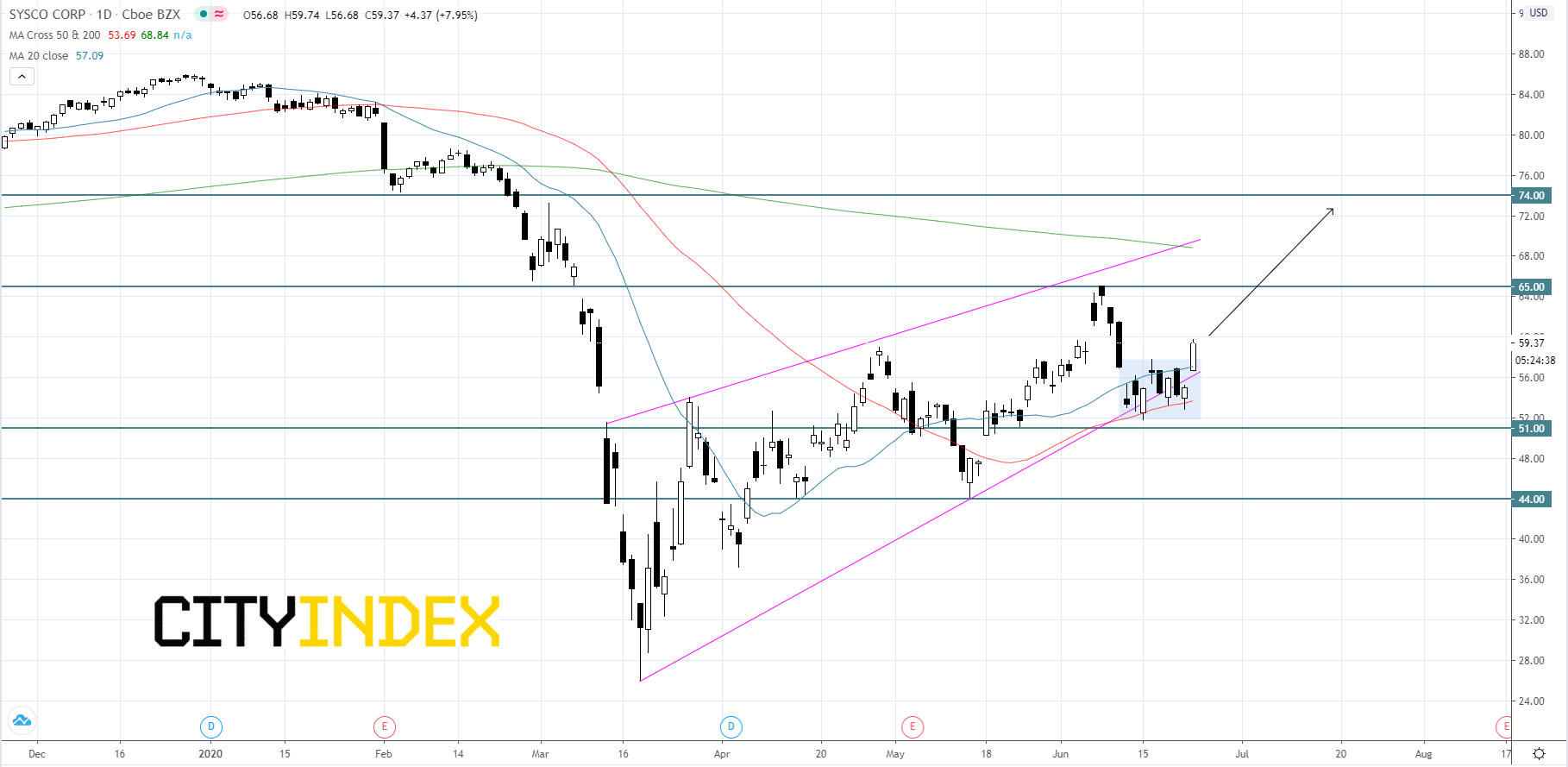

Biggest Gainer at the Opening Bell: Sysco

On Tuesday morning, Sysco (SYY), the largest food distribution company in the U.S. gapped up about 3% before continuing to advance.

Looking at a daily chart, Sysco's stock price is holding a rising wedge pattern that began to form in mid-March. Price was on the verge of breaking below the lower trend line until today's gap up. Price appears to be using the 50-day moving average as support, a slightly bearish signal considering that price was previously using the 20-day moving average as support. Price breaking to the upside of the short-term sideways channel that began on June 11th is bullish and the most recent signal. Price is expected to continue advancing inside of the rising wedge pattern to retest the $65.00 resistance. If price can break above $65.00, we will likely see price push onward to $74.00. If price falls back below the lower trend line then we can expect choppy price action as it re-enters the sideways channel. Price will then mostly likely hold below the lower trend line before breaking the 50-day moving average and falling back to $51.00 support and possibly to the $44.00 support.

Source: GAIN Capital, TradingView

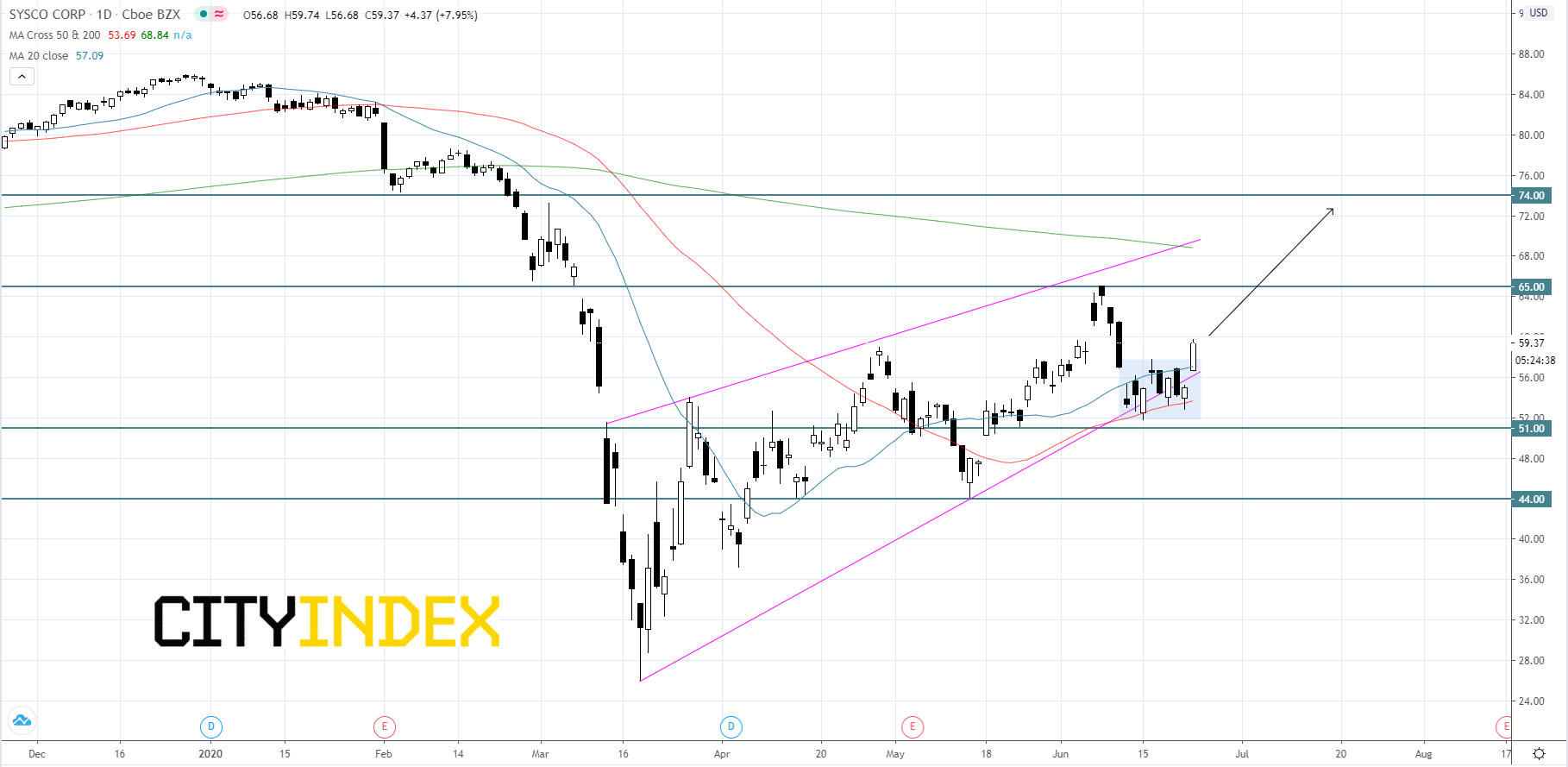

Looking at a daily chart, Sysco's stock price is holding a rising wedge pattern that began to form in mid-March. Price was on the verge of breaking below the lower trend line until today's gap up. Price appears to be using the 50-day moving average as support, a slightly bearish signal considering that price was previously using the 20-day moving average as support. Price breaking to the upside of the short-term sideways channel that began on June 11th is bullish and the most recent signal. Price is expected to continue advancing inside of the rising wedge pattern to retest the $65.00 resistance. If price can break above $65.00, we will likely see price push onward to $74.00. If price falls back below the lower trend line then we can expect choppy price action as it re-enters the sideways channel. Price will then mostly likely hold below the lower trend line before breaking the 50-day moving average and falling back to $51.00 support and possibly to the $44.00 support.

Source: GAIN Capital, TradingView

Latest market news

Today 11:14 AM

Today 08:28 AM

Yesterday 03:30 PM