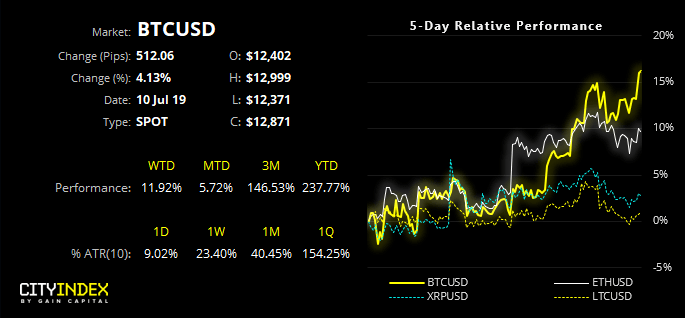

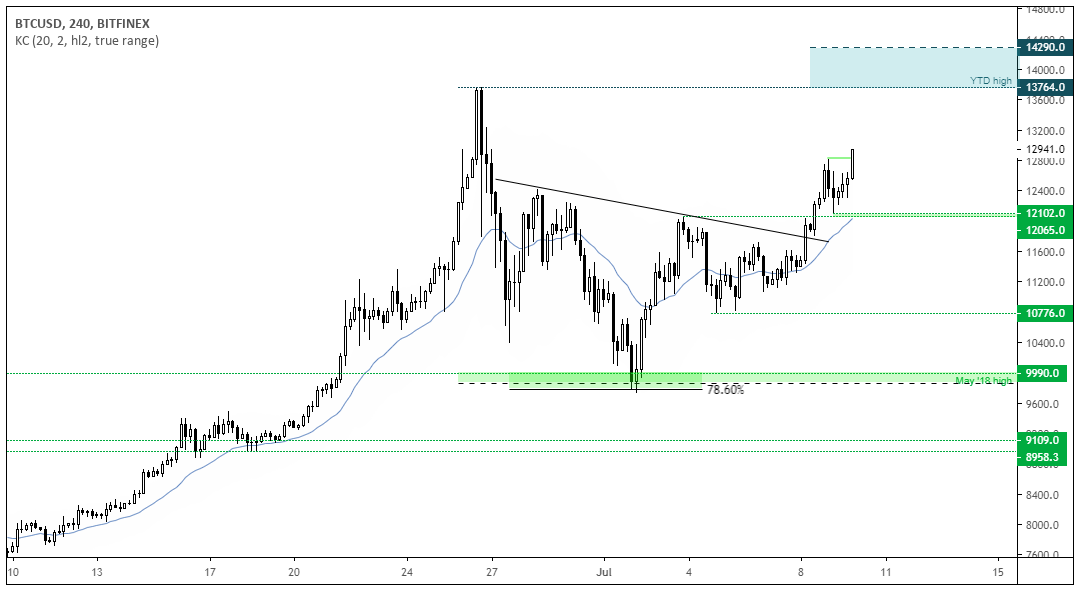

Bitcoin has broken out of compression in its usual style and closes in on the YTD highs (and potentially beyond).

Since our prior analysis, Bitcoin has broken out of its triangle to the upside and confirmed an inverted head and shoulders pattern with a break of its neckline. As a reminder, inverted head and shoulders usually appear during downtrends but can also be used as continuation patterns in uptrends.

- 12,100 has held as support and prices if broken to a new cycle high to suggest the next phase of the trend is underway.

- The bias remains bullish above 12,100

- If successful, the pattern projects an initial target around, 14,290, but can eventually travel further and is certainly something to consider given the strength of the underlying trend.

Related analysis:

Bitcoin Could Be Coiling Its Way Towards A Breakout

Bitcoin Rallies Its Way To Independence Day

Bitcoin: Do Volatile Bullish Sessions Lead To Further Gains?

Latest market news

Today 04:00 PM

Today 01:15 PM

Today 11:30 AM

Today 08:18 AM