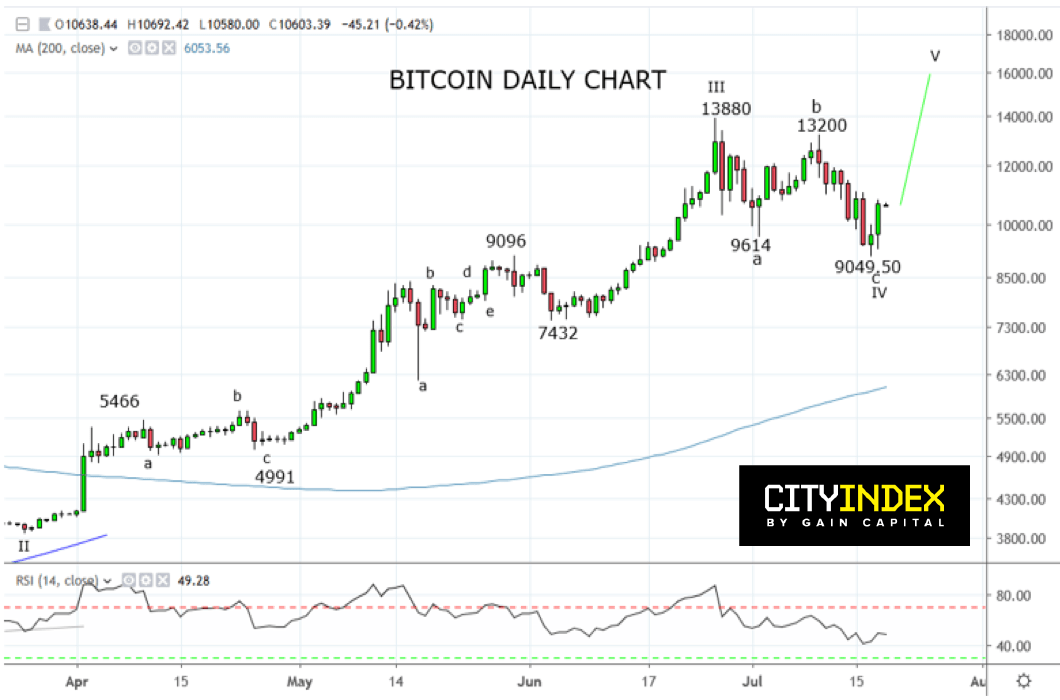

The wild ride in Bitcoin hit light speed overnight as prices rallied over U.S. $1000 in just under 60 minutes at around midnight Sydney time. The cause of the move is not clear, and given the opaque nature of Bitcoin, it is likely to remain so. However, the rally fits nicely within the roadmap highlighted in recent weeks.

To recap, Bitcoin rallied from $9k up to $13.8k in the last two weeks of June, benefitting from safe haven buying ahead of the G20 Summit in Osaka and following Facebook’s announcement that it would launch its own digital coin Libra.

Somewhat frustratingly the rally from $9k to $13.8k commenced after I had exited the last of my Bitcoin longs near $8k that I had opened earlier in the year ~$3.9k, leaving me with a sharp sense of FOMO. That said the plan had always been to re-enter Bitcoin longs on a pullback.

After noting some initial signs of technical rejection from the $13.8k in this article on June 27 https://www.cityindex.com.au/market-analysis/what-to-do-about-bitcoin/ support at $10/9k was first mentioned as a possible level to look to re-enter longs.

Last week echoing the concerns of U.S. lawmakers following the Libra announcement, U.S. Federal Reserve Chairman Powell and U.S. President Donald Trump both spoke out against the Libra coin. The tentative pullback that Bitcoin had endured until that point soon turned into a full-scale correction and the opportunity we had been anticipating.

In this article from July 12 https://www.cityindex.com.au/market-analysis/bitcoin-when-good-news-has-negative-consequences/ the final paragraph reads, “Assuming Bitcoin reaches near to the 9k pullback target, I will be watching closely for a bullish daily reversal candle as the set up to reload Bitcoin longs, in expectation of rally towards 16k.”

What happens next?

After falling to 9k on Wednesday this week and forming a bullish reversal candle, the prospects for Bitcoin again look positive through a technical analysis lens, and I have re-opened Bitcoin longs. The target for the move is the $15/17k region, mindful that as Libra and Bitcoin are in U.S. lawmakers’ sights its likely to be a bumpy ride and best to manage trading risk according.

Source Tradingview. The figures stated are as of the 19th of July 2019. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation

Disclaimer

TECH-FX TRADING PTY LTD (ACN 617 797 645) is an Authorised Representative (001255203) of JB Alpha Ltd (ABN 76 131 376 415) which holds an Australian Financial Services Licence (AFSL no. 327075)

Trading foreign exchange, futures and CFDs on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange, futures or CFDs you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss in excess of your deposited funds and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange, futures and CFD trading, and seek advice from an independent financial advisor if you have any doubts. It is important to note that past performance is not a reliable indicator of future performance.

Any advice provided is general advice only. It is important to note that:

- The advice has been prepared without taking into account the client’s objectives, financial situation or needs.

- The client should therefore consider the appropriateness of the advice, in light of their own objectives, financial situation or needs, before following the advice.

- If the advice relates to the acquisition or possible acquisition of a particular financial product, the client should obtain a copy of, and consider, the PDS for that product before making any decision.