After it’s capitulation in March and subsequent recovery in April, the month of May has brought much-needed stability to the price of Bitcoin, amongst further signs of acceptance and institutional legitimacy.

While the “halving” on May 11 appears to have been factored into the price of Bitcoin in advance, the month of May has been notable for the following reasons.

- Legendary macro trader Paul Tudor Jones said he bought Bitcoin as a hedge against the inflation that may come as a result of central bank money printing.

- U.S. bank, JP Morgan Chase has started to accept clients from the crypto space including Bitcoin exchanges Coinbase and Gemini Trust Co. This coming after JP Morgan Chase CEO Jamie Dimon called Bitcoin “a fraud” in September 2017.

- Goldman Sachs will later this week host a conference call for institutional clients on the Crisis, Crypto, and Inflation.

- An increase in U.S. - China tensions, including confirmation at China’s annual National People’s Congress last week that there will be a bill establishing “an enforcement mechanism for ensuring national security” for Hong Kong. This comes after U.S. President Trump said he would “react strongly”, if China was to proceed with this plan.

The developments above, add to the already supportive macro reasons for Bitcoin. Since our last update on Bitcoin in early April, the price action has erased much of the technical damage that followed its plunge in March.

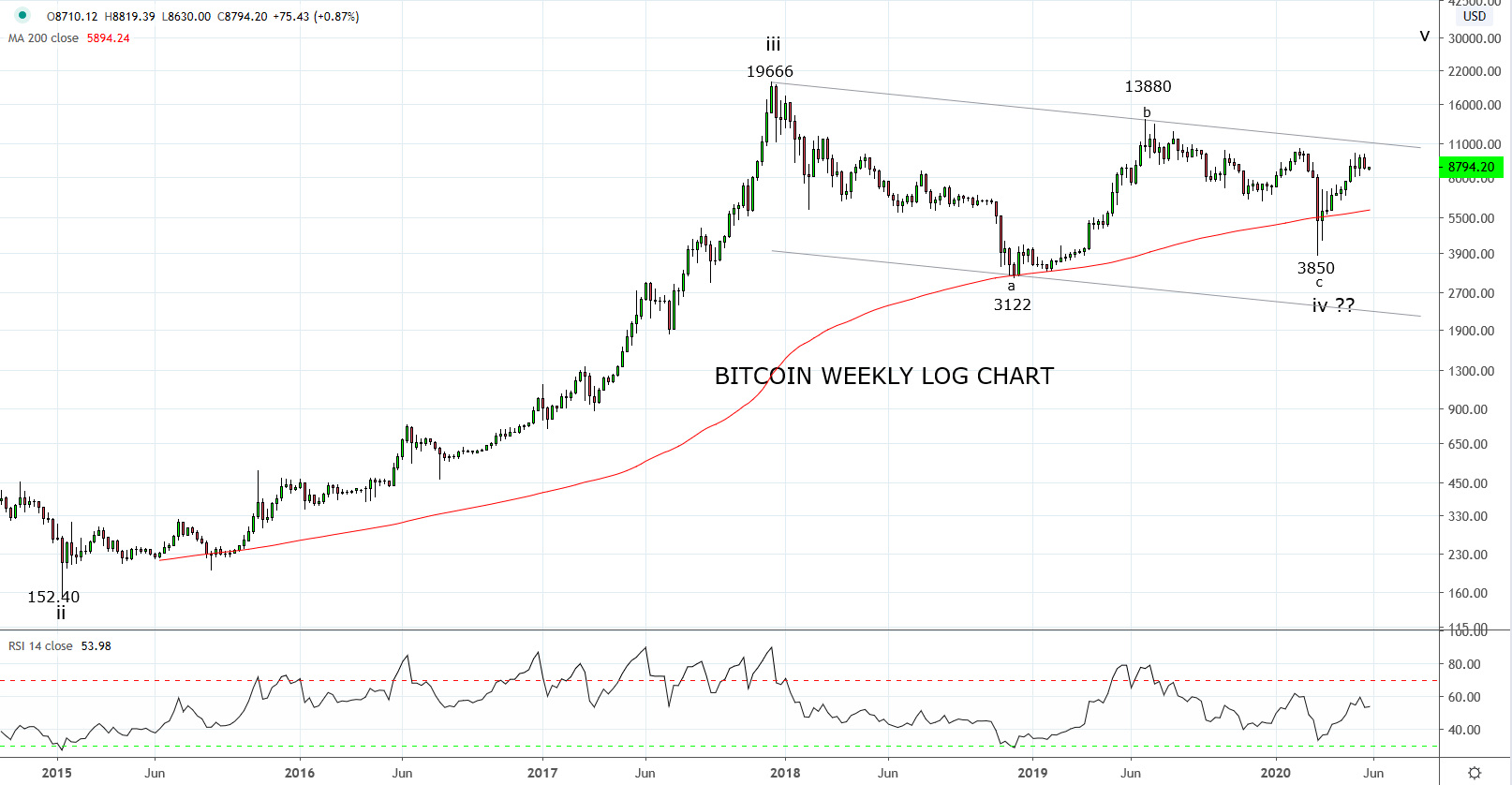

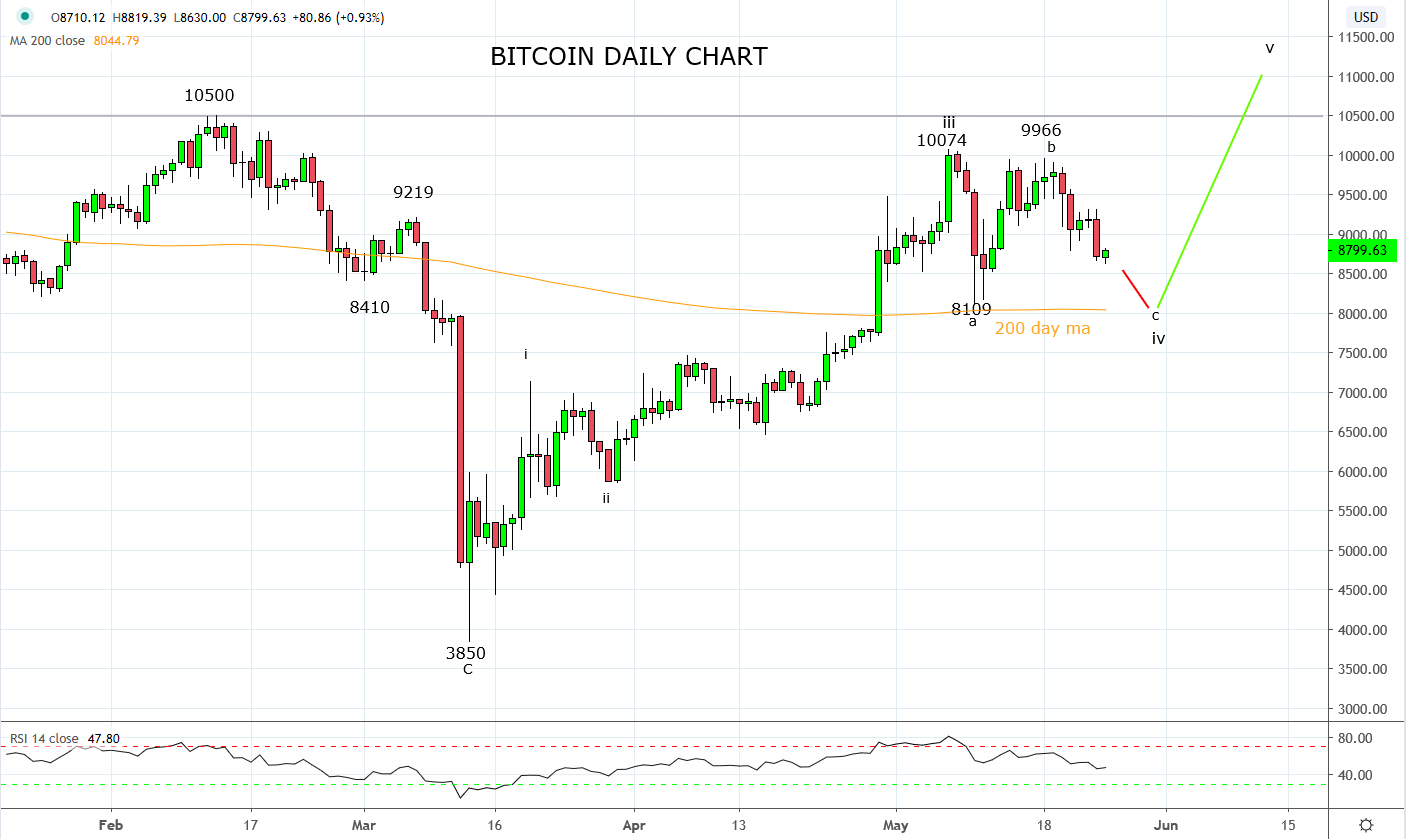

Specifically the rally from the March 3850-low has since late April, started to display more impulsive/bullish characteristics. However two medium-term bullish hurdles remain – a break/close above year to date highs 10500 area and weekly trend channel resistance ~11000 viewed on the Weekly Log chart immediately below.

In the short-term, the view is that Bitcoin is currently tracing out a corrective pullback towards support at 8100/00 (May low and the 200-day ma). Providing signs of a base form in/near this support region, the preference is to be a buyer of Bitcoin, in anticipation of a rally towards medium-term resistance levels 10500/11000 and possibly beyond.

Source Tradingview. The figures stated areas of the 25th of May 2020. Past performance is not a reliable indicator of future performance. This report does not contain and is not to be taken as containing any financial product advice or financial product recommendation