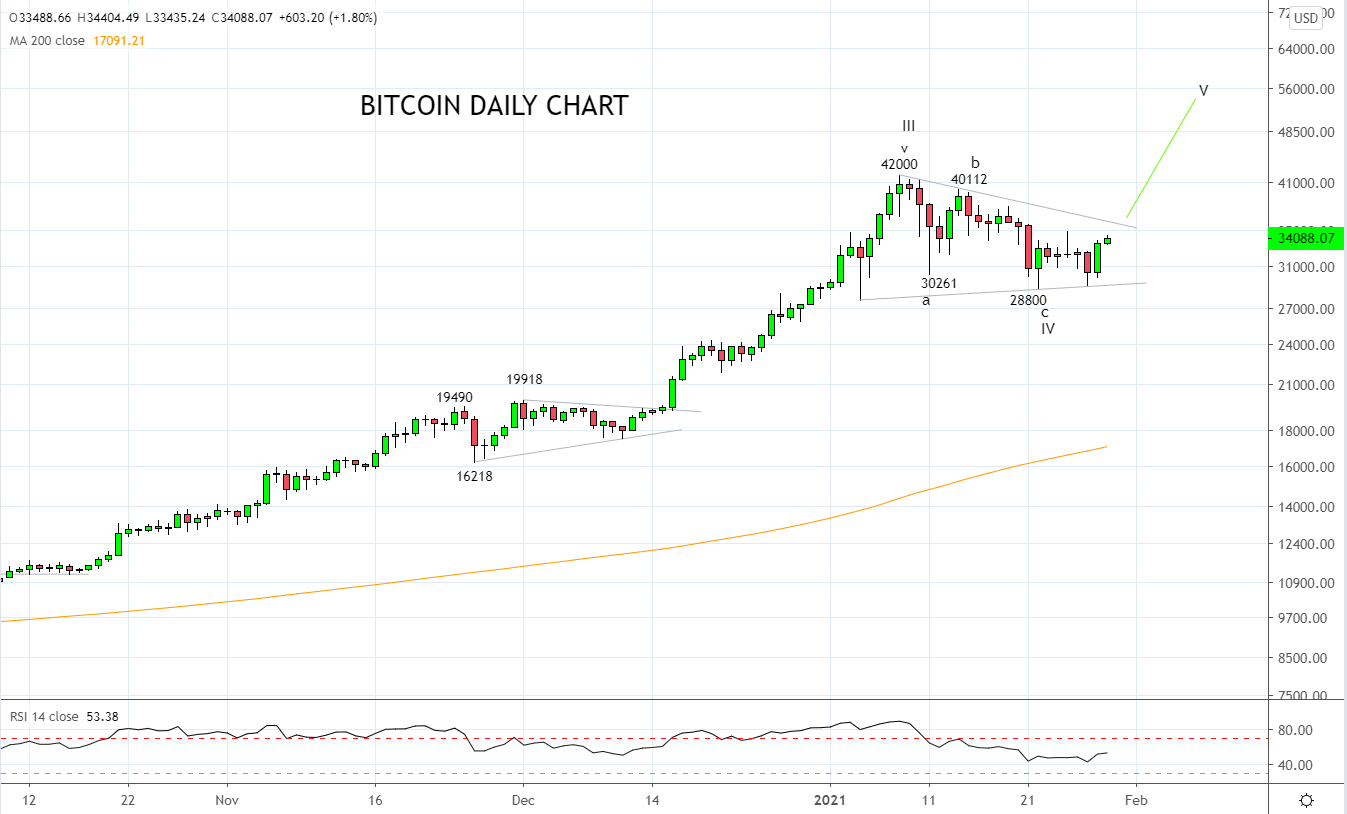

Additionally the technical set up in Bitcoin remains bullish. The impulsive rally to the January $42,000 high was followed by a pullback to towards wave equality support $28,800 that displays corrective or countertrend qualities.

Providing Bitcoin remains above the band of support ahead of $28,000 and then rallies above trendline resistance coming in currently near $36,000, the expectation is for a retest and break above the January $42,000 high, before $50,000.

Keeping in mind, should Bitcoin fail to break above $36,000 and then falls below support at $28,000, the risks are for a deeper pullback towards the December breakout level at $20,000.

Source Tradingview. The figures stated areas of the 29th of January 2021. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation